Designer sneaker portfolios offer high liquidity and trendy market appeal, often yielding rapid returns due to limited edition releases and celebrity endorsements. Rare coin collections provide historical value and long-term appreciation, benefiting from scarcity and numismatic significance, attracting dedicated collectors and investors. Explore how these distinct asset classes can diversify your investment strategy.

Why it is important

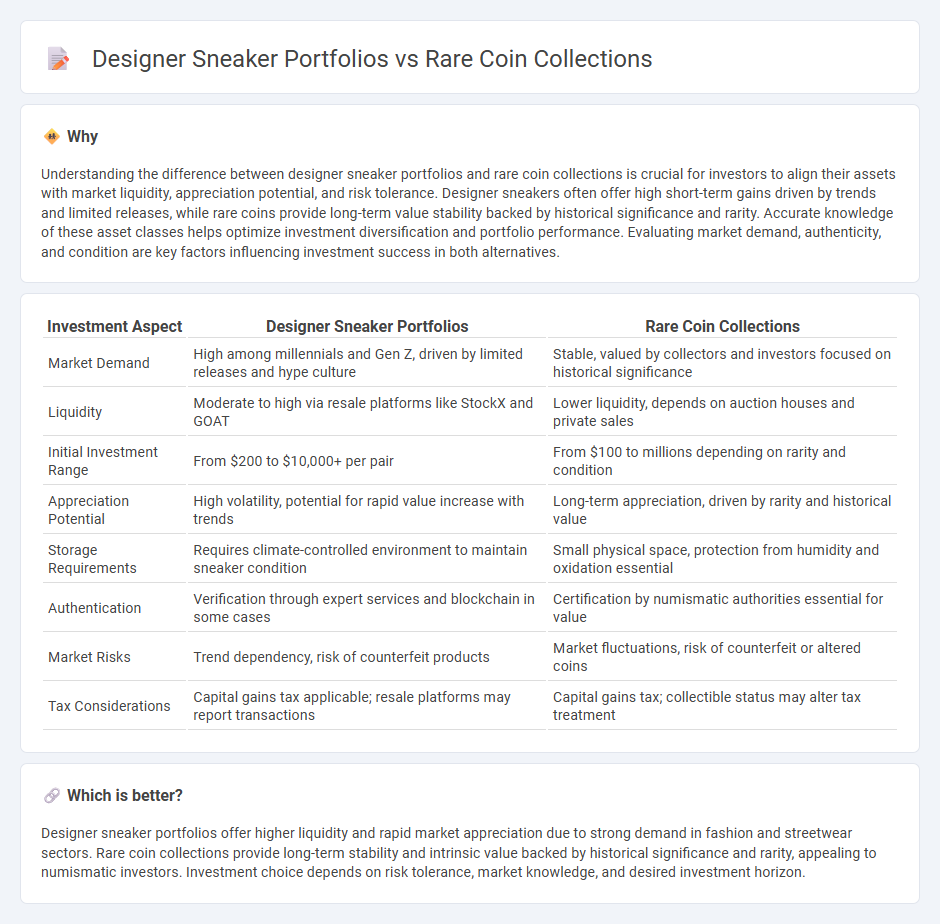

Understanding the difference between designer sneaker portfolios and rare coin collections is crucial for investors to align their assets with market liquidity, appreciation potential, and risk tolerance. Designer sneakers often offer high short-term gains driven by trends and limited releases, while rare coins provide long-term value stability backed by historical significance and rarity. Accurate knowledge of these asset classes helps optimize investment diversification and portfolio performance. Evaluating market demand, authenticity, and condition are key factors influencing investment success in both alternatives.

Comparison Table

| Investment Aspect | Designer Sneaker Portfolios | Rare Coin Collections |

|---|---|---|

| Market Demand | High among millennials and Gen Z, driven by limited releases and hype culture | Stable, valued by collectors and investors focused on historical significance |

| Liquidity | Moderate to high via resale platforms like StockX and GOAT | Lower liquidity, depends on auction houses and private sales |

| Initial Investment Range | From $200 to $10,000+ per pair | From $100 to millions depending on rarity and condition |

| Appreciation Potential | High volatility, potential for rapid value increase with trends | Long-term appreciation, driven by rarity and historical value |

| Storage Requirements | Requires climate-controlled environment to maintain sneaker condition | Small physical space, protection from humidity and oxidation essential |

| Authentication | Verification through expert services and blockchain in some cases | Certification by numismatic authorities essential for value |

| Market Risks | Trend dependency, risk of counterfeit products | Market fluctuations, risk of counterfeit or altered coins |

| Tax Considerations | Capital gains tax applicable; resale platforms may report transactions | Capital gains tax; collectible status may alter tax treatment |

Which is better?

Designer sneaker portfolios offer higher liquidity and rapid market appreciation due to strong demand in fashion and streetwear sectors. Rare coin collections provide long-term stability and intrinsic value backed by historical significance and rarity, appealing to numismatic investors. Investment choice depends on risk tolerance, market knowledge, and desired investment horizon.

Connection

Designer sneaker portfolios and rare coin collections both serve as alternative investment assets that blend cultural appeal with potential financial growth. Their value is driven by rarity, condition, and market demand, attracting collectors and investors seeking diversification beyond traditional stocks and bonds. The liquidity and market dynamics of these assets often depend on niche communities and evolving trends within the collectibles industry.

Key Terms

Rarity

Rare coin collections hold significant value due to their historical uniqueness and limited mintages, making each piece a coveted treasure among numismatists. Designer sneaker portfolios capitalize on exclusivity through limited-edition releases and collaborations with high-profile brands, driving hype and market demand. Explore the intricacies of rarity-driven value in these contrasting investment domains to deepen your understanding.

Authentication

Rare coin collections demand meticulous authentication through expert grading services like PCGS and NGC to verify metal content, strike quality, and provenance, ensuring value retention and fraud prevention. Designer sneaker portfolios rely on advanced authentication techniques including UV light inspection, micro-detail analysis, and blockchain certificates to confirm originality and condition in a highly counterfeit-prone market. Explore in-depth methods and tools to safeguard your investment in rare coins and designer sneakers by learning more about authentication standards.

Market Liquidity

Rare coin collections demonstrate varying degrees of market liquidity, often influenced by the coin's rarity, historical significance, and condition, making high-value coins highly sought after in niche auctions. Designer sneaker portfolios showcase relatively higher liquidity, fueled by trends, limited releases, and resell platforms like StockX and GOAT, enabling quicker asset turnover. Explore the dynamics of these unique investment avenues to better understand their liquidity potentials.

Source and External Links

Stack's Bowers Galleries - Specializes in U.S., world, and ancient rare coins, tokens, medals, and currency, offering auctions, direct sales, appraisals, and educational resources for collectors and investors of all levels.

Heritage Auctions - Buys, sells, auctions, and appraises rare and collectible U.S., world, and ancient coins, including gold, silver, and certified (slabbed) coins, with expert assistance for building and selling collections.

Coinappraiser.com - Provides a coin value guide with pictures and prices for thousands of rare U.S. coins, plus direct access to coin experts for appraisals, grading advice, and selling options.

dowidth.com

dowidth.com