Rare whisky bottles trading offers a unique investment avenue with limited-edition releases and aging potential that can significantly appreciate in value over time, contrasting with stamps that rely heavily on historical scarcity and condition for valuation. Whisky investment benefits from the growing global demand in luxury spirits markets, while stamps appeal primarily to niche collectors and historical enthusiasts. Explore the distinct advantages and risks of both to make an informed decision in alternative investing.

Why it is important

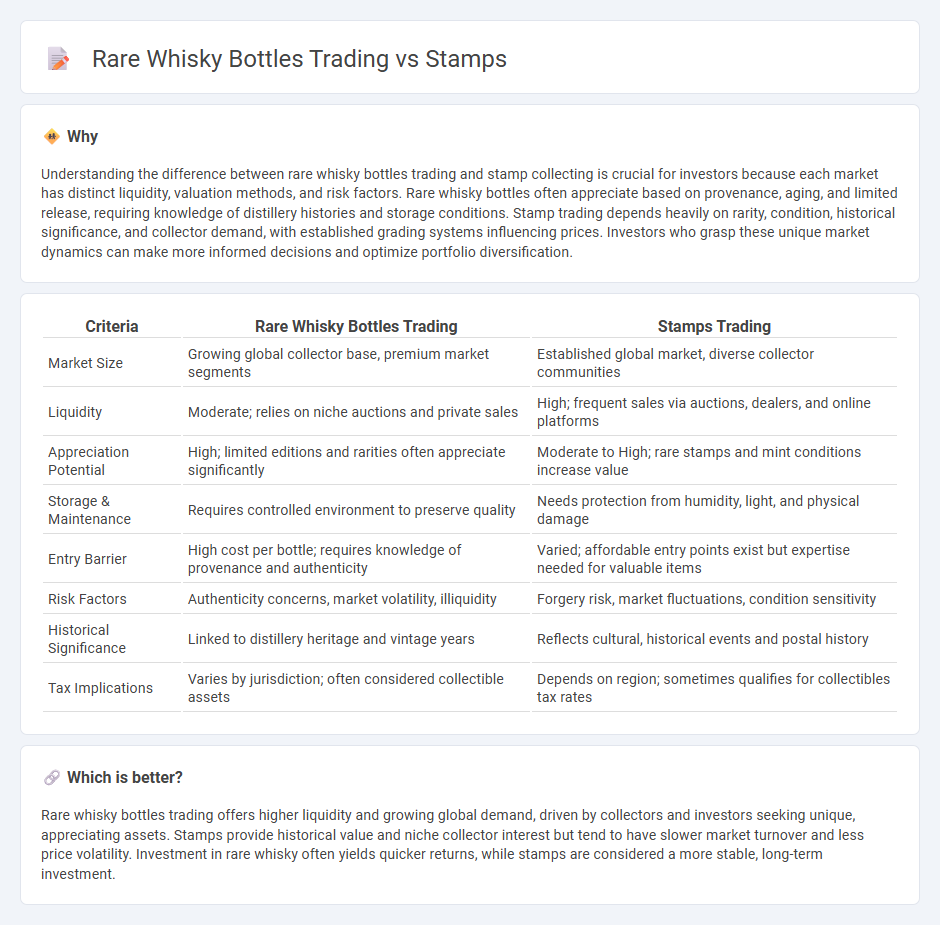

Understanding the difference between rare whisky bottles trading and stamp collecting is crucial for investors because each market has distinct liquidity, valuation methods, and risk factors. Rare whisky bottles often appreciate based on provenance, aging, and limited release, requiring knowledge of distillery histories and storage conditions. Stamp trading depends heavily on rarity, condition, historical significance, and collector demand, with established grading systems influencing prices. Investors who grasp these unique market dynamics can make more informed decisions and optimize portfolio diversification.

Comparison Table

| Criteria | Rare Whisky Bottles Trading | Stamps Trading |

|---|---|---|

| Market Size | Growing global collector base, premium market segments | Established global market, diverse collector communities |

| Liquidity | Moderate; relies on niche auctions and private sales | High; frequent sales via auctions, dealers, and online platforms |

| Appreciation Potential | High; limited editions and rarities often appreciate significantly | Moderate to High; rare stamps and mint conditions increase value |

| Storage & Maintenance | Requires controlled environment to preserve quality | Needs protection from humidity, light, and physical damage |

| Entry Barrier | High cost per bottle; requires knowledge of provenance and authenticity | Varied; affordable entry points exist but expertise needed for valuable items |

| Risk Factors | Authenticity concerns, market volatility, illiquidity | Forgery risk, market fluctuations, condition sensitivity |

| Historical Significance | Linked to distillery heritage and vintage years | Reflects cultural, historical events and postal history |

| Tax Implications | Varies by jurisdiction; often considered collectible assets | Depends on region; sometimes qualifies for collectibles tax rates |

Which is better?

Rare whisky bottles trading offers higher liquidity and growing global demand, driven by collectors and investors seeking unique, appreciating assets. Stamps provide historical value and niche collector interest but tend to have slower market turnover and less price volatility. Investment in rare whisky often yields quicker returns, while stamps are considered a more stable, long-term investment.

Connection

Rare whisky bottles trading and stamps share parallels as collectible investment markets driven by scarcity, historical significance, and condition. Both assets appreciate in value over time due to limited availability and demand from niche collectors seeking tangible, unique items. Market dynamics depend on provenance verification and authentication, enhancing investment appeal and potential returns.

Key Terms

Authentication

Authentication in stamps trading relies heavily on expert examination of paper, ink, and cancellation marks to verify rarity and condition, which directly impact market value. Rare whisky bottles authentication focuses on verifying provenance, seal integrity, and distillery markings to ensure originality and prevent counterfeiting. Explore more insights on how authentication shapes the value and security of these collectible markets.

Provenance

Provenance plays a vital role in both stamps and rare whisky bottles trading, as it authenticates the item's origin and history, directly influencing its value. In stamps, detailed provenance can verify limited editions or historical significance, while in whisky trading, provenance confirms the bottle's authenticity, age, and previous ownership. Explore more about how provenance impacts value and trust in these collectible markets.

Liquidity

Stamp trading offers higher liquidity due to a larger, more active global collector base and standardized grading systems, facilitating quicker sales and more price transparency. Rare whisky bottles, though less liquid, often hold intrinsic value through unique provenance and limited supply, attracting niche investors interested in long-term appreciation. Explore deeper insights into liquidity dynamics and investment strategies in both markets.

Source and External Links

Postage Stamp - A postage stamp is a small piece of paper issued by a post office to customers for paying postage, with the first stamp being the "Penny Black" introduced in the UK in 1840.

Linn's Stamp News - Linn's Stamp News is the world's largest newsmagazine for stamp collectors, providing updates on stamp issues and values.

USPS Stamps - Offers a variety of stamps for purchase, including the newly released U.S. Flags 2025 Forever stamp, and provides information on current stamp pricing.

dowidth.com

dowidth.com