Carbon credit trading facilitates businesses in offsetting their emissions by purchasing verified carbon offsets, creating a market-driven approach to reducing greenhouse gases. Climate tech venture capital focuses on funding innovative startups developing technologies that directly mitigate or adapt to climate change, driving long-term environmental impact and economic growth. Explore how these investment strategies contribute uniquely to advancing sustainability goals.

Why it is important

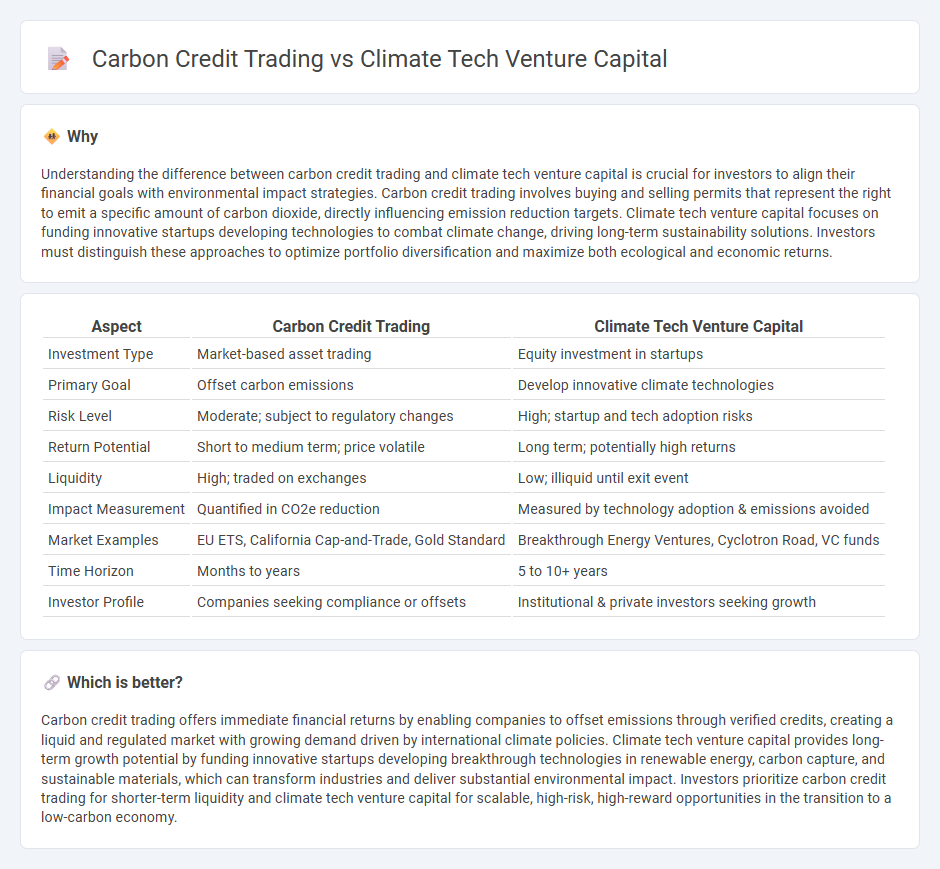

Understanding the difference between carbon credit trading and climate tech venture capital is crucial for investors to align their financial goals with environmental impact strategies. Carbon credit trading involves buying and selling permits that represent the right to emit a specific amount of carbon dioxide, directly influencing emission reduction targets. Climate tech venture capital focuses on funding innovative startups developing technologies to combat climate change, driving long-term sustainability solutions. Investors must distinguish these approaches to optimize portfolio diversification and maximize both ecological and economic returns.

Comparison Table

| Aspect | Carbon Credit Trading | Climate Tech Venture Capital |

|---|---|---|

| Investment Type | Market-based asset trading | Equity investment in startups |

| Primary Goal | Offset carbon emissions | Develop innovative climate technologies |

| Risk Level | Moderate; subject to regulatory changes | High; startup and tech adoption risks |

| Return Potential | Short to medium term; price volatile | Long term; potentially high returns |

| Liquidity | High; traded on exchanges | Low; illiquid until exit event |

| Impact Measurement | Quantified in CO2e reduction | Measured by technology adoption & emissions avoided |

| Market Examples | EU ETS, California Cap-and-Trade, Gold Standard | Breakthrough Energy Ventures, Cyclotron Road, VC funds |

| Time Horizon | Months to years | 5 to 10+ years |

| Investor Profile | Companies seeking compliance or offsets | Institutional & private investors seeking growth |

Which is better?

Carbon credit trading offers immediate financial returns by enabling companies to offset emissions through verified credits, creating a liquid and regulated market with growing demand driven by international climate policies. Climate tech venture capital provides long-term growth potential by funding innovative startups developing breakthrough technologies in renewable energy, carbon capture, and sustainable materials, which can transform industries and deliver substantial environmental impact. Investors prioritize carbon credit trading for shorter-term liquidity and climate tech venture capital for scalable, high-risk, high-reward opportunities in the transition to a low-carbon economy.

Connection

Carbon credit trading creates market incentives for reducing greenhouse gas emissions, driving demand for innovative climate technologies that improve sustainability. Climate tech venture capital funds startups developing advanced solutions such as carbon capture, renewable energy, and emissions monitoring, which enhance the efficacy and scalability of carbon credit systems. The synergy between carbon credit markets and climate tech investments accelerates global decarbonization and supports the transition to a low-carbon economy.

Key Terms

**Climate tech venture capital:**

Climate tech venture capital drives innovation by funding startups that develop scalable solutions to reduce greenhouse gas emissions, such as renewable energy technologies, energy storage, and advanced carbon capture systems. This investment strategy targets early-stage companies with high growth potential, aiming to accelerate the deployment of cutting-edge climate technologies that can transform industries and support global decarbonization goals. Discover more about how climate tech venture capital catalyzes the transition to a sustainable future.

Equity financing

Climate tech venture capital drives innovation by providing equity financing to startups developing cutting-edge technologies aimed at reducing greenhouse gas emissions. In contrast, carbon credit trading focuses on buying and selling carbon offset certificates to meet regulatory or voluntary emission reduction targets rather than equity investment. Explore the differences in risk, return, and impact to better understand how each approach fuels the transition to a low-carbon economy.

Startups

Climate tech venture capital targets innovative startups developing cutting-edge technologies to reduce greenhouse gas emissions and promote sustainability across various sectors. Carbon credit trading startups focus on creating platforms that facilitate the buying and selling of carbon offsets, enabling companies to meet regulatory requirements and achieve carbon neutrality. Explore the evolving landscape of climate tech startups and their impact on environmental solutions.

Source and External Links

5 Leading Climate Tech VCs & Investors - Lists top climate tech venture capital firms including Breakthrough Energy Ventures, Pale Blue Dot, and others that focus on climate tech investments.

State of Climate Tech 2024 - Discusses trends in climate tech investments, including the shift towards later-stage investments and the role of corporate ventures.

Clean Energy Ventures - Focuses on early-stage climate tech startups with scalable clean energy technologies, aiming to mitigate significant CO2 emissions by 2050.

dowidth.com

dowidth.com