Wine investing platforms offer investors access to rare vintages and fine wines with potential for portfolio diversification and long-term appreciation. Art investment platforms provide opportunities to invest in emerging and established artists, leveraging market trends and art valuation expertise for potential high returns. Explore the distinctive advantages and risks of wine and art investment platforms to make informed decisions.

Why it is important

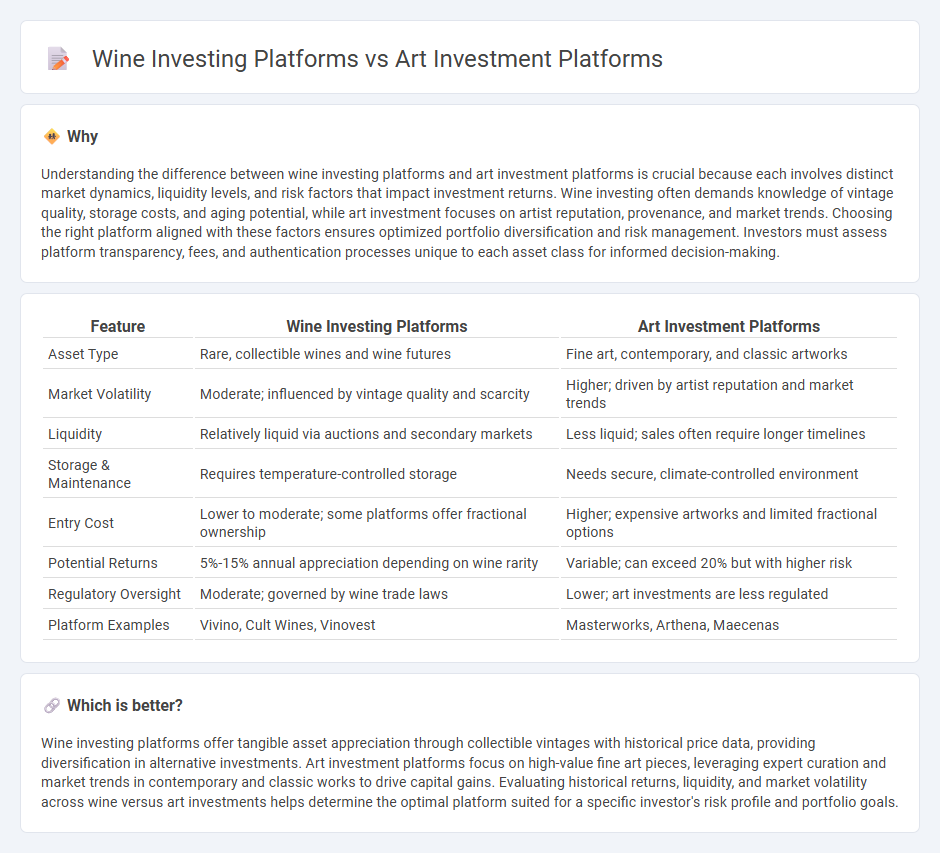

Understanding the difference between wine investing platforms and art investment platforms is crucial because each involves distinct market dynamics, liquidity levels, and risk factors that impact investment returns. Wine investing often demands knowledge of vintage quality, storage costs, and aging potential, while art investment focuses on artist reputation, provenance, and market trends. Choosing the right platform aligned with these factors ensures optimized portfolio diversification and risk management. Investors must assess platform transparency, fees, and authentication processes unique to each asset class for informed decision-making.

Comparison Table

| Feature | Wine Investing Platforms | Art Investment Platforms |

|---|---|---|

| Asset Type | Rare, collectible wines and wine futures | Fine art, contemporary, and classic artworks |

| Market Volatility | Moderate; influenced by vintage quality and scarcity | Higher; driven by artist reputation and market trends |

| Liquidity | Relatively liquid via auctions and secondary markets | Less liquid; sales often require longer timelines |

| Storage & Maintenance | Requires temperature-controlled storage | Needs secure, climate-controlled environment |

| Entry Cost | Lower to moderate; some platforms offer fractional ownership | Higher; expensive artworks and limited fractional options |

| Potential Returns | 5%-15% annual appreciation depending on wine rarity | Variable; can exceed 20% but with higher risk |

| Regulatory Oversight | Moderate; governed by wine trade laws | Lower; art investments are less regulated |

| Platform Examples | Vivino, Cult Wines, Vinovest | Masterworks, Arthena, Maecenas |

Which is better?

Wine investing platforms offer tangible asset appreciation through collectible vintages with historical price data, providing diversification in alternative investments. Art investment platforms focus on high-value fine art pieces, leveraging expert curation and market trends in contemporary and classic works to drive capital gains. Evaluating historical returns, liquidity, and market volatility across wine versus art investments helps determine the optimal platform suited for a specific investor's risk profile and portfolio goals.

Connection

Wine investing platforms and art investment platforms both capitalize on the growing demand for alternative assets that offer portfolio diversification and potential high returns. These platforms leverage digital technology to provide fractional ownership, transparent valuation, and secure trading of rare wines and collectible artworks. By targeting affluent investors seeking non-traditional investments, they create interconnected marketplaces driven by scarcity, provenance verification, and market liquidity.

Key Terms

Provenance

Art investment platforms emphasize detailed provenance records, including artist authenticity, exhibition history, and previous ownership, ensuring transparency and value validation. Wine investing platforms prioritize provenance through vineyard origin, vintage quality, and storage conditions, which directly impact the wine's rarity and market price. Explore the nuances of provenance in art and wine investing to enhance your portfolio insights.

Authentication

Art investment platforms prioritize rigorous authentication processes leveraging expert appraisals, provenance research, and advanced imaging technologies to ensure the originality and value of the artwork. Wine investing platforms emphasize authentication through cellar-to-bottle tracking, certification by renowned sommeliers, and blockchain-based provenance records to guarantee genuineness and proper storage conditions. Explore more about how authentication standards impact investment security in art and wine markets.

Storage conditions

Art investment platforms prioritize climate-controlled storage environments with regulated temperature and humidity to prevent damage and preserve the integrity of artworks. Wine investing platforms emphasize cellar conditions tailored to each varietal, maintaining optimal temperature (around 55degF or 13degC) and humidity (60-70%) to ensure proper aging and quality retention. Explore detailed storage standards and best practices to make informed investment decisions.

Source and External Links

Best Art Investments and Platforms in 2025 - Benzinga - Masterworks is highlighted as the best art investment platform for its low fees, diverse high-quality artworks, and ease of fractional ownership, allowing investors to buy shares of blue-chip pieces and trade them on a secondary market with an average 14% annual artwork appreciation.

Top 6 Fractional Art Investment Platforms - Leading platforms like Masterworks, Mintus, Particle, and Timeless offer fractional ownership of valuable art, enabling exposure to blue-chip investments with relatively accessible entry points and a typical holding period of 3 to 10 years before exit via sale.

Top Art Investment Platforms in 2025 - Slashdot - The art investment market includes platforms such as Artscapy, Splint Invest, SplitXchange, Masterworks.io, and Yieldstreet, offering diverse opportunities from full ownership to fractional shares and digital rights, making art investments accessible beyond traditional high-net-worth collectors.

dowidth.com

dowidth.com