Investing in song catalogs offers steady royalty income and long-term value tied to music rights, while collectible sneakers provide capital gains through limited-edition releases and high market demand. Both assets require market knowledge and risk assessment to maximize returns in dynamic industries. Explore the advantages and challenges of each investment type to make informed financial decisions.

Why it is important

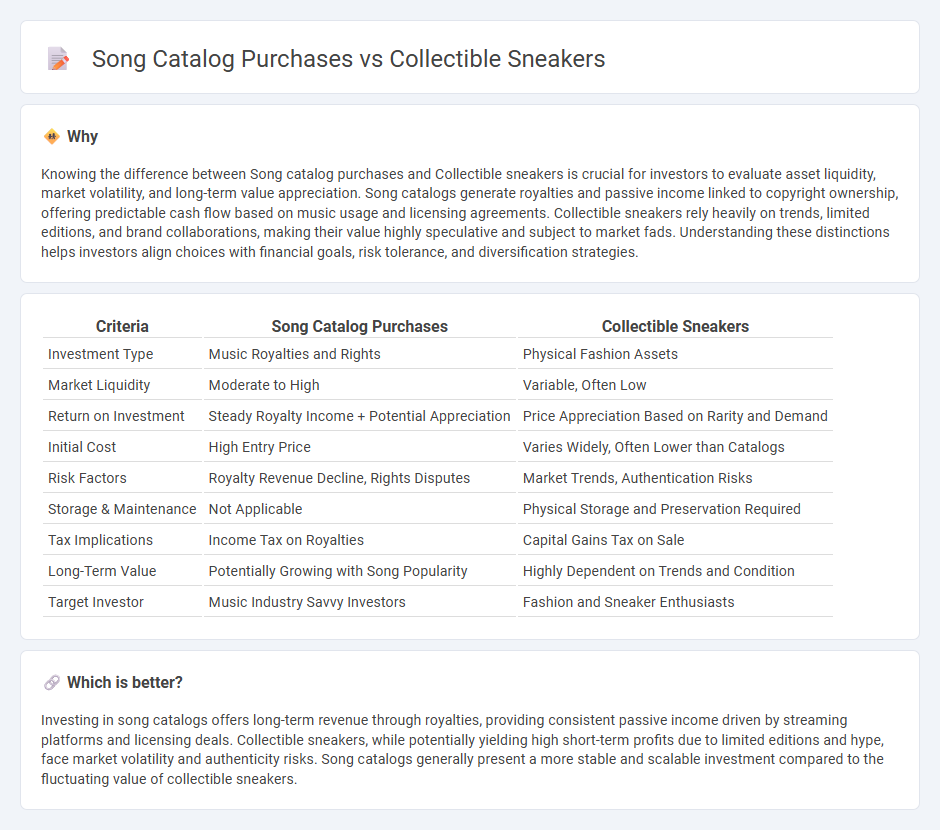

Knowing the difference between Song catalog purchases and Collectible sneakers is crucial for investors to evaluate asset liquidity, market volatility, and long-term value appreciation. Song catalogs generate royalties and passive income linked to copyright ownership, offering predictable cash flow based on music usage and licensing agreements. Collectible sneakers rely heavily on trends, limited editions, and brand collaborations, making their value highly speculative and subject to market fads. Understanding these distinctions helps investors align choices with financial goals, risk tolerance, and diversification strategies.

Comparison Table

| Criteria | Song Catalog Purchases | Collectible Sneakers |

|---|---|---|

| Investment Type | Music Royalties and Rights | Physical Fashion Assets |

| Market Liquidity | Moderate to High | Variable, Often Low |

| Return on Investment | Steady Royalty Income + Potential Appreciation | Price Appreciation Based on Rarity and Demand |

| Initial Cost | High Entry Price | Varies Widely, Often Lower than Catalogs |

| Risk Factors | Royalty Revenue Decline, Rights Disputes | Market Trends, Authentication Risks |

| Storage & Maintenance | Not Applicable | Physical Storage and Preservation Required |

| Tax Implications | Income Tax on Royalties | Capital Gains Tax on Sale |

| Long-Term Value | Potentially Growing with Song Popularity | Highly Dependent on Trends and Condition |

| Target Investor | Music Industry Savvy Investors | Fashion and Sneaker Enthusiasts |

Which is better?

Investing in song catalogs offers long-term revenue through royalties, providing consistent passive income driven by streaming platforms and licensing deals. Collectible sneakers, while potentially yielding high short-term profits due to limited editions and hype, face market volatility and authenticity risks. Song catalogs generally present a more stable and scalable investment compared to the fluctuating value of collectible sneakers.

Connection

Song catalog purchases and collectible sneakers share a common investment appeal through their potential for long-term value appreciation driven by rarity and cultural significance. Both assets benefit from growing markets where demand is fueled by passionate communities and limited supply, creating lucrative opportunities for investors. Their performance often hinges on evolving trends, artist influence, and sneaker model exclusivity, making them alternative asset classes within diversified investment portfolios.

Key Terms

Asset Valuation

Collectible sneakers often derive their asset valuation from factors such as rarity, brand collaboration, condition, and market trends within the sneaker community, with certain limited editions appreciating significantly over time. In contrast, song catalog purchases are valued based on royalty income potential, historical revenue, publishing rights, and the cultural impact of the music, offering investors a stream of passive income tied to the catalog's performance. Explore deeper insights on asset valuation methodologies for both sneaker collectibles and music catalogs to optimize investment decisions.

Liquidity

Collectible sneakers often face liquidity challenges due to limited buyers and niche markets, leading to longer holding periods and price volatility. In contrast, song catalog purchases benefit from more stable cash flows and broader market demand, providing greater liquidity through diversified revenue streams like royalties and licensing. Explore the nuances of liquidity differences between these asset classes to make informed investment decisions.

Intellectual Property Rights

Investing in collectible sneakers involves ownership of physical goods with limited intellectual property rights, primarily related to trademarks and design patents protecting brand logos and shoe aesthetics. Song catalog purchases grant stakeholders extensive intellectual property rights, including copyrights and publishing royalties, enabling control over licensing, distribution, and monetization of the music. Explore more to understand the nuanced impact of intellectual property rights in these unique investment domains.

Source and External Links

Collector's Guide to Sneakers - Explains the importance of exclusivity, condition, and high-profile collaborations in driving the collectibility and value of sneakers, with advice on how to identify and evaluate rare releases.

Rare Sneakers And More Private-sales Sotheby's - Offers a curated selection of rare and collectible sneakers, including iconic collaborations and streetwear releases, for private sale to serious collectors.

The Top 10 Most Expensive Sneakers | myGemma - Lists the world's most valuable sneakers ever sold, detailing record-breaking prices for limited-edition collaborations and rare prototypes.

dowidth.com

dowidth.com