Collectible sneakers represent a niche investment market driven by rarity, brand collaboration, and cultural trends, often yielding high returns for limited editions and exclusive releases. Commodities, such as gold, oil, and agricultural products, provide investors with tangible assets that hedge against inflation and market volatility through global supply and demand dynamics. Explore these investment avenues to understand their unique risks and potential for portfolio diversification.

Why it is important

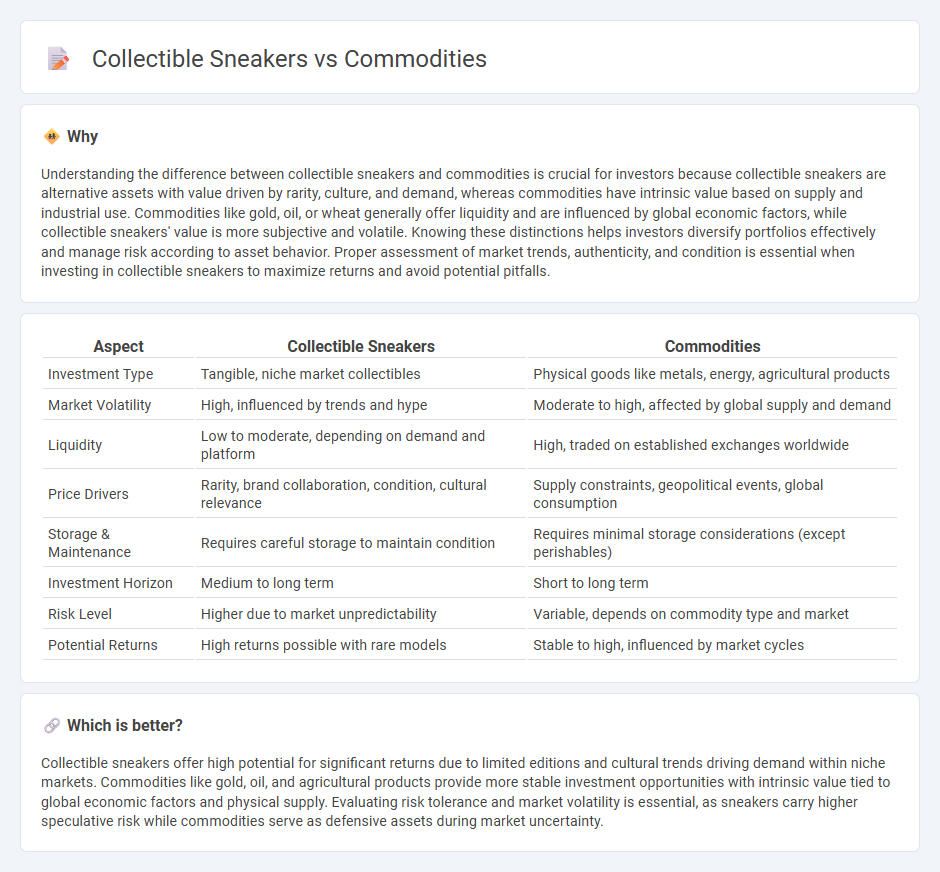

Understanding the difference between collectible sneakers and commodities is crucial for investors because collectible sneakers are alternative assets with value driven by rarity, culture, and demand, whereas commodities have intrinsic value based on supply and industrial use. Commodities like gold, oil, or wheat generally offer liquidity and are influenced by global economic factors, while collectible sneakers' value is more subjective and volatile. Knowing these distinctions helps investors diversify portfolios effectively and manage risk according to asset behavior. Proper assessment of market trends, authenticity, and condition is essential when investing in collectible sneakers to maximize returns and avoid potential pitfalls.

Comparison Table

| Aspect | Collectible Sneakers | Commodities |

|---|---|---|

| Investment Type | Tangible, niche market collectibles | Physical goods like metals, energy, agricultural products |

| Market Volatility | High, influenced by trends and hype | Moderate to high, affected by global supply and demand |

| Liquidity | Low to moderate, depending on demand and platform | High, traded on established exchanges worldwide |

| Price Drivers | Rarity, brand collaboration, condition, cultural relevance | Supply constraints, geopolitical events, global consumption |

| Storage & Maintenance | Requires careful storage to maintain condition | Requires minimal storage considerations (except perishables) |

| Investment Horizon | Medium to long term | Short to long term |

| Risk Level | Higher due to market unpredictability | Variable, depends on commodity type and market |

| Potential Returns | High returns possible with rare models | Stable to high, influenced by market cycles |

Which is better?

Collectible sneakers offer high potential for significant returns due to limited editions and cultural trends driving demand within niche markets. Commodities like gold, oil, and agricultural products provide more stable investment opportunities with intrinsic value tied to global economic factors and physical supply. Evaluating risk tolerance and market volatility is essential, as sneakers carry higher speculative risk while commodities serve as defensive assets during market uncertainty.

Connection

Collectible sneakers and commodities are connected through their shared characteristics as alternative investment assets with the potential for significant returns. Both markets rely heavily on supply and demand dynamics, rarity, and cultural trends, influencing their value appreciation over time. Investors often diversify portfolios by including collectibles like limited-edition sneakers alongside traditional commodities such as gold and oil to hedge against market volatility.

Key Terms

Liquidity

Commodities like oil, gold, and agricultural products offer high liquidity due to standardized contracts and active global markets, enabling rapid buying and selling with transparent pricing. Collectible sneakers, such as limited-edition releases from brands like Nike and Adidas, have lower liquidity as their value depends on rarity, condition, and market demand, often requiring specialized platforms or auctions for sale. Explore the nuances of liquidity in these asset classes to better understand how to balance investment potential and market accessibility.

Volatility

Commodity markets typically experience higher volatility due to factors such as geopolitical events, supply chain disruptions, and fluctuating demand. Collectible sneakers, while subject to market trends and rarity-driven price spikes, generally demonstrate more stable and gradual value appreciation. Explore the unique volatility dynamics and investment potential in both asset classes to make informed financial decisions.

Provenance

Provenance plays a crucial role in distinguishing collectible sneakers from commodities, as it verifies authenticity, ownership history, and rarity, directly influencing market value. Unlike commodities, collectible sneakers often come with detailed background information, limited editions, and unique production stories that appeal to enthusiasts and investors. Explore the intricate provenance factors that elevate sneaker collecting to an art form and investment opportunity.

Source and External Links

Understanding Commodities - Commodities are raw materials like agricultural products, energy, and metals that serve as a distinct asset class with returns largely independent from stocks and bonds, and they are traded via futures and options contracts globally.

Commodities Versus Differentiated Products | Ag Decision Maker - Commodities are fungible raw materials identical across producers, making their pricing uniform and treating producers as price takers with no control over market prices.

Futures and Commodities | FINRA - Investors can access commodities through direct ownership or commodity futures contracts, which provide exposure to price movements without necessarily owning physical commodities, offering portfolio diversification but with high price volatility.

dowidth.com

dowidth.com