Investing in wine cask aging offers potential gains through the appreciation of aged vintages and the growing demand for collectible wines, while rare coins provide a tangible asset with historical value and liquidity in global markets. Wine cask investments rely on expert storage conditions and market trends, whereas rare coins benefit from rarity, condition, and numismatic significance. Explore the advantages and risks of both asset classes to determine which aligns best with your investment strategy.

Why it is important

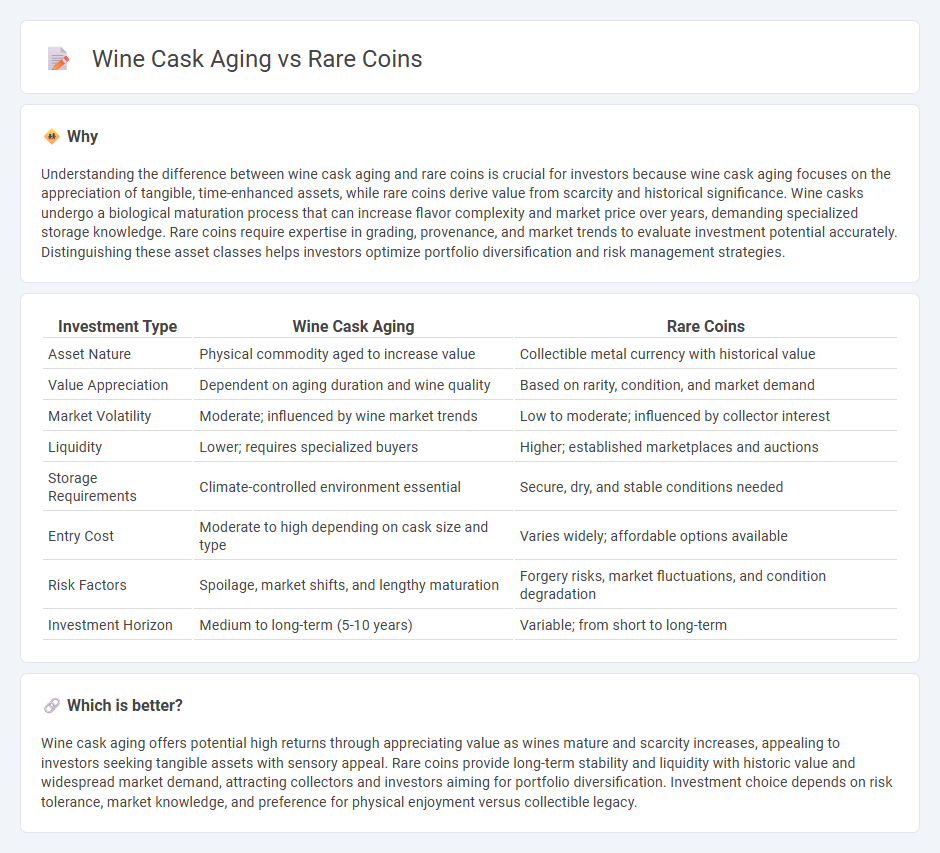

Understanding the difference between wine cask aging and rare coins is crucial for investors because wine cask aging focuses on the appreciation of tangible, time-enhanced assets, while rare coins derive value from scarcity and historical significance. Wine casks undergo a biological maturation process that can increase flavor complexity and market price over years, demanding specialized storage knowledge. Rare coins require expertise in grading, provenance, and market trends to evaluate investment potential accurately. Distinguishing these asset classes helps investors optimize portfolio diversification and risk management strategies.

Comparison Table

| Investment Type | Wine Cask Aging | Rare Coins |

|---|---|---|

| Asset Nature | Physical commodity aged to increase value | Collectible metal currency with historical value |

| Value Appreciation | Dependent on aging duration and wine quality | Based on rarity, condition, and market demand |

| Market Volatility | Moderate; influenced by wine market trends | Low to moderate; influenced by collector interest |

| Liquidity | Lower; requires specialized buyers | Higher; established marketplaces and auctions |

| Storage Requirements | Climate-controlled environment essential | Secure, dry, and stable conditions needed |

| Entry Cost | Moderate to high depending on cask size and type | Varies widely; affordable options available |

| Risk Factors | Spoilage, market shifts, and lengthy maturation | Forgery risks, market fluctuations, and condition degradation |

| Investment Horizon | Medium to long-term (5-10 years) | Variable; from short to long-term |

Which is better?

Wine cask aging offers potential high returns through appreciating value as wines mature and scarcity increases, appealing to investors seeking tangible assets with sensory appeal. Rare coins provide long-term stability and liquidity with historic value and widespread market demand, attracting collectors and investors aiming for portfolio diversification. Investment choice depends on risk tolerance, market knowledge, and preference for physical enjoyment versus collectible legacy.

Connection

Wine cask aging and rare coins share a unique connection through the principle of value appreciation over time, driven by scarcity and controlled aging processes. Both assets rely on expert curation and market demand, where carefully aged wine enhances flavor complexity and rarity in coins boosts collectible worth. Investors leverage these characteristics to diversify portfolios with tangible goods that historically resist inflation and economic volatility.

Key Terms

**Provenance**

Provenance plays a crucial role in establishing the value of rare coins and wine cask aging, as it verifies authenticity and history. In numismatics, detailed ownership records and minting sources enhance a coin's rarity and market worth. Explore how provenance superiority impacts investment potential in both collectibles to learn more.

**Authenticity**

Authenticity in rare coins is verified through meticulous grading and provenance documentation, ensuring each coin's origin and historical significance remain intact. Wine cask aging authenticity relies on controlled environmental conditions and certified barrel sources, guaranteeing the wine's genuine maturation process. Explore how authenticity standards impact value retention in both collectibles and fine wines.

**Liquidity**

Rare coins offer high liquidity as they can be quickly sold in auctions, numismatic shops, or online marketplaces, attracting collectors worldwide. Wine cask aging typically ties up capital for years until the wine reaches optimal maturity, limiting immediate resale opportunities. Explore how liquidity impacts investment strategies in collectibles and alternative assets.

Source and External Links

9 Of The World's Most Valuable Coins - Bankrate - The 1794 Flowing Hair Silver Dollar is considered the most expensive rare coin sold at auction for $12 million, followed by extremely valuable coins like the 1787 Brasher Doubloon, with only a few examples remaining worldwide.

What's My Coin Worth? Rare coin values. Rare coin prices. - A beginner's price guide listing valuable rare coins such as Early Eagles Capped Bust Right (1795-1797) valued between $5,000 and $15,000, Indian Head Eagles, Morgan Dollars, and Peace Dollars with varying price ranges depending on condition and rarity.

Rare Coins for Sale | Rare Gold & Silver Coins - Finest Known - Offers a wide selection of rare gold and silver coins including world silver talers from the 1500s, 17th-century Austrian coins, and historic bust dimes from the 1800s, catering to collectors seeking diverse rare coins.

dowidth.com

dowidth.com