Music royalties platforms provide artists with a steady income stream by allowing investors to purchase rights to future royalties, creating a tangible asset backed by creative works. Cryptocurrency exchanges offer a digital marketplace for buying, selling, and trading diverse cryptocurrencies, emphasizing liquidity and market volatility. Explore how these investment opportunities can diversify portfolios and tap into emerging markets.

Why it is important

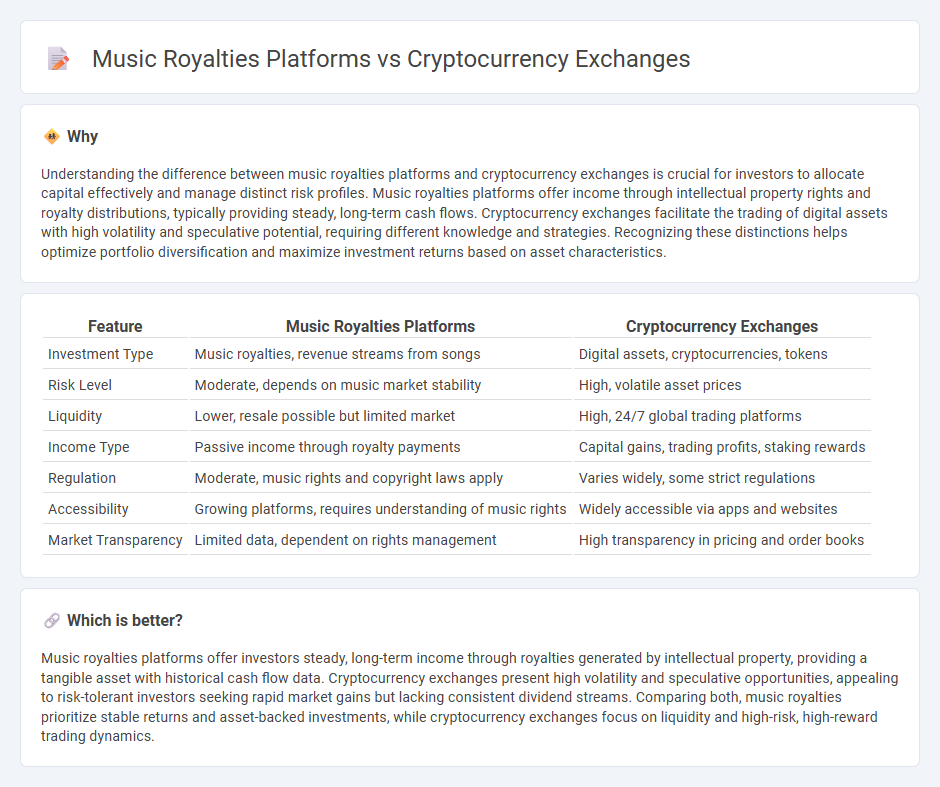

Understanding the difference between music royalties platforms and cryptocurrency exchanges is crucial for investors to allocate capital effectively and manage distinct risk profiles. Music royalties platforms offer income through intellectual property rights and royalty distributions, typically providing steady, long-term cash flows. Cryptocurrency exchanges facilitate the trading of digital assets with high volatility and speculative potential, requiring different knowledge and strategies. Recognizing these distinctions helps optimize portfolio diversification and maximize investment returns based on asset characteristics.

Comparison Table

| Feature | Music Royalties Platforms | Cryptocurrency Exchanges |

|---|---|---|

| Investment Type | Music royalties, revenue streams from songs | Digital assets, cryptocurrencies, tokens |

| Risk Level | Moderate, depends on music market stability | High, volatile asset prices |

| Liquidity | Lower, resale possible but limited market | High, 24/7 global trading platforms |

| Income Type | Passive income through royalty payments | Capital gains, trading profits, staking rewards |

| Regulation | Moderate, music rights and copyright laws apply | Varies widely, some strict regulations |

| Accessibility | Growing platforms, requires understanding of music rights | Widely accessible via apps and websites |

| Market Transparency | Limited data, dependent on rights management | High transparency in pricing and order books |

Which is better?

Music royalties platforms offer investors steady, long-term income through royalties generated by intellectual property, providing a tangible asset with historical cash flow data. Cryptocurrency exchanges present high volatility and speculative opportunities, appealing to risk-tolerant investors seeking rapid market gains but lacking consistent dividend streams. Comparing both, music royalties prioritize stable returns and asset-backed investments, while cryptocurrency exchanges focus on liquidity and high-risk, high-reward trading dynamics.

Connection

Music royalties platforms utilize blockchain technology similar to cryptocurrency exchanges to ensure transparent and secure royalty payments. Both systems leverage decentralized ledgers to track transactions and ownership rights, reducing fraud and enhancing payment efficiency. Integrating cryptocurrency exchanges allows music platforms to facilitate faster, cross-border payments to artists using digital assets.

Key Terms

Liquidity

Cryptocurrency exchanges offer high liquidity by enabling rapid buying and selling of digital assets across global markets, supported by advanced trading algorithms and deep order books. In contrast, music royalties platforms typically provide lower liquidity as royalty payments are distributed over time and negotiations for rights transfers can be complex and infrequent. Explore the distinct liquidity mechanisms and their impact on investment opportunities in both sectors to gain deeper insights.

Ownership rights

Cryptocurrency exchanges facilitate the buying, selling, and trading of digital assets, emphasizing secure ownership and transfer of tokens via blockchain technology. Music royalties platforms utilize blockchain to establish transparent ownership rights and automate royalty distribution to artists and stakeholders. Explore how these innovations redefine asset ownership in both finance and creative industries.

Digital assets

Cryptocurrency exchanges facilitate the buying, selling, and trading of digital assets like Bitcoin and Ethereum, offering liquidity and market access to investors globally. Music royalties platforms tokenize music rights as digital assets, enabling artists and rights holders to monetize and trade future royalty income through blockchain technology. Explore how these evolving digital asset markets impact ownership and investment opportunities in diverse industries.

Source and External Links

Cryptocurrency Exchanges - Overview, Advantages, Top 10 - Cryptocurrency exchanges are private platforms facilitating trading between cryptocurrencies and fiat currencies, with centralized exchanges like Binance and Coinbase acting as intermediaries using order book systems to match buyers and sellers at prevailing or limit prices.

Best Crypto Exchanges, Platforms & Apps for 2025 - NerdWallet - Leading crypto exchanges in 2025 include Coinbase for beginners, Uphold for staking, and Robinhood for trading with zero trade fees, each varying in fees, minimum deposits, and promotions.

Top Crypto Exchanges Ranked by Trust Score - CoinGecko - The largest cryptocurrency exchanges by 24-hour trading volume are Binance, Bitget, and Bybit, with a total tracked market volume exceeding $200 billion, showing the scale and liquidity in the crypto exchange market.

dowidth.com

dowidth.com