Royalty streams provide investors with direct income derived from the revenue generated by intellectual property or natural resources, offering a potentially steady cash flow independent of market fluctuations. Exchange-Traded Funds (ETFs) represent a diversified portfolio of assets traded on stock exchanges, combining liquidity and broad market exposure with the ability to track various indices or sectors. Explore the key distinctions and benefits of each investment type to determine the best fit for your portfolio goals.

Why it is important

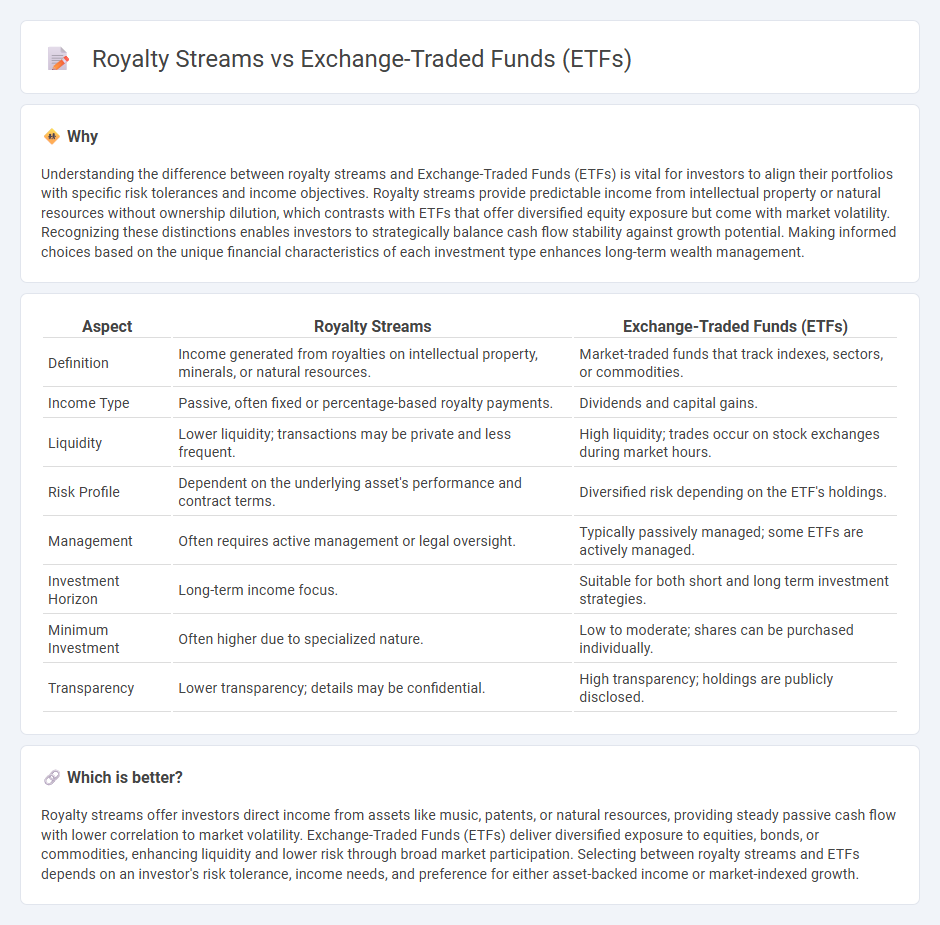

Understanding the difference between royalty streams and Exchange-Traded Funds (ETFs) is vital for investors to align their portfolios with specific risk tolerances and income objectives. Royalty streams provide predictable income from intellectual property or natural resources without ownership dilution, which contrasts with ETFs that offer diversified equity exposure but come with market volatility. Recognizing these distinctions enables investors to strategically balance cash flow stability against growth potential. Making informed choices based on the unique financial characteristics of each investment type enhances long-term wealth management.

Comparison Table

| Aspect | Royalty Streams | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Income generated from royalties on intellectual property, minerals, or natural resources. | Market-traded funds that track indexes, sectors, or commodities. |

| Income Type | Passive, often fixed or percentage-based royalty payments. | Dividends and capital gains. |

| Liquidity | Lower liquidity; transactions may be private and less frequent. | High liquidity; trades occur on stock exchanges during market hours. |

| Risk Profile | Dependent on the underlying asset's performance and contract terms. | Diversified risk depending on the ETF's holdings. |

| Management | Often requires active management or legal oversight. | Typically passively managed; some ETFs are actively managed. |

| Investment Horizon | Long-term income focus. | Suitable for both short and long term investment strategies. |

| Minimum Investment | Often higher due to specialized nature. | Low to moderate; shares can be purchased individually. |

| Transparency | Lower transparency; details may be confidential. | High transparency; holdings are publicly disclosed. |

Which is better?

Royalty streams offer investors direct income from assets like music, patents, or natural resources, providing steady passive cash flow with lower correlation to market volatility. Exchange-Traded Funds (ETFs) deliver diversified exposure to equities, bonds, or commodities, enhancing liquidity and lower risk through broad market participation. Selecting between royalty streams and ETFs depends on an investor's risk tolerance, income needs, and preference for either asset-backed income or market-indexed growth.

Connection

Royalty streams provide investors with consistent income by receiving a percentage of revenue from assets like intellectual property or natural resources, while Exchange-Traded Funds (ETFs) often include shares of companies managing these royalties. Investing in ETFs that focus on royalty trusts or royalty-bearing assets offers diversified exposure to steady cash flows without direct asset ownership. This connection allows investors to benefit from royalty income volatility reduction and portfolio diversification through the liquidity and accessibility of ETFs.

Key Terms

Liquidity

Exchange-Traded Funds (ETFs) offer high liquidity with shares traded on major stock exchanges, enabling investors to buy and sell instantly at market prices throughout trading hours. Royalty streams provide steady income from intellectual property or resource rights but lack the ease of market trading, often resulting in limited liquidity and longer holding horizons. Explore how liquidity differences impact investment strategies and portfolio diversification in depth.

Diversification

Exchange-Traded Funds (ETFs) offer diversification by pooling a wide range of assets across sectors, industries, and geographies, reducing individual investment risk. Royalty streams provide income from intellectual property or natural resources but often lack the broad diversification found in ETFs. Explore the benefits and limitations of each to optimize your investment strategy effectively.

Income generation

Exchange-Traded Funds (ETFs) offer diversified income through dividends from a broad range of assets, providing liquidity and ease of trading on stock exchanges. Royalty streams generate passive income by entitling investors to a percentage of revenue from intellectual property or natural resource production, often delivering steady cash flow tied to specific assets. Explore the nuances of income generation strategies to determine which investment aligns with your financial goals.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are exchange-traded investment products that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets, with shares traded on exchanges like stocks.

What is an ETF? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification benefits of mutual funds, offering affordable access to a wide range of asset classes and typically featuring lower costs and greater tax efficiency than actively managed mutual funds.

Exchange-traded fund - Wikipedia - Most ETFs are index funds that track the performance of a specific market index by holding the same securities in the same proportions as the index, such as the S&P 500 or NASDAQ-100, enabling investors to gain broad market exposure through a single trade.

dowidth.com

dowidth.com