Music royalties investing offers consistent cash flow through rights to song earnings, with low correlation to traditional markets, providing portfolio diversification. Commodity investing involves buying physical goods like gold, oil, or agricultural products, which are subject to market volatility and influenced by supply-demand dynamics and geopolitical factors. Discover the advantages and risks of both to make informed investment decisions.

Why it is important

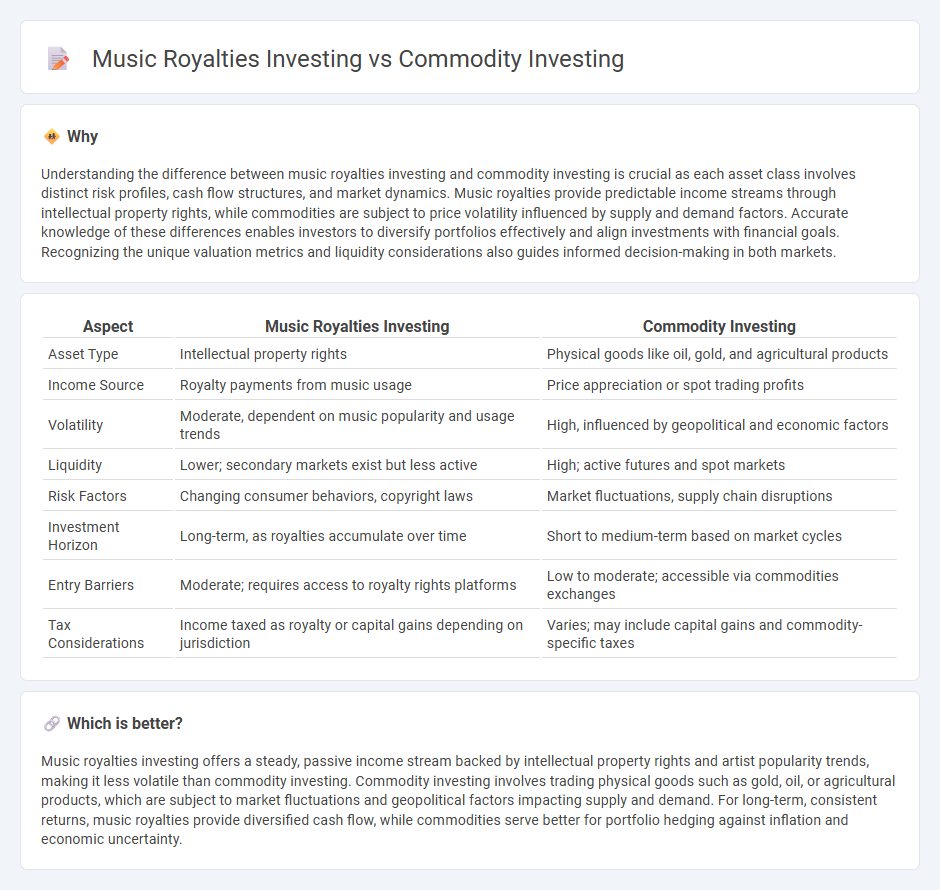

Understanding the difference between music royalties investing and commodity investing is crucial as each asset class involves distinct risk profiles, cash flow structures, and market dynamics. Music royalties provide predictable income streams through intellectual property rights, while commodities are subject to price volatility influenced by supply and demand factors. Accurate knowledge of these differences enables investors to diversify portfolios effectively and align investments with financial goals. Recognizing the unique valuation metrics and liquidity considerations also guides informed decision-making in both markets.

Comparison Table

| Aspect | Music Royalties Investing | Commodity Investing |

|---|---|---|

| Asset Type | Intellectual property rights | Physical goods like oil, gold, and agricultural products |

| Income Source | Royalty payments from music usage | Price appreciation or spot trading profits |

| Volatility | Moderate, dependent on music popularity and usage trends | High, influenced by geopolitical and economic factors |

| Liquidity | Lower; secondary markets exist but less active | High; active futures and spot markets |

| Risk Factors | Changing consumer behaviors, copyright laws | Market fluctuations, supply chain disruptions |

| Investment Horizon | Long-term, as royalties accumulate over time | Short to medium-term based on market cycles |

| Entry Barriers | Moderate; requires access to royalty rights platforms | Low to moderate; accessible via commodities exchanges |

| Tax Considerations | Income taxed as royalty or capital gains depending on jurisdiction | Varies; may include capital gains and commodity-specific taxes |

Which is better?

Music royalties investing offers a steady, passive income stream backed by intellectual property rights and artist popularity trends, making it less volatile than commodity investing. Commodity investing involves trading physical goods such as gold, oil, or agricultural products, which are subject to market fluctuations and geopolitical factors impacting supply and demand. For long-term, consistent returns, music royalties provide diversified cash flow, while commodities serve better for portfolio hedging against inflation and economic uncertainty.

Connection

Investment in music royalties and commodities both offer alternative asset classes that diversify traditional portfolios by generating passive income streams and hedging against market volatility. Music royalties provide steady cash flow through intellectual property rights, while commodity investing capitalizes on tangible goods like metals, energy, and agriculture, which often have intrinsic value during economic fluctuations. Both asset types respond differently to economic cycles, enhancing portfolio resilience and offering unique risk-return profiles.

Key Terms

Asset Type

Commodity investing involves tangible assets like metals, oil, and agricultural products that have intrinsic value and are influenced by supply-demand dynamics and geopolitical events. Music royalties investing centers on intangible assets generated by rights to artists' compositions and recordings, providing income through licensing fees and royalties from public and commercial usage. Discover the unique benefits and risk profiles of these asset types to make informed investment choices.

Market Liquidity

Commodity investing offers high market liquidity with active exchanges such as the Chicago Mercantile Exchange enabling quick buying and selling of assets like oil, gold, and agricultural products. Music royalties investing provides lower liquidity, as transactions often involve private deals or royalty marketplaces with less frequent trading and longer holding periods. Explore deeper insights into market liquidity differences between these investment types to enhance your portfolio strategy.

Revenue Source

Commodity investing generates revenue primarily through price fluctuations in physical goods like oil, gold, or agricultural products, influenced by supply-demand dynamics and geopolitical events. Music royalties investing produces revenue by earning a share of income from music usage across streams, broadcasts, and licensing deals, providing a steady cash flow less correlated to market volatility. Explore the distinct revenue sources of both investment types to determine which aligns best with your portfolio goals.

Source and External Links

Commodity investing and its role in a portfolio - Vanguard - Commodity investing offers diversification benefits, potential positive real returns, and protection against inflation, with strategies to include commodities systematically in portfolios to optimize allocation and inflation targeting.

Futures and Commodities - FINRA - Commodity investing includes direct exposure through physical goods or commodity futures contracts and can be accessed by investors via futures, mutual funds, and exchange-traded products such as ETFs and ETNs.

Learn About Risks Before Investing in Commodity ETPs or ... - CFTC - Investing in commodity ETPs involves risks like roll yield impacts on returns due to futures contract expirations, with additional trading and management fees, making it crucial to understand investment mechanics and risks.

dowidth.com

dowidth.com