Fractional real estate investing allows individuals to buy a share of a specific property, providing direct ownership and potential rental income proportional to their investment. Crowdfunding real estate pools capital from multiple investors to fund larger projects, offering diversified exposure but less control over individual assets. Explore detailed comparisons to determine which strategy aligns best with your investment goals.

Why it is important

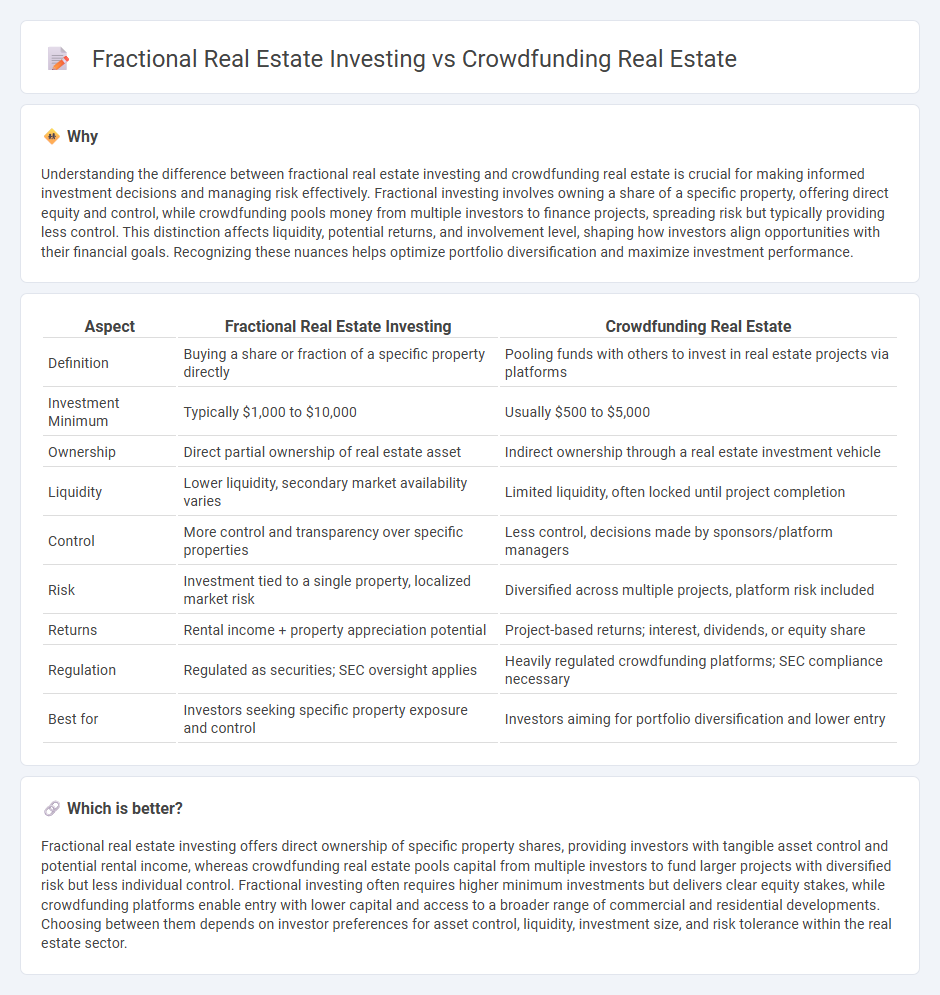

Understanding the difference between fractional real estate investing and crowdfunding real estate is crucial for making informed investment decisions and managing risk effectively. Fractional investing involves owning a share of a specific property, offering direct equity and control, while crowdfunding pools money from multiple investors to finance projects, spreading risk but typically providing less control. This distinction affects liquidity, potential returns, and involvement level, shaping how investors align opportunities with their financial goals. Recognizing these nuances helps optimize portfolio diversification and maximize investment performance.

Comparison Table

| Aspect | Fractional Real Estate Investing | Crowdfunding Real Estate |

|---|---|---|

| Definition | Buying a share or fraction of a specific property directly | Pooling funds with others to invest in real estate projects via platforms |

| Investment Minimum | Typically $1,000 to $10,000 | Usually $500 to $5,000 |

| Ownership | Direct partial ownership of real estate asset | Indirect ownership through a real estate investment vehicle |

| Liquidity | Lower liquidity, secondary market availability varies | Limited liquidity, often locked until project completion |

| Control | More control and transparency over specific properties | Less control, decisions made by sponsors/platform managers |

| Risk | Investment tied to a single property, localized market risk | Diversified across multiple projects, platform risk included |

| Returns | Rental income + property appreciation potential | Project-based returns; interest, dividends, or equity share |

| Regulation | Regulated as securities; SEC oversight applies | Heavily regulated crowdfunding platforms; SEC compliance necessary |

| Best for | Investors seeking specific property exposure and control | Investors aiming for portfolio diversification and lower entry |

Which is better?

Fractional real estate investing offers direct ownership of specific property shares, providing investors with tangible asset control and potential rental income, whereas crowdfunding real estate pools capital from multiple investors to fund larger projects with diversified risk but less individual control. Fractional investing often requires higher minimum investments but delivers clear equity stakes, while crowdfunding platforms enable entry with lower capital and access to a broader range of commercial and residential developments. Choosing between them depends on investor preferences for asset control, liquidity, investment size, and risk tolerance within the real estate sector.

Connection

Fractional real estate investing and crowdfunding real estate both enable multiple investors to collectively own a portion of a property, lowering the financial barrier to entry. These approaches utilize online platforms to pool capital from numerous investors, making real estate investment more accessible and diversified. By sharing ownership and risks, they provide flexible investment opportunities compared to traditional real estate purchases.

Key Terms

Ownership Structure

Crowdfunding real estate involves multiple investors pooling funds to finance a property, often without direct ownership rights, whereas fractional real estate investing grants investors specific shares with legal ownership stakes. In fractional investing, ownership is divided into well-defined percentages, allowing investors to earn rental income and vote on property management, contrasting with the more collective and passive nature of crowdfunding models. Explore deeper insights on ownership frameworks to determine the best investment approach for your portfolio goals.

Liquidity

Crowdfunding real estate offers moderate liquidity through periodic redemption windows or secondary markets, often allowing investors to exit within a few years. Fractional real estate investing typically provides higher liquidity with shares traded on regulated exchanges, enabling quicker entry and exit similar to stocks. Explore detailed comparisons to understand which investment suits your liquidity needs best.

Due Diligence

Due diligence in crowdfunding real estate involves thorough evaluation of project developers, financial projections, and platform transparency to mitigate risks. Fractional real estate investing requires scrutiny of property valuation, ownership structure, and liquidity options to ensure a secure investment. Explore detailed comparisons and expert insights to master due diligence in both investment methods.

Source and External Links

What Is Real Estate Crowdfunding & How Does It Work - BetterWorld - Real estate crowdfunding pools funds from multiple investors to finance real estate projects, offering equity and debt investment options through online platforms that connect investors with opportunities while managing funds and due diligence.

Crowdfunding real estate: What to know - Rocket Mortgage - Crowdfunding lets investors collectively fund residential or commercial real estate through online platforms, enabling access to investments that might be unaffordable individually and helping diversify portfolios with both accredited and nonaccredited participation.

Crowdfunding - National Association of REALTORS(r) - Real estate crowdfunding allows investors to pool money online to fund projects and earn passive income without traditional real estate maintenance, with platforms like Crowdstreet and Fundrise providing curated commercial and residential opportunities.

dowidth.com

dowidth.com