Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, such as reforestation or renewable energy initiatives, providing a direct environmental impact. Environmental mutual funds invest in a diversified portfolio of companies committed to sustainable practices, clean technology, and environmental innovation. Explore the differences and benefits of these green investment options to align your portfolio with your eco-conscious goals.

Why it is important

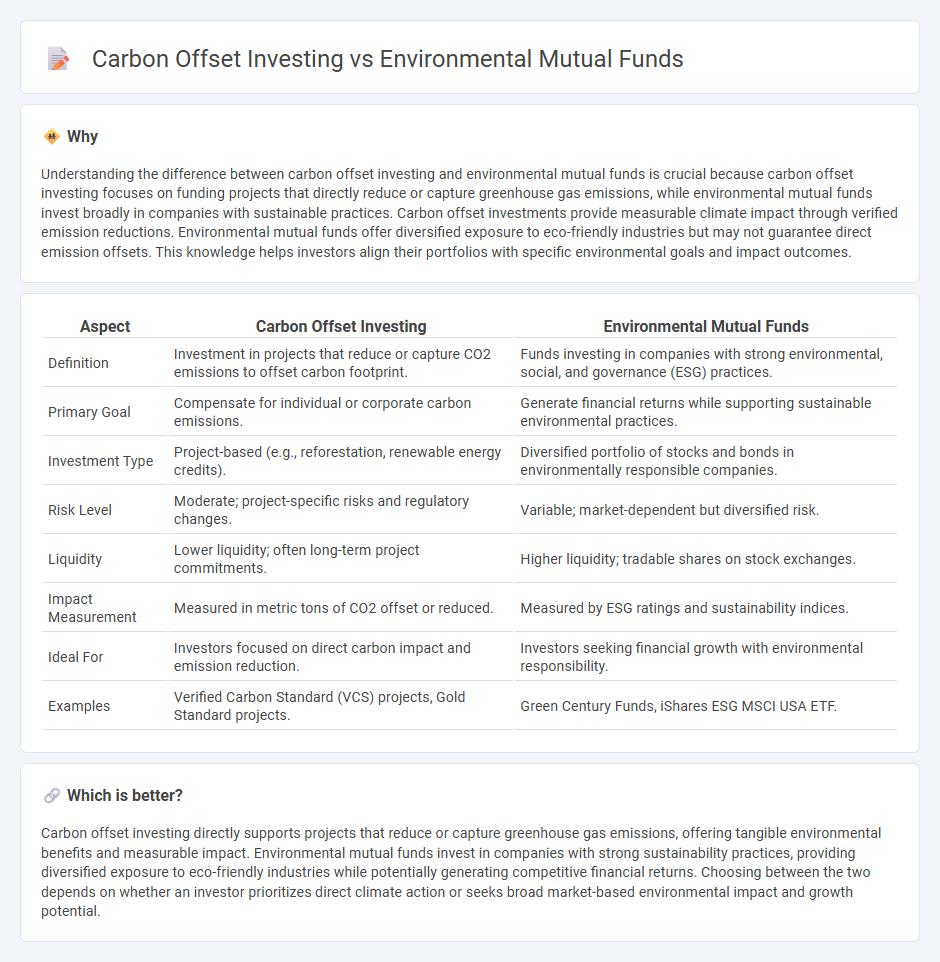

Understanding the difference between carbon offset investing and environmental mutual funds is crucial because carbon offset investing focuses on funding projects that directly reduce or capture greenhouse gas emissions, while environmental mutual funds invest broadly in companies with sustainable practices. Carbon offset investments provide measurable climate impact through verified emission reductions. Environmental mutual funds offer diversified exposure to eco-friendly industries but may not guarantee direct emission offsets. This knowledge helps investors align their portfolios with specific environmental goals and impact outcomes.

Comparison Table

| Aspect | Carbon Offset Investing | Environmental Mutual Funds |

|---|---|---|

| Definition | Investment in projects that reduce or capture CO2 emissions to offset carbon footprint. | Funds investing in companies with strong environmental, social, and governance (ESG) practices. |

| Primary Goal | Compensate for individual or corporate carbon emissions. | Generate financial returns while supporting sustainable environmental practices. |

| Investment Type | Project-based (e.g., reforestation, renewable energy credits). | Diversified portfolio of stocks and bonds in environmentally responsible companies. |

| Risk Level | Moderate; project-specific risks and regulatory changes. | Variable; market-dependent but diversified risk. |

| Liquidity | Lower liquidity; often long-term project commitments. | Higher liquidity; tradable shares on stock exchanges. |

| Impact Measurement | Measured in metric tons of CO2 offset or reduced. | Measured by ESG ratings and sustainability indices. |

| Ideal For | Investors focused on direct carbon impact and emission reduction. | Investors seeking financial growth with environmental responsibility. |

| Examples | Verified Carbon Standard (VCS) projects, Gold Standard projects. | Green Century Funds, iShares ESG MSCI USA ETF. |

Which is better?

Carbon offset investing directly supports projects that reduce or capture greenhouse gas emissions, offering tangible environmental benefits and measurable impact. Environmental mutual funds invest in companies with strong sustainability practices, providing diversified exposure to eco-friendly industries while potentially generating competitive financial returns. Choosing between the two depends on whether an investor prioritizes direct climate action or seeks broad market-based environmental impact and growth potential.

Connection

Carbon offset investing and environmental mutual funds both focus on channeling capital towards sustainable projects that reduce greenhouse gas emissions and promote ecological balance. Environmental mutual funds diversify investments across companies and projects committed to renewable energy, waste reduction, and carbon footprint mitigation, often including carbon offset initiatives as a core component. This synergy enhances portfolio impact by integrating direct carbon credit purchases with broader environmental asset management strategies.

Key Terms

ESG (Environmental, Social, and Governance)

Environmental mutual funds invest in companies with strong ESG ratings, emphasizing sustainability practices within their operations and supply chains. Carbon offset investing targets projects that reduce or capture greenhouse gas emissions, such as reforestation or renewable energy, directly mitigating environmental impact. Explore the differences and benefits of these strategies to enhance your sustainable investment portfolio.

Carbon Credits

Carbon credits represent tradable certificates that verify the reduction of one metric ton of CO2 emissions, playing a pivotal role in both environmental mutual funds and carbon offset investing strategies. Environmental mutual funds invest in companies that demonstrate strong environmental performance and sustainable practices, whereas carbon offset investing directly funds projects that reduce or capture greenhouse gas emissions through carbon credits. Explore how carbon credits drive impactful climate actions across these investment approaches for deeper insights.

Green Portfolio

Environmental mutual funds prioritize investments in companies with strong sustainability practices, renewable energy projects, and low carbon footprints, integrating ESG criteria to promote long-term ecological impact. Carbon offset investing involves funding projects like reforestation, renewable energy, or methane capture to compensate for an investor's carbon emissions, directly mitigating environmental harm. Explore how a Green Portfolio balances these strategies to enhance eco-friendly returns and support global sustainability goals.

Source and External Links

Green America Mutual Funds - Offers a list of clean energy mutual funds, along with others that exclude fossil fuels and focus on community development.

Schwab Socially Responsible Mutual Funds - Provides Environmental, Social, and Governance (ESG) mutual funds for investors seeking to align their investments with environmental and social issues.

Fidelity Sustainable Investing Funds - Includes thematic funds focused on environmental themes such as climate action, water sustainability, and renewable energy.

dowidth.com

dowidth.com