Private credit funds specialize in lending to mid-sized companies, offering tailored debt solutions with less regulatory oversight, enabling flexible financing structures and potentially higher yields. Business development companies (BDCs) are publicly traded investment vehicles that provide capital primarily to small and middle-market businesses, combining equity and debt investments while offering liquidity and dividend income to investors. Explore the differences in risk, return profiles, and investment strategies between private credit funds and BDCs to determine the best fit for your portfolio.

Why it is important

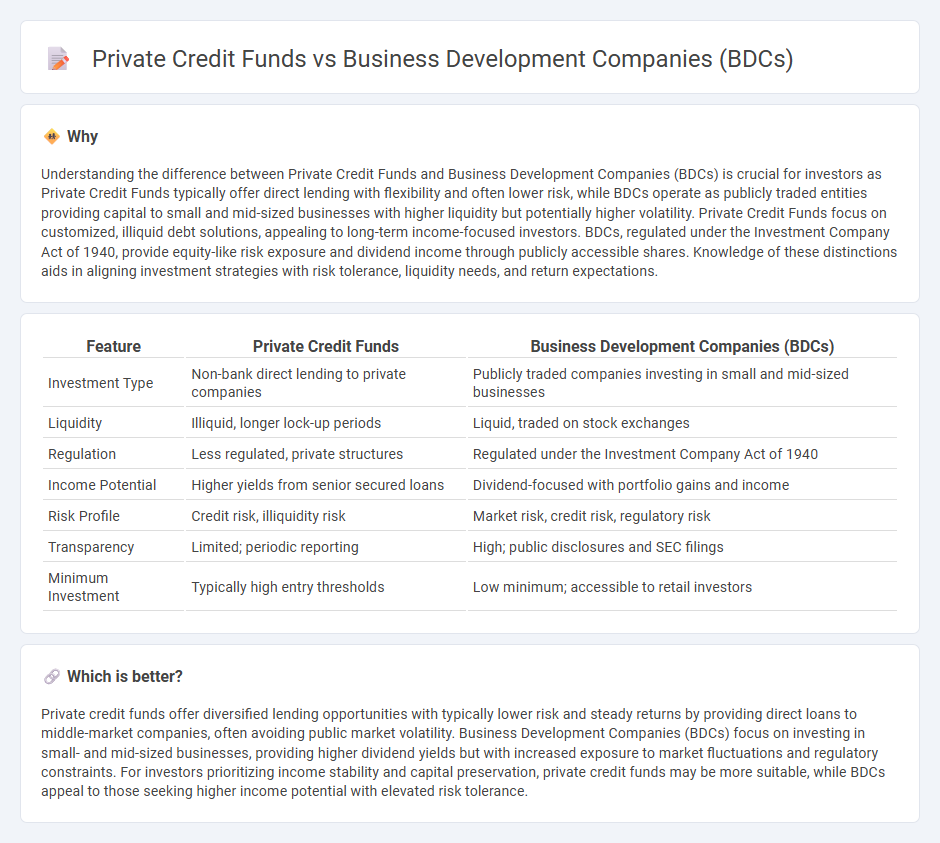

Understanding the difference between Private Credit Funds and Business Development Companies (BDCs) is crucial for investors as Private Credit Funds typically offer direct lending with flexibility and often lower risk, while BDCs operate as publicly traded entities providing capital to small and mid-sized businesses with higher liquidity but potentially higher volatility. Private Credit Funds focus on customized, illiquid debt solutions, appealing to long-term income-focused investors. BDCs, regulated under the Investment Company Act of 1940, provide equity-like risk exposure and dividend income through publicly accessible shares. Knowledge of these distinctions aids in aligning investment strategies with risk tolerance, liquidity needs, and return expectations.

Comparison Table

| Feature | Private Credit Funds | Business Development Companies (BDCs) |

|---|---|---|

| Investment Type | Non-bank direct lending to private companies | Publicly traded companies investing in small and mid-sized businesses |

| Liquidity | Illiquid, longer lock-up periods | Liquid, traded on stock exchanges |

| Regulation | Less regulated, private structures | Regulated under the Investment Company Act of 1940 |

| Income Potential | Higher yields from senior secured loans | Dividend-focused with portfolio gains and income |

| Risk Profile | Credit risk, illiquidity risk | Market risk, credit risk, regulatory risk |

| Transparency | Limited; periodic reporting | High; public disclosures and SEC filings |

| Minimum Investment | Typically high entry thresholds | Low minimum; accessible to retail investors |

Which is better?

Private credit funds offer diversified lending opportunities with typically lower risk and steady returns by providing direct loans to middle-market companies, often avoiding public market volatility. Business Development Companies (BDCs) focus on investing in small- and mid-sized businesses, providing higher dividend yields but with increased exposure to market fluctuations and regulatory constraints. For investors prioritizing income stability and capital preservation, private credit funds may be more suitable, while BDCs appeal to those seeking higher income potential with elevated risk tolerance.

Connection

Private credit funds and Business Development Companies (BDCs) are interconnected through their shared focus on providing non-bank lending to middle-market companies. BDCs often act as vehicles for private credit funds, raising capital from investors to offer debt and equity financing solutions to smaller businesses that may have limited access to traditional bank loans. This connection supports the growth and expansion of private credit markets while offering investors access to alternative credit investments with potential for higher yields.

Key Terms

Regulation (e.g., SEC for BDCs, less regulated for Private Credit Funds)

Business Development Companies (BDCs) are regulated under the Investment Company Act of 1940 and overseen by the Securities and Exchange Commission (SEC), requiring strict disclosure, leverage limits, and governance standards. Private credit funds operate with less regulatory scrutiny, often exempt from SEC registration, allowing greater flexibility in investment strategies and fewer reporting obligations. Explore the differences in regulatory impact and risk profiles to better understand these investment vehicles.

Liquidity (Publicly traded BDCs vs. typically illiquid Private Credit Funds)

Publicly traded Business Development Companies (BDCs) offer investors daily liquidity through stock exchanges, providing flexibility to buy or sell shares quickly. In contrast, private credit funds are typically illiquid, with capital locked in for multi-year periods and limited redemption opportunities. To understand the implications of liquidity differences for your investment strategy, explore the detailed comparison of BDCs and private credit funds.

Investor Access (Retail access for BDCs vs. Accredited/Institutional for Private Credit Funds)

Business development companies (BDCs) provide retail investors with accessible entry points through publicly traded shares, offering liquidity and regulatory oversight under the Investment Company Act of 1940. In contrast, private credit funds predominantly seek accredited or institutional investors, leveraging less regulatory scrutiny and longer lock-up periods to pursue bespoke lending strategies. Explore deeper insights into how investor access shapes risk, returns, and portfolio diversification between these asset classes.

Source and External Links

Business Development Company - Wikipedia - BDCs are U.S.-regulated, closed-end investment companies that provide capital to small and mid-sized businesses, must invest at least 70% of their assets in qualifying private or thinly traded public companies, and avoid corporate-level taxation if they distribute most income to shareholders.

Operating Business Development Companies: A Brief Overview - Created in 1980, BDCs act as closed-end venture capital funds for retail investors, enabling them to finance small- to mid-sized U.S. private companies, with structures that allow external or internal management and flexible compensation for advisers.

BDCs Work for America - Small Business Investor Alliance - BDCs are SEC-regulated, job-creating investment vehicles that give everyday investors access to the growth of smaller American businesses, bridging the capital gap for companies and the investment opportunity gap for individuals.

dowidth.com

dowidth.com