Litigation funding involves third-party financing of legal cases in exchange for a portion of the settlement or judgment, offering investors access to alternative assets with non-correlated returns. Public equities represent ownership shares in companies traded on stock exchanges, providing liquidity and exposure to market-driven growth and dividends. Explore more to understand the distinct risk-return profiles and strategic benefits of these investment options.

Why it is important

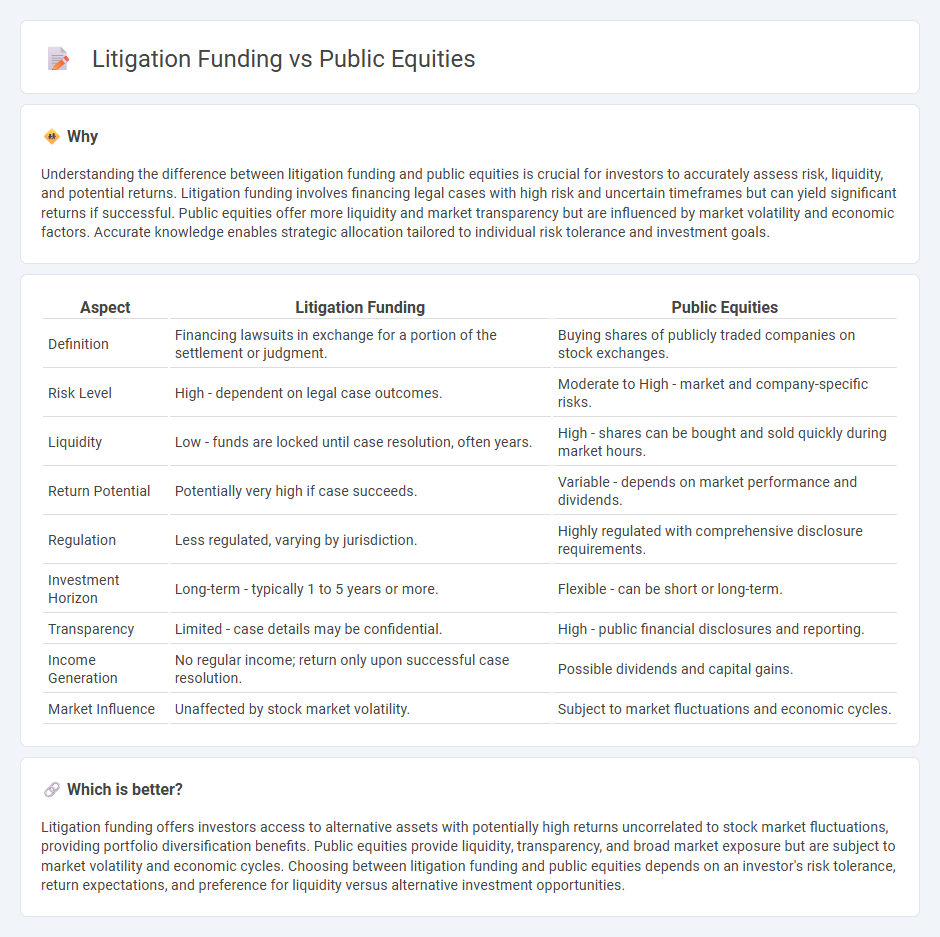

Understanding the difference between litigation funding and public equities is crucial for investors to accurately assess risk, liquidity, and potential returns. Litigation funding involves financing legal cases with high risk and uncertain timeframes but can yield significant returns if successful. Public equities offer more liquidity and market transparency but are influenced by market volatility and economic factors. Accurate knowledge enables strategic allocation tailored to individual risk tolerance and investment goals.

Comparison Table

| Aspect | Litigation Funding | Public Equities |

|---|---|---|

| Definition | Financing lawsuits in exchange for a portion of the settlement or judgment. | Buying shares of publicly traded companies on stock exchanges. |

| Risk Level | High - dependent on legal case outcomes. | Moderate to High - market and company-specific risks. |

| Liquidity | Low - funds are locked until case resolution, often years. | High - shares can be bought and sold quickly during market hours. |

| Return Potential | Potentially very high if case succeeds. | Variable - depends on market performance and dividends. |

| Regulation | Less regulated, varying by jurisdiction. | Highly regulated with comprehensive disclosure requirements. |

| Investment Horizon | Long-term - typically 1 to 5 years or more. | Flexible - can be short or long-term. |

| Transparency | Limited - case details may be confidential. | High - public financial disclosures and reporting. |

| Income Generation | No regular income; return only upon successful case resolution. | Possible dividends and capital gains. |

| Market Influence | Unaffected by stock market volatility. | Subject to market fluctuations and economic cycles. |

Which is better?

Litigation funding offers investors access to alternative assets with potentially high returns uncorrelated to stock market fluctuations, providing portfolio diversification benefits. Public equities provide liquidity, transparency, and broad market exposure but are subject to market volatility and economic cycles. Choosing between litigation funding and public equities depends on an investor's risk tolerance, return expectations, and preference for liquidity versus alternative investment opportunities.

Connection

Litigation funding and public equities intersect through the financial markets where investment in legal claims can influence stock prices and shareholder value. Investors use litigation funding to capitalize on unsettled lawsuits, potentially impacting the volatility and valuation of public equities linked to the companies involved. This connection creates opportunities for portfolio diversification and risk management by integrating alternative assets like legal finance into traditional equity investments.

Key Terms

**Liquidity**

Public equities offer high liquidity, allowing investors to buy or sell shares quickly on stock exchanges with minimal transaction costs. Litigation funding, by contrast, is illiquid due to the long and uncertain timeline of legal cases, often requiring investors to lock capital for extended periods. Explore more about the risk-return profiles and liquidity considerations in these investment options.

**Risk profile**

Public equities typically present a moderate to high risk profile influenced by market volatility, economic cycles, and company-specific performance factors. Litigation funding involves high risk due to the uncertainty of legal outcomes, dependency on case merits, and potential long duration before returns. Explore detailed risk comparisons between these investment types to make informed financial decisions.

**Return horizon**

Public equities typically offer liquidity with short to medium-term return horizons ranging from months to a few years, driven by market fluctuations and corporate performance. Litigation funding usually involves longer return horizons, often spanning several years due to the time-consuming nature of legal processes and case resolutions. Explore more about how return horizons influence investment strategies in equities and litigation funding.

Source and External Links

Public Equity | Gresham House | Alternative asset management - Public equities are shares of publicly traded companies, characterized by market capitalization size, investment style (value, growth, blend), volatility, and liquidity, allowing investors to buy or sell shares easily on stock exchanges.

Public Equities Allocation-APFC - Alaska Permanent Fund Corporation - Public equities form the largest and most liquid asset class in institutional portfolios such as the Alaska Permanent Fund, consisting of U.S. and international stocks traded on public markets and serving as a primary driver of portfolio growth.

Private Market vs Public Market: What's the Difference? - Public equities markets like the FTSE-100 or S&P 500 enable companies to raise capital by selling shares to the public, representing ownership interests that are accessible to anyone, with regulatory requirements ensuring ongoing transparency and information disclosure.

dowidth.com

dowidth.com