Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them at a significant profit, leveraging trends in fashion and scarcity. FOREX trading focuses on the global currency market, where investors speculate on currency pair fluctuations to capitalize on economic shifts. Explore the strategies and risks of both to determine the ideal investment path for your financial goals.

Why it is important

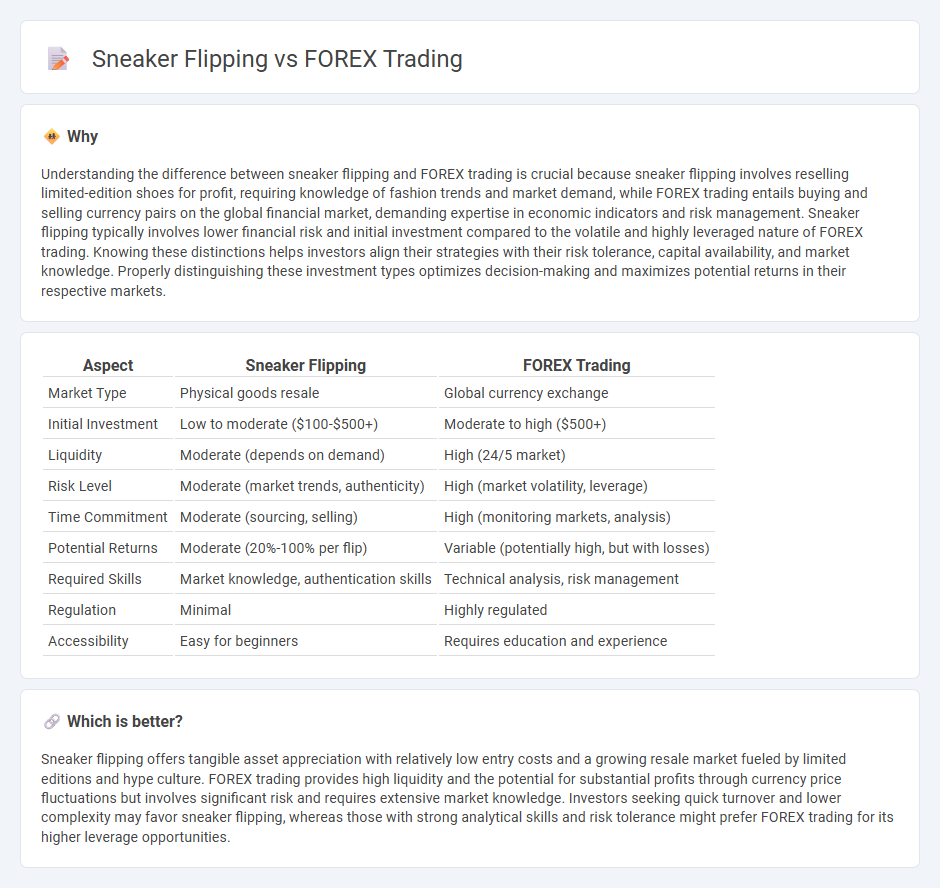

Understanding the difference between sneaker flipping and FOREX trading is crucial because sneaker flipping involves reselling limited-edition shoes for profit, requiring knowledge of fashion trends and market demand, while FOREX trading entails buying and selling currency pairs on the global financial market, demanding expertise in economic indicators and risk management. Sneaker flipping typically involves lower financial risk and initial investment compared to the volatile and highly leveraged nature of FOREX trading. Knowing these distinctions helps investors align their strategies with their risk tolerance, capital availability, and market knowledge. Properly distinguishing these investment types optimizes decision-making and maximizes potential returns in their respective markets.

Comparison Table

| Aspect | Sneaker Flipping | FOREX Trading |

|---|---|---|

| Market Type | Physical goods resale | Global currency exchange |

| Initial Investment | Low to moderate ($100-$500+) | Moderate to high ($500+) |

| Liquidity | Moderate (depends on demand) | High (24/5 market) |

| Risk Level | Moderate (market trends, authenticity) | High (market volatility, leverage) |

| Time Commitment | Moderate (sourcing, selling) | High (monitoring markets, analysis) |

| Potential Returns | Moderate (20%-100% per flip) | Variable (potentially high, but with losses) |

| Required Skills | Market knowledge, authentication skills | Technical analysis, risk management |

| Regulation | Minimal | Highly regulated |

| Accessibility | Easy for beginners | Requires education and experience |

Which is better?

Sneaker flipping offers tangible asset appreciation with relatively low entry costs and a growing resale market fueled by limited editions and hype culture. FOREX trading provides high liquidity and the potential for substantial profits through currency price fluctuations but involves significant risk and requires extensive market knowledge. Investors seeking quick turnover and lower complexity may favor sneaker flipping, whereas those with strong analytical skills and risk tolerance might prefer FOREX trading for its higher leverage opportunities.

Connection

Sneaker flipping and FOREX trading both involve capitalizing on market fluctuations to generate profit, relying on timely buying and selling strategies. Both require deep market knowledge, trend analysis, and risk management skills to optimize returns in volatile environments. Investors in each field must monitor supply-demand dynamics and global economic indicators to identify lucrative opportunities.

Key Terms

FOREX Trading:

FOREX trading involves the exchange of global currencies in a highly liquid market with daily trading volumes exceeding $6 trillion, offering opportunities for profit through currency value fluctuations. It requires understanding economic indicators, geopolitical events, and technical analysis to predict market movements effectively. Explore detailed strategies and risk management techniques to enhance your FOREX trading success.

Leverage

Forex trading offers leverage ratios commonly up to 100:1 or more, enabling traders to control large positions with relatively small capital, thereby increasing profit potential and risk exposure significantly. Sneaker flipping typically involves minimal financial leverage, relying instead on market demand and product scarcity to generate returns without borrowing or margin. Explore the mechanics of leverage in both domains to understand their impact on investment strategies and risk management.

Pips

FOREX trading involves capitalizing on pips, the smallest price movement in currency pairs, to execute profitable trades, whereas sneaker flipping relies on buying limited-edition sneakers at retail and selling them at a higher market value. Pips in FOREX represent precise profit margins driven by market volatility and leverage, while sneaker flipping profits depend heavily on sneaker rarity, brand hype, and consumer demand. Discover how mastering pips in FOREX can enhance your trading strategy by learning more about market analysis techniques.

Source and External Links

How to start forex trading: A complete guide for beginners | Saxo - Forex trading is the buying and selling of currencies on the global market, which operates 24 hours a day and is the world's largest, most liquid financial market, with daily volume over $7 trillion.

What is Forex Trading? - Forex (FX) trading involves exchanging one currency for another through a decentralized global network, where traders profit from currency value fluctuations in highly liquid and volatile markets.

What is Forex (FX) Trading and How Does it Work? - IG - In forex trading, traders use currency pairs (e.g., GBP/USD) to speculate on exchange rate movements, aiming to buy low and sell high or sell high and buy low to generate profit.

dowidth.com

dowidth.com