Designer sneaker portfolios offer a unique investment opportunity by capitalizing on the growing demand for limited-edition releases and brand collaborations, often yielding high resale values. Comic book portfolios, on the other hand, tap into the expanding collectibles market driven by rare issues and cultural significance, with iconic comics sometimes appreciating dramatically over time. Explore how these distinct asset classes compare in potential returns and market dynamics.

Why it is important

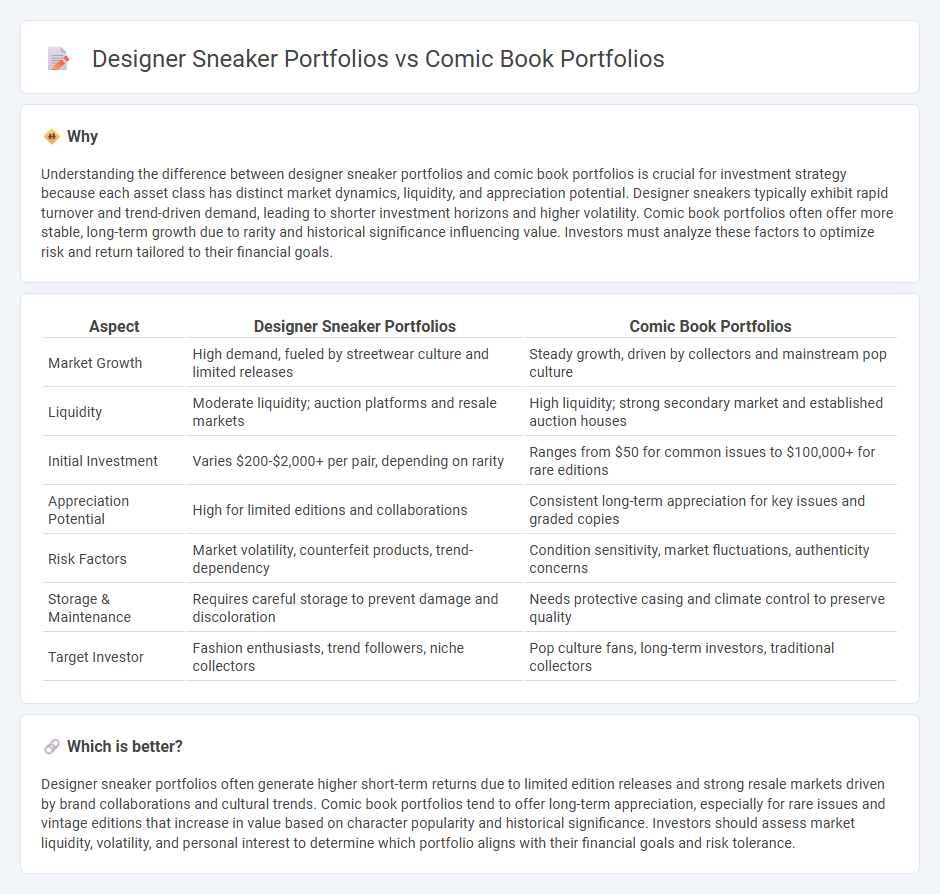

Understanding the difference between designer sneaker portfolios and comic book portfolios is crucial for investment strategy because each asset class has distinct market dynamics, liquidity, and appreciation potential. Designer sneakers typically exhibit rapid turnover and trend-driven demand, leading to shorter investment horizons and higher volatility. Comic book portfolios often offer more stable, long-term growth due to rarity and historical significance influencing value. Investors must analyze these factors to optimize risk and return tailored to their financial goals.

Comparison Table

| Aspect | Designer Sneaker Portfolios | Comic Book Portfolios |

|---|---|---|

| Market Growth | High demand, fueled by streetwear culture and limited releases | Steady growth, driven by collectors and mainstream pop culture |

| Liquidity | Moderate liquidity; auction platforms and resale markets | High liquidity; strong secondary market and established auction houses |

| Initial Investment | Varies $200-$2,000+ per pair, depending on rarity | Ranges from $50 for common issues to $100,000+ for rare editions |

| Appreciation Potential | High for limited editions and collaborations | Consistent long-term appreciation for key issues and graded copies |

| Risk Factors | Market volatility, counterfeit products, trend-dependency | Condition sensitivity, market fluctuations, authenticity concerns |

| Storage & Maintenance | Requires careful storage to prevent damage and discoloration | Needs protective casing and climate control to preserve quality |

| Target Investor | Fashion enthusiasts, trend followers, niche collectors | Pop culture fans, long-term investors, traditional collectors |

Which is better?

Designer sneaker portfolios often generate higher short-term returns due to limited edition releases and strong resale markets driven by brand collaborations and cultural trends. Comic book portfolios tend to offer long-term appreciation, especially for rare issues and vintage editions that increase in value based on character popularity and historical significance. Investors should assess market liquidity, volatility, and personal interest to determine which portfolio aligns with their financial goals and risk tolerance.

Connection

Designer sneaker portfolios and comic book portfolios both capitalize on the growing market for rare and collectible assets, leveraging scarcity and cultural trends to drive value appreciation. Investors in these niches benefit from a combination of historical demand data, limited edition releases, and the influence of pop culture, which boost the long-term potential of their holdings. Digital tracking platforms and auction house analytics further enhance portfolio management by providing transparency and market insights for these alternative investment classes.

Key Terms

Grading

Comic book portfolios rely heavily on professional grading services like CGC to determine condition, authenticity, and market value, with grades ranging from 0.5 to 10. Designer sneaker portfolios often use platforms such as StockX or GOAT, where grading focuses on authenticity, wear condition, and sometimes exclusivity, impacting resale prices significantly. Explore the detailed criteria and top grading services to better manage your collection and maximize its value.

Authentication

Comic book portfolios emphasize authentication through certifications from recognized grading companies like CGC and CBCS, ensuring the condition and rarity of collectible issues. Designer sneaker portfolios rely on detailed provenance, including purchase receipts and authentication services such as StockX or GOAT, to validate originality and exclusivity. Explore more about the distinct authentication methods securing value in both comic book and designer sneaker portfolios.

Market Liquidity

Comic book portfolios exhibit higher market liquidity due to frequent auctions, established grading systems, and strong collector demand, facilitating quicker asset turnover with transparent pricing. Designer sneaker portfolios experience fluctuating liquidity driven by limited releases, hype cycles, and platform-specific marketplaces like StockX or GOAT, which can cause price volatility and varying sell times. Explore deeper market insights to optimize portfolio strategies for these alternative asset classes.

Source and External Links

How To Build A Comic Portfolio - Offers step-by-step advice on selecting and presenting your best comic work, including tips on curating original art, showcasing process vs. finals, and organizing your portfolio for maximum impact.

21 Examples Of Cartoonist Websites & Portfolios - Features real-world comic artist portfolio websites across genres, highlighting diverse presentation styles and visual storytelling approaches from established professionals.

Comic Portfolio Projects - A large online gallery of comic portfolio projects from artists worldwide, allowing immediate browsing, comparison, and discovery of current trends in comic art presentation.

dowidth.com

dowidth.com