Wine investing platforms offer access to rare vintages and diversified portfolios tailored for enthusiasts seeking tangible assets with potential appreciation. Private equity platforms provide opportunities to invest in private companies, often requiring larger capital commitments and offering direct exposure to company growth and operational shifts. Explore the nuances of each investment avenue to determine the best fit for your financial goals.

Why it is important

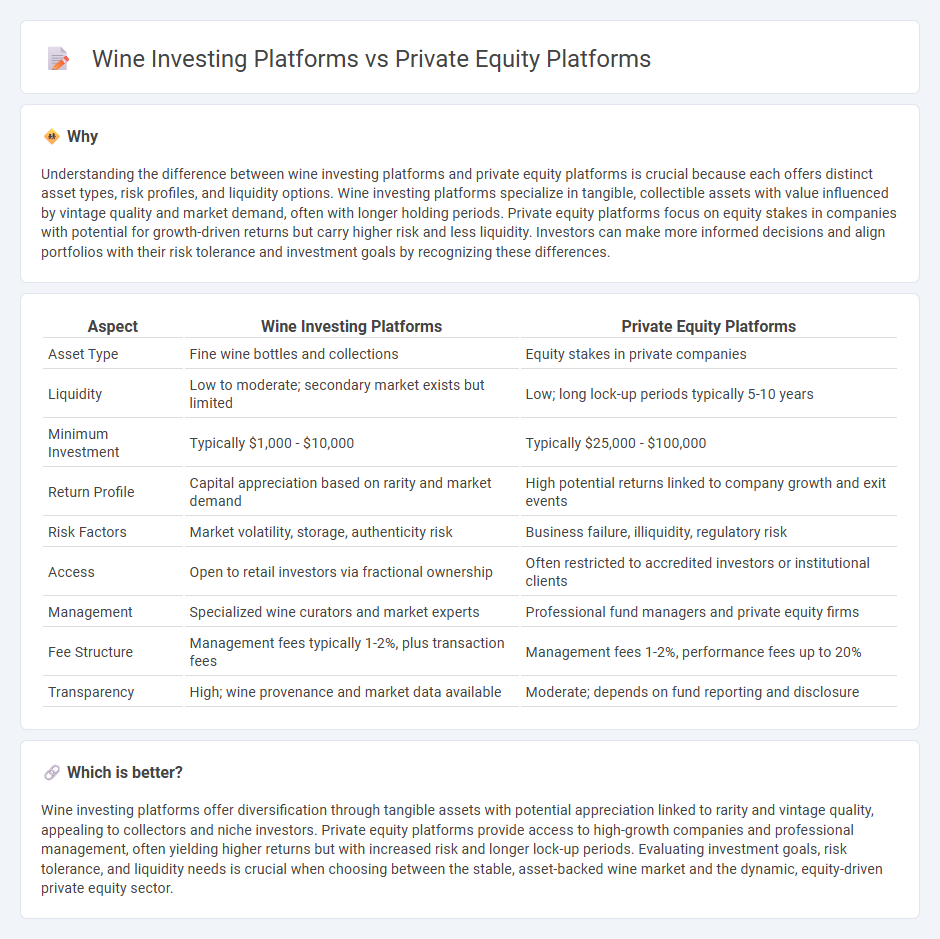

Understanding the difference between wine investing platforms and private equity platforms is crucial because each offers distinct asset types, risk profiles, and liquidity options. Wine investing platforms specialize in tangible, collectible assets with value influenced by vintage quality and market demand, often with longer holding periods. Private equity platforms focus on equity stakes in companies with potential for growth-driven returns but carry higher risk and less liquidity. Investors can make more informed decisions and align portfolios with their risk tolerance and investment goals by recognizing these differences.

Comparison Table

| Aspect | Wine Investing Platforms | Private Equity Platforms |

|---|---|---|

| Asset Type | Fine wine bottles and collections | Equity stakes in private companies |

| Liquidity | Low to moderate; secondary market exists but limited | Low; long lock-up periods typically 5-10 years |

| Minimum Investment | Typically $1,000 - $10,000 | Typically $25,000 - $100,000 |

| Return Profile | Capital appreciation based on rarity and market demand | High potential returns linked to company growth and exit events |

| Risk Factors | Market volatility, storage, authenticity risk | Business failure, illiquidity, regulatory risk |

| Access | Open to retail investors via fractional ownership | Often restricted to accredited investors or institutional clients |

| Management | Specialized wine curators and market experts | Professional fund managers and private equity firms |

| Fee Structure | Management fees typically 1-2%, plus transaction fees | Management fees 1-2%, performance fees up to 20% |

| Transparency | High; wine provenance and market data available | Moderate; depends on fund reporting and disclosure |

Which is better?

Wine investing platforms offer diversification through tangible assets with potential appreciation linked to rarity and vintage quality, appealing to collectors and niche investors. Private equity platforms provide access to high-growth companies and professional management, often yielding higher returns but with increased risk and longer lock-up periods. Evaluating investment goals, risk tolerance, and liquidity needs is crucial when choosing between the stable, asset-backed wine market and the dynamic, equity-driven private equity sector.

Connection

Wine investing platforms and private equity platforms are connected through the shared goal of offering alternative investment opportunities that diversify traditional portfolios. Both platforms leverage fractional ownership models, enabling investors to access niche markets like fine wine collections or private company shares with lower capital requirements. Data-driven valuation methods and secure digital marketplaces enhance transparency and liquidity, making these platforms increasingly attractive to sophisticated investors seeking non-correlated asset classes.

Key Terms

Fund Structure

Private equity platforms typically offer closed-end funds with fixed lifespans ranging from 7 to 10 years, allowing investors to commit capital for targeted business growth and eventual exit strategies. In contrast, wine investing platforms often utilize open-end or private investment funds that provide liquidity through secondary markets or allowing investors to buy and sell shares in rare and collectible wines. Explore the structural differences further to optimize your portfolio strategy in alternative investments.

Asset Liquidity

Private equity platforms typically offer lower asset liquidity due to longer investment horizons and complex exit strategies, whereas wine investing platforms provide relatively higher liquidity through secondary markets and quicker resale options. Wine investments benefit from growing global demand and collectible value, enhancing their tradability compared to the often illiquid nature of private equity stakes. Explore the nuances of asset liquidity between these platforms to make informed investment decisions.

Risk Diversification

Private equity platforms typically offer diversified portfolios across various industries and stages, reducing exposure to specific market risks and enhancing overall risk management. Wine investing platforms concentrate on high-value collectible wines, where risk diversification depends heavily on provenance, vintage, and storage conditions, leading to unique but narrower risk profiles. Explore further to understand how these distinct risk diversification strategies impact your investment choices.

Source and External Links

Moonfare - Moonfare is a private equity investing platform offering access to top-tier funds for retail and institutional investors at lower minimums.

Midstreet - Provides insights into what a platform company is in private equity, where a company is purchased and grown by acquisitions.

PE Hub - Offers news, analysis, and insights into private equity, venture capital, and mergers & acquisitions.

dowidth.com

dowidth.com