Social token investment offers investors decentralized ownership in digital communities, enabling liquidity and direct participation in brand growth. Real estate tokenization transforms physical property assets into tradable digital tokens, increasing market accessibility and enabling fractional ownership. Discover the distinctions and opportunities in these evolving investment landscapes to enhance your portfolio strategy.

Why it is important

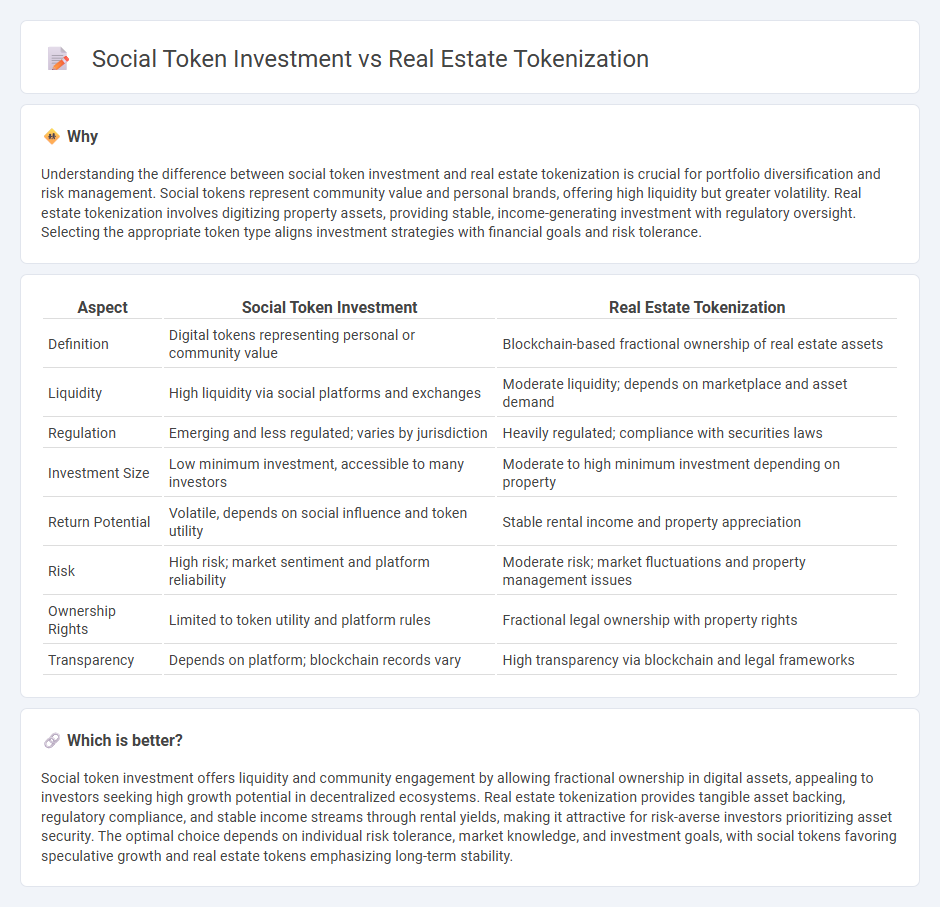

Understanding the difference between social token investment and real estate tokenization is crucial for portfolio diversification and risk management. Social tokens represent community value and personal brands, offering high liquidity but greater volatility. Real estate tokenization involves digitizing property assets, providing stable, income-generating investment with regulatory oversight. Selecting the appropriate token type aligns investment strategies with financial goals and risk tolerance.

Comparison Table

| Aspect | Social Token Investment | Real Estate Tokenization |

|---|---|---|

| Definition | Digital tokens representing personal or community value | Blockchain-based fractional ownership of real estate assets |

| Liquidity | High liquidity via social platforms and exchanges | Moderate liquidity; depends on marketplace and asset demand |

| Regulation | Emerging and less regulated; varies by jurisdiction | Heavily regulated; compliance with securities laws |

| Investment Size | Low minimum investment, accessible to many investors | Moderate to high minimum investment depending on property |

| Return Potential | Volatile, depends on social influence and token utility | Stable rental income and property appreciation |

| Risk | High risk; market sentiment and platform reliability | Moderate risk; market fluctuations and property management issues |

| Ownership Rights | Limited to token utility and platform rules | Fractional legal ownership with property rights |

| Transparency | Depends on platform; blockchain records vary | High transparency via blockchain and legal frameworks |

Which is better?

Social token investment offers liquidity and community engagement by allowing fractional ownership in digital assets, appealing to investors seeking high growth potential in decentralized ecosystems. Real estate tokenization provides tangible asset backing, regulatory compliance, and stable income streams through rental yields, making it attractive for risk-averse investors prioritizing asset security. The optimal choice depends on individual risk tolerance, market knowledge, and investment goals, with social tokens favoring speculative growth and real estate tokens emphasizing long-term stability.

Connection

Social token investment and real estate tokenization both leverage blockchain technology to create liquid, tradable digital assets representing underlying value. Social tokens enable community-driven economies by tokenizing personal or brand equity, while real estate tokenization breaks down property ownership into fractional shares, enhancing accessibility and liquidity. Both models facilitate decentralized investment opportunities, democratizing asset ownership and streamlining transaction processes.

Key Terms

**Real Estate Tokenization:**

Real estate tokenization converts property ownership into digital tokens using blockchain technology, enabling fractional investment and increased liquidity in the real estate market. This approach allows investors to access diverse real estate assets with lower entry barriers compared to traditional methods. Explore more to understand how real estate tokenization is transforming property investment opportunities.

Asset-backed tokens

Real estate tokenization involves converting physical properties into digital tokens, representing fractional ownership on blockchain platforms, which enhances liquidity and accessibility compared to traditional real estate investing. Social token investment leverages individual or community value, where tokens represent influence, access, or rewards rather than tangible assets. Explore deeper insights into how asset-backed tokens are revolutionizing investment portfolios and creating new opportunities for investors.

Fractional ownership

Real estate tokenization enables fractional ownership by converting property assets into digital tokens, allowing investors to buy and trade small shares of real estate with enhanced liquidity and reduced entry barriers. Social token investment involves creators or communities issuing tokens that represent fractional ownership of their brand or content, fostering direct engagement and monetization opportunities for supporters. Explore the distinct benefits and mechanisms of fractional ownership in both real estate and social token investment to optimize your portfolio strategies.

Source and External Links

Real Estate Tokenization: Unlocking the Future of Property Investment - Real estate tokenization converts property ownership or cash flows into digital tokens on a blockchain, enabling full property ownership, fractional ownership, or tokenized cash flows, thus modernizing investment processes.

An introduction to real estate tokenization on AWS - Tokenization creates blockchain-based digital assets representing real estate ownership or rights, reducing costs and automating property transfers while preserving legal ownership through smart contracts.

What Is Tokenized Real Estate? - Tokenized real estate uses blockchain tokens, either NFTs or fungible tokens, to increase liquidity, enable fractional ownership, and streamline complex real estate transactions.

dowidth.com

dowidth.com