Royalty rights investing involves purchasing a percentage of future revenue from intellectual property, providing ongoing passive income tied to creative works or patents. Peer-to-peer lending connects individual borrowers with investors through online platforms, offering fixed interest returns over a specified loan term. Explore their differences to determine which investment aligns with your financial goals.

Why it is important

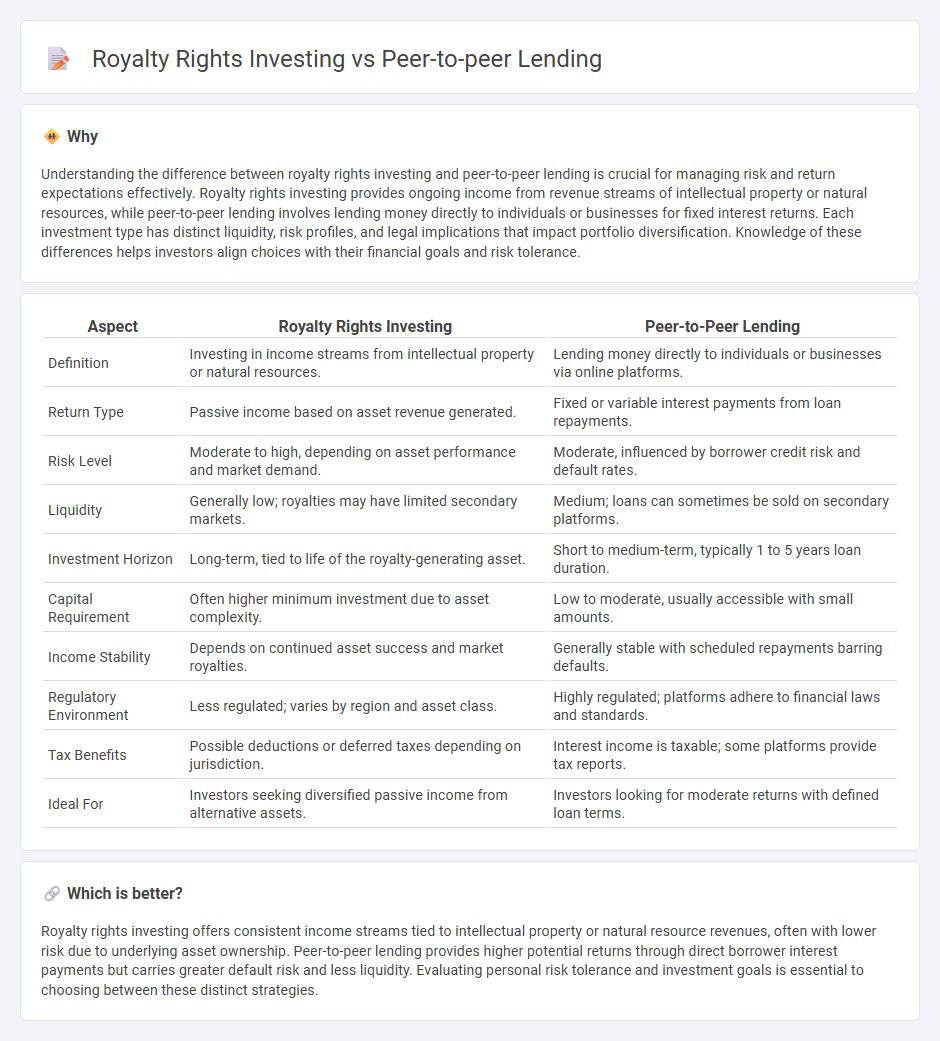

Understanding the difference between royalty rights investing and peer-to-peer lending is crucial for managing risk and return expectations effectively. Royalty rights investing provides ongoing income from revenue streams of intellectual property or natural resources, while peer-to-peer lending involves lending money directly to individuals or businesses for fixed interest returns. Each investment type has distinct liquidity, risk profiles, and legal implications that impact portfolio diversification. Knowledge of these differences helps investors align choices with their financial goals and risk tolerance.

Comparison Table

| Aspect | Royalty Rights Investing | Peer-to-Peer Lending |

|---|---|---|

| Definition | Investing in income streams from intellectual property or natural resources. | Lending money directly to individuals or businesses via online platforms. |

| Return Type | Passive income based on asset revenue generated. | Fixed or variable interest payments from loan repayments. |

| Risk Level | Moderate to high, depending on asset performance and market demand. | Moderate, influenced by borrower credit risk and default rates. |

| Liquidity | Generally low; royalties may have limited secondary markets. | Medium; loans can sometimes be sold on secondary platforms. |

| Investment Horizon | Long-term, tied to life of the royalty-generating asset. | Short to medium-term, typically 1 to 5 years loan duration. |

| Capital Requirement | Often higher minimum investment due to asset complexity. | Low to moderate, usually accessible with small amounts. |

| Income Stability | Depends on continued asset success and market royalties. | Generally stable with scheduled repayments barring defaults. |

| Regulatory Environment | Less regulated; varies by region and asset class. | Highly regulated; platforms adhere to financial laws and standards. |

| Tax Benefits | Possible deductions or deferred taxes depending on jurisdiction. | Interest income is taxable; some platforms provide tax reports. |

| Ideal For | Investors seeking diversified passive income from alternative assets. | Investors looking for moderate returns with defined loan terms. |

Which is better?

Royalty rights investing offers consistent income streams tied to intellectual property or natural resource revenues, often with lower risk due to underlying asset ownership. Peer-to-peer lending provides higher potential returns through direct borrower interest payments but carries greater default risk and less liquidity. Evaluating personal risk tolerance and investment goals is essential to choosing between these distinct strategies.

Connection

Royalty rights investing and peer-to-peer lending both offer alternative investment opportunities that generate passive income through direct financial participation. By purchasing royalty rights, investors earn a percentage of revenue from intellectual property or natural resources, while peer-to-peer lending connects borrowers with individual lenders for interest payments. Both methods reduce reliance on traditional financial institutions, diversifying investment portfolios with cash flow tied to tangible assets or loan repayments.

Key Terms

Platform Intermediary

Peer-to-peer lending platforms act as intermediaries connecting borrowers with individual investors, facilitating unsecured loans with fixed interest returns and streamlined digital processes. Royalty rights investing platforms serve as intermediaries enabling investors to purchase rights to future earnings from intellectual property or natural resources, providing income tied to revenue streams rather than fixed repayments. Explore our detailed comparison to understand the role of platform intermediaries in maximizing investment returns and managing risk profiles effectively.

Risk Profile

Peer-to-peer lending offers moderate risk with the potential for borrower default, but usually benefits from diversified loan portfolios and platform credit assessments. Royalty rights investing carries higher risk due to dependency on the commercial success of underlying intellectual property or assets, with returns linked to revenue streams and often limited liquidity. Explore deeper insights into risk profiles of both investment types to make informed financial decisions.

Revenue Sharing

Peer-to-peer lending involves investors directly funding borrowers in exchange for interest payments, creating a fixed-income stream based on loan agreements. Royalty rights investing focuses on revenue sharing by purchasing the right to receive a percentage of future sales or earnings from intellectual property, minerals, or business revenues. Discover how these distinct approaches impact your investment portfolio and income potential.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending is a method where individuals can borrow and lend money directly through online platforms, bypassing traditional banks, offering borrowers potentially lower eligibility requirements and lenders a unique investment opportunity.

Peer-to-peer lending - Wikipedia - P2P lending involves online services connecting borrowers and lenders, often with no prior relationship, through intermediaries that handle credit checks, payments, and loan servicing, offering secured or unsecured loans as tradable securities but without government insurance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending functions as an online marketplace matching lenders with individuals or businesses seeking loans, generally providing higher interest rates than savings accounts but with higher risk due to potential borrower default.

dowidth.com

dowidth.com