Sports memorabilia funds offer high-growth potential through niche market collectibles with increasing demand from enthusiasts and investors alike. Real estate funds provide stable cash flow and long-term appreciation by investing in residential, commercial, or industrial properties across diverse locations. Explore more to understand which investment fund aligns best with your financial goals and risk tolerance.

Why it is important

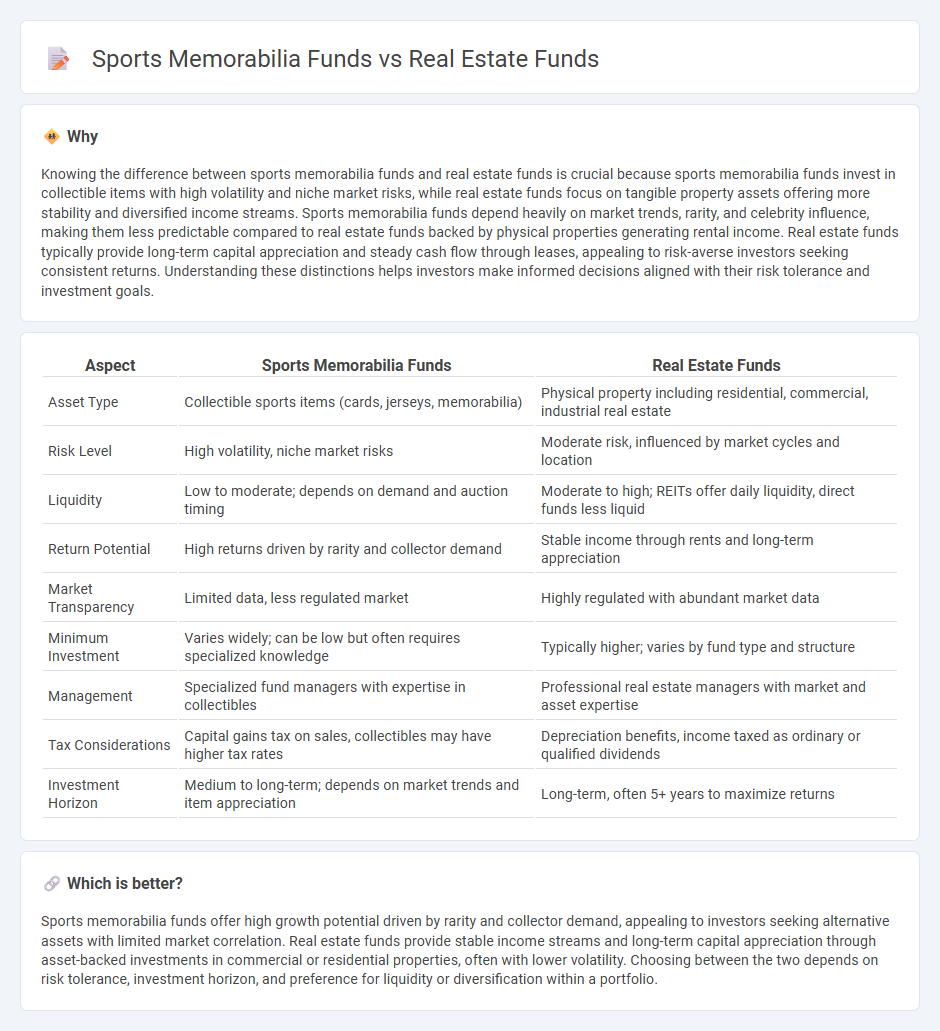

Knowing the difference between sports memorabilia funds and real estate funds is crucial because sports memorabilia funds invest in collectible items with high volatility and niche market risks, while real estate funds focus on tangible property assets offering more stability and diversified income streams. Sports memorabilia funds depend heavily on market trends, rarity, and celebrity influence, making them less predictable compared to real estate funds backed by physical properties generating rental income. Real estate funds typically provide long-term capital appreciation and steady cash flow through leases, appealing to risk-averse investors seeking consistent returns. Understanding these distinctions helps investors make informed decisions aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Sports Memorabilia Funds | Real Estate Funds |

|---|---|---|

| Asset Type | Collectible sports items (cards, jerseys, memorabilia) | Physical property including residential, commercial, industrial real estate |

| Risk Level | High volatility, niche market risks | Moderate risk, influenced by market cycles and location |

| Liquidity | Low to moderate; depends on demand and auction timing | Moderate to high; REITs offer daily liquidity, direct funds less liquid |

| Return Potential | High returns driven by rarity and collector demand | Stable income through rents and long-term appreciation |

| Market Transparency | Limited data, less regulated market | Highly regulated with abundant market data |

| Minimum Investment | Varies widely; can be low but often requires specialized knowledge | Typically higher; varies by fund type and structure |

| Management | Specialized fund managers with expertise in collectibles | Professional real estate managers with market and asset expertise |

| Tax Considerations | Capital gains tax on sales, collectibles may have higher tax rates | Depreciation benefits, income taxed as ordinary or qualified dividends |

| Investment Horizon | Medium to long-term; depends on market trends and item appreciation | Long-term, often 5+ years to maximize returns |

Which is better?

Sports memorabilia funds offer high growth potential driven by rarity and collector demand, appealing to investors seeking alternative assets with limited market correlation. Real estate funds provide stable income streams and long-term capital appreciation through asset-backed investments in commercial or residential properties, often with lower volatility. Choosing between the two depends on risk tolerance, investment horizon, and preference for liquidity or diversification within a portfolio.

Connection

Sports memorabilia funds and real estate funds both represent alternative investment vehicles that diversify portfolios beyond traditional stocks and bonds. These funds are connected through their appeal to investors seeking tangible asset exposure and potential inflation protection, leveraging the unique market dynamics of collectibles and property valuation. Their underlying value appreciation relies on scarcity and demand, making them strategic options for risk-adjusted portfolio growth.

Key Terms

**Real Estate Funds:**

Real estate funds primarily invest in income-generating properties such as commercial buildings, residential complexes, and industrial spaces, offering investors steady cash flow and potential for capital appreciation. These funds benefit from market stability, tangible asset backing, and diversification across various property types and geographic locations. Explore how real estate funds compare in risk, liquidity, and return profiles to understand their role in a balanced investment portfolio.

Property Valuation

Real estate funds rely heavily on comprehensive property valuation methods that include market trends, location analysis, and income potential to assess asset worth accurately. Sports memorabilia funds determine value based on rarity, provenance, and historical significance, making their valuation more subjective and volatile. Explore deeper insights into how these valuation techniques impact investment returns and risks.

Rental Yield

Real estate funds typically offer consistent rental yields averaging 4-7% annually, providing stable income through property leases and rent payments. Sports memorabilia funds, however, generate returns primarily from asset appreciation and auction sales, with limited or no rental income, resulting in less predictable yield patterns. Explore further to understand the nuanced performance and risk profiles between these investment types.

Source and External Links

The Best REIT ETFs to Buy | Morningstar - Vanguard Real Estate ETF is the largest and most popular real estate fund, offering a diversified portfolio of equity REITs and real estate management companies with low fees and broad market exposure as a proxy for the US real estate market.

Private Real Estate Investment Funds - DLP Capital - DLP Capital offers private real estate funds focusing on strong returns with impact investing in affordable housing, targeting high income and capital appreciation for accredited investors.

List of REITs & Real Estate Funds | Nareit - Mutual funds and ETFs provide accessible ways for investors to engage in real estate investment trusts (REITs), which deliver competitive returns and diversification by owning or financing income-producing real estate.

dowidth.com

dowidth.com