Vintage sneaker portfolios have gained traction as alternative investments, driven by limited releases and strong resale demand that often yield high returns in short time frames. Luxury watch investments offer durability and appreciation potential due to brand heritage, craftsmanship, and scarcity, appealing to both collectors and investors. Explore the nuances of these dynamic investment sectors to discover which aligns best with your portfolio goals.

Why it is important

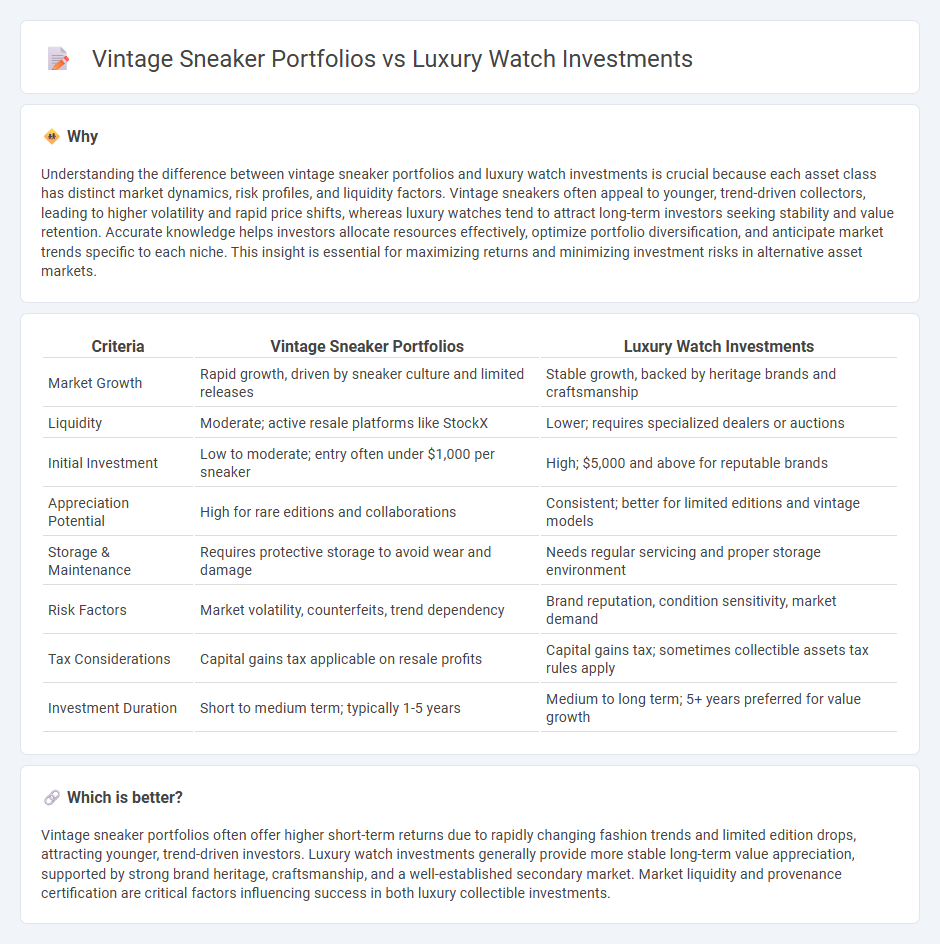

Understanding the difference between vintage sneaker portfolios and luxury watch investments is crucial because each asset class has distinct market dynamics, risk profiles, and liquidity factors. Vintage sneakers often appeal to younger, trend-driven collectors, leading to higher volatility and rapid price shifts, whereas luxury watches tend to attract long-term investors seeking stability and value retention. Accurate knowledge helps investors allocate resources effectively, optimize portfolio diversification, and anticipate market trends specific to each niche. This insight is essential for maximizing returns and minimizing investment risks in alternative asset markets.

Comparison Table

| Criteria | Vintage Sneaker Portfolios | Luxury Watch Investments |

|---|---|---|

| Market Growth | Rapid growth, driven by sneaker culture and limited releases | Stable growth, backed by heritage brands and craftsmanship |

| Liquidity | Moderate; active resale platforms like StockX | Lower; requires specialized dealers or auctions |

| Initial Investment | Low to moderate; entry often under $1,000 per sneaker | High; $5,000 and above for reputable brands |

| Appreciation Potential | High for rare editions and collaborations | Consistent; better for limited editions and vintage models |

| Storage & Maintenance | Requires protective storage to avoid wear and damage | Needs regular servicing and proper storage environment |

| Risk Factors | Market volatility, counterfeits, trend dependency | Brand reputation, condition sensitivity, market demand |

| Tax Considerations | Capital gains tax applicable on resale profits | Capital gains tax; sometimes collectible assets tax rules apply |

| Investment Duration | Short to medium term; typically 1-5 years | Medium to long term; 5+ years preferred for value growth |

Which is better?

Vintage sneaker portfolios often offer higher short-term returns due to rapidly changing fashion trends and limited edition drops, attracting younger, trend-driven investors. Luxury watch investments generally provide more stable long-term value appreciation, supported by strong brand heritage, craftsmanship, and a well-established secondary market. Market liquidity and provenance certification are critical factors influencing success in both luxury collectible investments.

Connection

Vintage sneaker portfolios and luxury watch investments both capitalize on rarity, brand heritage, and market demand to generate significant returns. Collectors seek limited-edition releases and iconic models that appreciate over time due to their exclusivity and cultural significance. These tangible assets diversify investment strategies by blending fashion, history, and craftsmanship in lucrative alternative markets.

Key Terms

Appreciation

Luxury watch investments often appreciate due to brand prestige, limited editions, and market demand, with iconic models from Rolex and Patek Philippe showing consistent value growth. Vintage sneaker portfolios, driven by hype culture, brand collaborations, and rarity, have surged in popularity, with certain releases appreciating exponentially over short periods. Explore detailed market trends and expert analyses to understand which investment aligns best with your financial goals.

Authenticity

Authenticity plays a pivotal role in both luxury watch investments and vintage sneaker portfolios, heavily influencing market value and demand. Certified provenance and expert verification ensure genuine pieces, protecting investors from counterfeits and preserving asset worth. Explore how authentication methods impact these dynamic collectible markets.

Liquidity

Luxury watch investments often provide higher liquidity due to established auction houses and resale platforms, enabling faster transactions and pricing transparency. Vintage sneaker portfolios may face more volatility and limited market depth, impacting quick sale opportunities and consistent valuation. Explore detailed comparisons to understand which asset suits your liquidity needs better.

Source and External Links

Luxury Watches: A Guide to Smart Investing | IIFL Securities - Luxury watches are increasingly popular as investments, offering stable or appreciating value, higher liquidity compared to many assets, and resilience to market downturns, with some models like stainless-steel Rolexes never depreciating over decades.

Best Investment Watches: Top Timepieces for Value Growth - The best investment watches typically come from prestigious brands like Rolex, Patek Philippe, and Audemars Piguet, with rarity, limited editions, and brand reputation being key drivers of value appreciation in the secondary market.

The Beginner's Guide to Watch Investing: How to Get Started - Kubera - Investors can gain exposure to luxury watches by buying physical pieces, investing in watch company stocks, or participating in specialized watch investment funds, each with varying levels of risk, liquidity, and required expertise.

dowidth.com

dowidth.com