Litigation funding provides capital to plaintiffs involved in lawsuits in exchange for a portion of the settlement or judgment, focusing on legal risk and potential returns tied to case outcomes. Distressed debt investing involves purchasing the debt of financially troubled companies at discounted prices, aiming to profit from the company's recovery or asset liquidation. Explore the distinct risk profiles and strategic benefits of litigation funding versus distressed debt investing to make informed investment decisions.

Why it is important

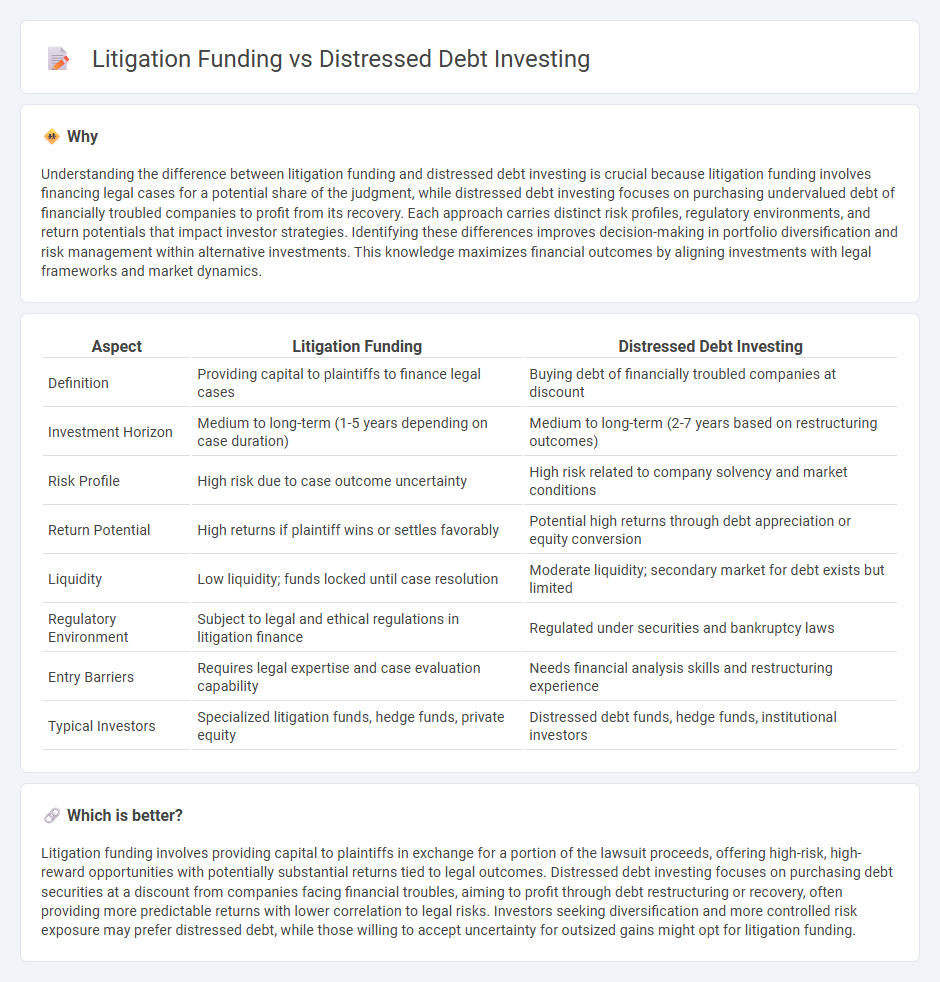

Understanding the difference between litigation funding and distressed debt investing is crucial because litigation funding involves financing legal cases for a potential share of the judgment, while distressed debt investing focuses on purchasing undervalued debt of financially troubled companies to profit from its recovery. Each approach carries distinct risk profiles, regulatory environments, and return potentials that impact investor strategies. Identifying these differences improves decision-making in portfolio diversification and risk management within alternative investments. This knowledge maximizes financial outcomes by aligning investments with legal frameworks and market dynamics.

Comparison Table

| Aspect | Litigation Funding | Distressed Debt Investing |

|---|---|---|

| Definition | Providing capital to plaintiffs to finance legal cases | Buying debt of financially troubled companies at discount |

| Investment Horizon | Medium to long-term (1-5 years depending on case duration) | Medium to long-term (2-7 years based on restructuring outcomes) |

| Risk Profile | High risk due to case outcome uncertainty | High risk related to company solvency and market conditions |

| Return Potential | High returns if plaintiff wins or settles favorably | Potential high returns through debt appreciation or equity conversion |

| Liquidity | Low liquidity; funds locked until case resolution | Moderate liquidity; secondary market for debt exists but limited |

| Regulatory Environment | Subject to legal and ethical regulations in litigation finance | Regulated under securities and bankruptcy laws |

| Entry Barriers | Requires legal expertise and case evaluation capability | Needs financial analysis skills and restructuring experience |

| Typical Investors | Specialized litigation funds, hedge funds, private equity | Distressed debt funds, hedge funds, institutional investors |

Which is better?

Litigation funding involves providing capital to plaintiffs in exchange for a portion of the lawsuit proceeds, offering high-risk, high-reward opportunities with potentially substantial returns tied to legal outcomes. Distressed debt investing focuses on purchasing debt securities at a discount from companies facing financial troubles, aiming to profit through debt restructuring or recovery, often providing more predictable returns with lower correlation to legal risks. Investors seeking diversification and more controlled risk exposure may prefer distressed debt, while those willing to accept uncertainty for outsized gains might opt for litigation funding.

Connection

Litigation funding and distressed debt investing intersect through their shared focus on high-risk, high-reward financial strategies that capitalize on undervalued or uncertain assets. Litigation funding provides capital to plaintiffs involved in legal disputes, creating investment opportunities analogous to distressed debt investments, where investors acquire debt from financially troubled companies at a discount. Both methods rely on detailed risk assessment and legal expertise to maximize potential returns from uncertain or contentious financial situations.

Key Terms

Distressed Debt Investing:

Distressed debt investing involves purchasing the securities of companies facing financial difficulties or bankruptcy, aiming to profit from their recovery or restructuring. This strategy requires in-depth analysis of credit risk, company fundamentals, and market conditions to identify undervalued debt with high potential returns. Explore key insights and strategies in distressed debt investing to enhance your portfolio performance.

Defaulted Securities

Distressed debt investing targets defaulted securities by purchasing debt at a significant discount, aiming to profit from restructuring or improved company performance. Litigation funding involves financing legal claims related to defaulted securities, enabling investors to potentially recover value through legal judgments or settlements. Explore further to understand the strategic benefits and risks of each approach in managing defaulted securities.

Recovery Rate

Distressed debt investing targets purchasing the debt of financially troubled companies at significant discounts, aiming for high recovery rates through restructuring or asset liquidation. Litigation funding provides capital to plaintiffs or law firms in exchange for a portion of the lawsuit's settlement or award, with recovery rates dependent on legal outcomes and case merits. Explore the differences in recovery rate dynamics and risk profiles to determine which strategy aligns best with your investment objectives.

Source and External Links

What is Distressed Debt Investing? | Allvue Systems - Distressed debt investing involves purchasing debt from companies that are unable to meet their obligations, typically at a significant discount, with the goal of profiting from restructuring, bankruptcy, or eventual recovery of value.

Distressed Debt Investing: Definition & Strategies - Distressed debt investors buy high-risk, low-priced bonds or loans of financially troubled companies, either passively waiting for a turnaround or actively pushing for restructuring or conversion to equity to maximize returns.

What Is Distressed Debt Investing? | HBS Online - This high-risk, high-reward strategy focuses on acquiring a controlling share of a distressed company's debt to influence its restructuring or bankruptcy process, aiming to convert debt into equity or receive liquidation payouts ahead of stockholders.

dowidth.com

dowidth.com