Dark kitchen real estate presents a unique investment opportunity with high demand driven by the rise of food delivery services and minimal operational costs. Event venue rentals offer flexible income streams, capitalizing on diverse occasions from corporate meetings to private celebrations, often yielding higher short-term returns. Explore the differences and potential benefits to determine which investment aligns with your financial goals.

Why it is important

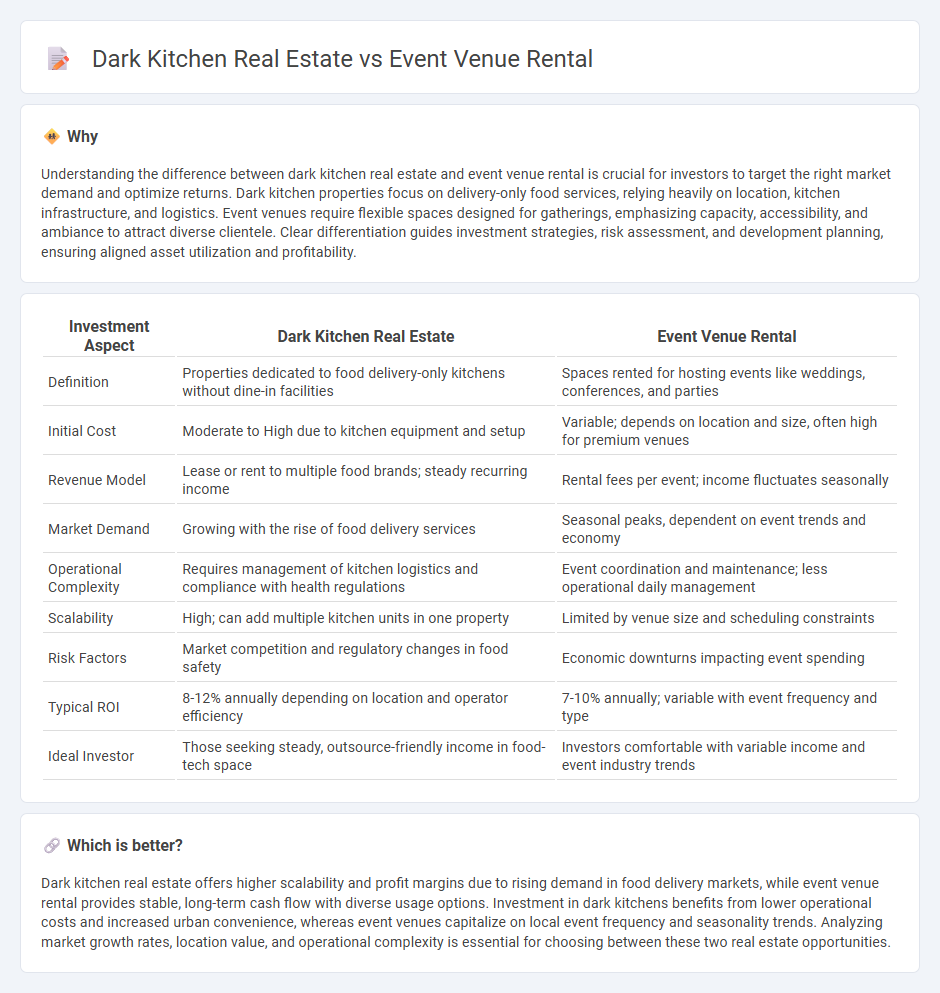

Understanding the difference between dark kitchen real estate and event venue rental is crucial for investors to target the right market demand and optimize returns. Dark kitchen properties focus on delivery-only food services, relying heavily on location, kitchen infrastructure, and logistics. Event venues require flexible spaces designed for gatherings, emphasizing capacity, accessibility, and ambiance to attract diverse clientele. Clear differentiation guides investment strategies, risk assessment, and development planning, ensuring aligned asset utilization and profitability.

Comparison Table

| Investment Aspect | Dark Kitchen Real Estate | Event Venue Rental |

|---|---|---|

| Definition | Properties dedicated to food delivery-only kitchens without dine-in facilities | Spaces rented for hosting events like weddings, conferences, and parties |

| Initial Cost | Moderate to High due to kitchen equipment and setup | Variable; depends on location and size, often high for premium venues |

| Revenue Model | Lease or rent to multiple food brands; steady recurring income | Rental fees per event; income fluctuates seasonally |

| Market Demand | Growing with the rise of food delivery services | Seasonal peaks, dependent on event trends and economy |

| Operational Complexity | Requires management of kitchen logistics and compliance with health regulations | Event coordination and maintenance; less operational daily management |

| Scalability | High; can add multiple kitchen units in one property | Limited by venue size and scheduling constraints |

| Risk Factors | Market competition and regulatory changes in food safety | Economic downturns impacting event spending |

| Typical ROI | 8-12% annually depending on location and operator efficiency | 7-10% annually; variable with event frequency and type |

| Ideal Investor | Those seeking steady, outsource-friendly income in food-tech space | Investors comfortable with variable income and event industry trends |

Which is better?

Dark kitchen real estate offers higher scalability and profit margins due to rising demand in food delivery markets, while event venue rental provides stable, long-term cash flow with diverse usage options. Investment in dark kitchens benefits from lower operational costs and increased urban convenience, whereas event venues capitalize on local event frequency and seasonality trends. Analyzing market growth rates, location value, and operational complexity is essential for choosing between these two real estate opportunities.

Connection

Dark kitchen real estate and event venue rental share a strategic connection through flexible property investment targeting evolving urban lifestyles. Investors capitalize on high-demand locations by repurposing or developing spaces adaptable for food delivery hubs and private event hosting, maximizing rental yields. This dual-use real estate approach leverages the growing gig economy and experiential consumption trends to optimize asset utilization and revenue streams.

Key Terms

Lease Agreement

Lease agreements for event venue rentals often include flexible terms for short-term use, permitting customization for specific occasions and customer requirements, with clauses addressing liability and security deposits. In contrast, dark kitchen real estate leases typically involve longer commitments, strict compliance with health regulations, and provisions for specialized kitchen equipment installation and maintenance. Explore detailed lease agreement considerations for both to optimize your investment and operational success.

Occupancy Rate

Event venue rental boasts an average occupancy rate of 65%, driven by high demand for weddings, corporate gatherings, and social events. In contrast, dark kitchen real estate achieves occupancy rates close to 80%, fueled by the rapid growth of food delivery services and multiple tenants sharing compact kitchen spaces. Explore detailed insights to understand which investment aligns best with evolving market trends.

Asset Utilization

Event venue rental maximizes asset utilization by generating revenue through bookings for various occasions, optimizing space during peak times to ensure consistent cash flow. Dark kitchen real estate leverages underutilized commercial spaces exclusively for food delivery operations, increasing operational efficiency by reducing front-of-house costs and enhancing delivery logistics. Explore detailed strategies to enhance asset utilization in both sectors for improved profitability.

Source and External Links

33 Best Event Venues for Rent Near Me - Event venues average $210 per hour to rent, with smaller venues around $164 and larger ones about $275 per hour, offering a range of options based on size and budget.

Event Spaces Bangalore | Premium Corporate Event Venues - Provides flexible, premium event spaces in Bangalore with amenities like high-speed internet, AV equipment, and professional support, suitable for corporate meetings and other professional events with variable rates based on location and services.

Unique Venues: Party, Wedding & Corporate Event ... - Offers a wide variety of unique event venues across the US and Canada, including party, wedding, corporate, and academic spaces, with nearly 40 years of experience helping planners find the perfect venue tailored to event type, size, and style.

dowidth.com

dowidth.com