Livestock investment platforms provide direct exposure to agricultural assets such as cattle, poultry, and dairy, offering investors tangible portfolio diversification and potential income through animal growth and product sales. Commodity trading platforms, on the other hand, focus on the buying and selling of futures contracts for agricultural products like corn, wheat, and livestock feed, enabling traders to speculate on price movements with leverage and liquidity. Explore these investment avenues further to understand their risk profiles and return potentials.

Why it is important

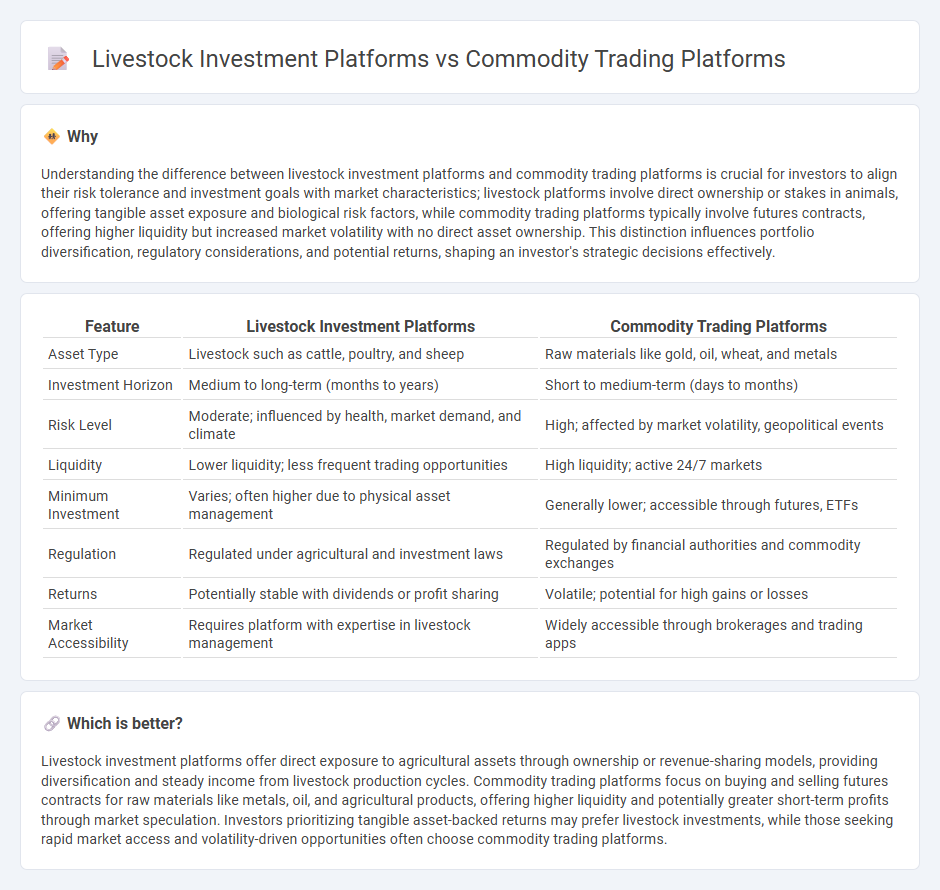

Understanding the difference between livestock investment platforms and commodity trading platforms is crucial for investors to align their risk tolerance and investment goals with market characteristics; livestock platforms involve direct ownership or stakes in animals, offering tangible asset exposure and biological risk factors, while commodity trading platforms typically involve futures contracts, offering higher liquidity but increased market volatility with no direct asset ownership. This distinction influences portfolio diversification, regulatory considerations, and potential returns, shaping an investor's strategic decisions effectively.

Comparison Table

| Feature | Livestock Investment Platforms | Commodity Trading Platforms |

|---|---|---|

| Asset Type | Livestock such as cattle, poultry, and sheep | Raw materials like gold, oil, wheat, and metals |

| Investment Horizon | Medium to long-term (months to years) | Short to medium-term (days to months) |

| Risk Level | Moderate; influenced by health, market demand, and climate | High; affected by market volatility, geopolitical events |

| Liquidity | Lower liquidity; less frequent trading opportunities | High liquidity; active 24/7 markets |

| Minimum Investment | Varies; often higher due to physical asset management | Generally lower; accessible through futures, ETFs |

| Regulation | Regulated under agricultural and investment laws | Regulated by financial authorities and commodity exchanges |

| Returns | Potentially stable with dividends or profit sharing | Volatile; potential for high gains or losses |

| Market Accessibility | Requires platform with expertise in livestock management | Widely accessible through brokerages and trading apps |

Which is better?

Livestock investment platforms offer direct exposure to agricultural assets through ownership or revenue-sharing models, providing diversification and steady income from livestock production cycles. Commodity trading platforms focus on buying and selling futures contracts for raw materials like metals, oil, and agricultural products, offering higher liquidity and potentially greater short-term profits through market speculation. Investors prioritizing tangible asset-backed returns may prefer livestock investments, while those seeking rapid market access and volatility-driven opportunities often choose commodity trading platforms.

Connection

Livestock investment platforms and commodity trading platforms are interconnected through their shared focus on agricultural commodities and market-driven pricing mechanisms. Livestock investment platforms enable investors to profit from the rising demand and value of livestock assets, while commodity trading platforms facilitate the buying and selling of livestock-related futures and derivatives. Both platforms rely on real-time data and market trends to optimize investment strategies and hedge risks in agricultural markets.

Key Terms

Asset Type

Commodity trading platforms specialize in assets such as metals, energy products, and agricultural goods, offering traders opportunities to engage with tangible, fungible resources. Livestock investment platforms focus on biological assets like cattle, poultry, and other farm animals, which present unique variables like growth cycles, health management, and market demand fluctuations. Discover the specific advantages and challenges of each asset type to determine the best option for your investment goals.

Market Liquidity

Commodity trading platforms offer high market liquidity through extensive participation in futures and spot markets, enabling rapid asset conversion and price transparency. In contrast, livestock investment platforms exhibit lower liquidity due to the physical nature of assets, longer holding periods, and limited secondary markets. Explore detailed comparisons and strategies to optimize liquidity in both investment types.

Regulatory Oversight

Commodity trading platforms operate under stringent regulatory frameworks set by entities such as the Commodity Futures Trading Commission (CFTC) and the Securities Exchange Commission (SEC), ensuring transparency, risk management, and investor protection. In contrast, livestock investment platforms often face less uniform regulation, varying significantly by jurisdiction, which may increase exposure to operational and market risks. Explore the specific regulatory requirements of each platform type to make informed investment decisions.

Source and External Links

Commodity Trading via CFDs - FOREX.com - FOREX.com offers contract for difference (CFD) trading on commodities through spot and futures contracts, allowing users to trade both long and short positions with leverage on their web, TradingView, or MetaTrader 5 platforms.

Best Commodities Brokers in the U.S - Investing.com - Interactive Brokers and IG US provide access to a diverse range of commodity markets (metals, energies, agriculture) via futures, options, and ETFs, with advanced trading tools, low commissions, and competitive spreads.

Best Commodity Trading Platforms/Brokers Compared & Reviewed - Saxo Markets and XTB are leading platforms for retail and professional traders, offering CFDs, futures, options, spot pairs, and ETFs across major commodity groups, with additional features like integrated news, risk management, and direct market access for institutional clients.

dowidth.com

dowidth.com