Sports card fractionalization offers investors access to high-value collectibles by dividing ownership into smaller shares, enabling diversified portfolios with relatively low capital. Wine investment platforms, on the other hand, provide exposure to rare and fine wines, leveraging market appreciation tied to vintage quality and scarcity. Explore how these alternative asset classes can enhance your investment strategy and risk management.

Why it is important

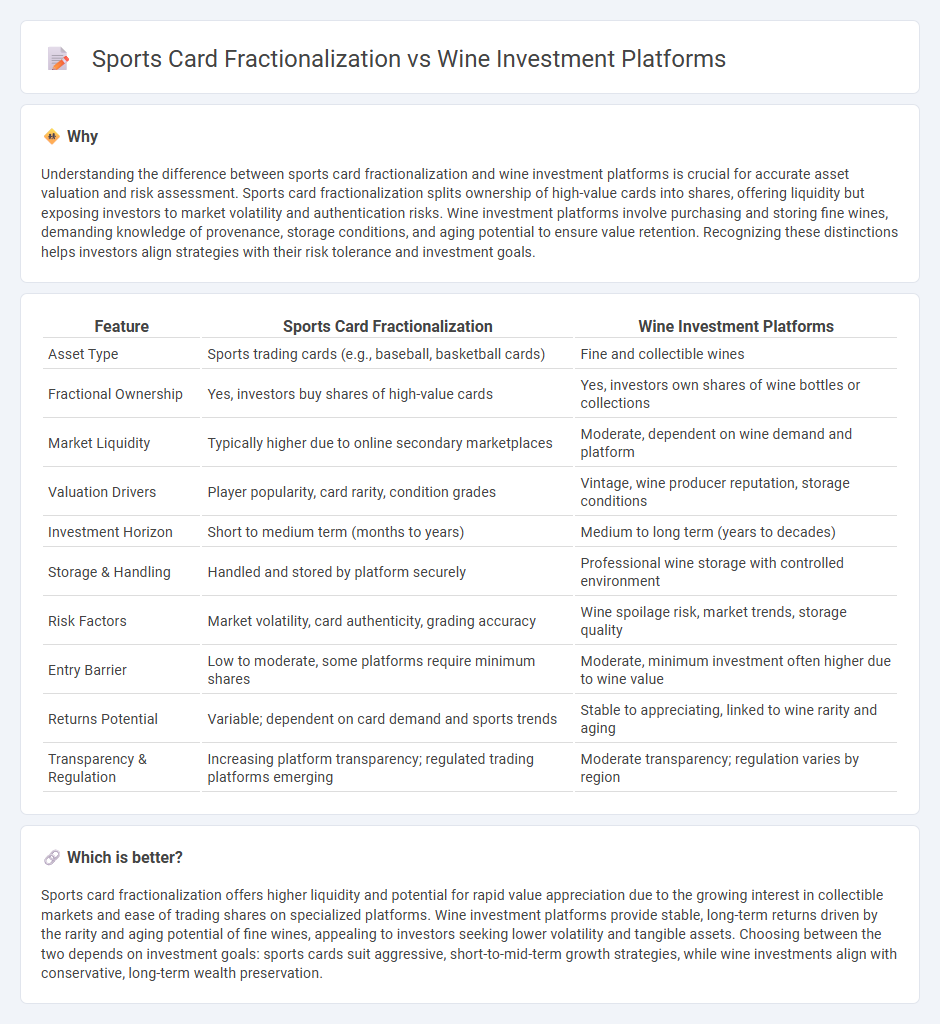

Understanding the difference between sports card fractionalization and wine investment platforms is crucial for accurate asset valuation and risk assessment. Sports card fractionalization splits ownership of high-value cards into shares, offering liquidity but exposing investors to market volatility and authentication risks. Wine investment platforms involve purchasing and storing fine wines, demanding knowledge of provenance, storage conditions, and aging potential to ensure value retention. Recognizing these distinctions helps investors align strategies with their risk tolerance and investment goals.

Comparison Table

| Feature | Sports Card Fractionalization | Wine Investment Platforms |

|---|---|---|

| Asset Type | Sports trading cards (e.g., baseball, basketball cards) | Fine and collectible wines |

| Fractional Ownership | Yes, investors buy shares of high-value cards | Yes, investors own shares of wine bottles or collections |

| Market Liquidity | Typically higher due to online secondary marketplaces | Moderate, dependent on wine demand and platform |

| Valuation Drivers | Player popularity, card rarity, condition grades | Vintage, wine producer reputation, storage conditions |

| Investment Horizon | Short to medium term (months to years) | Medium to long term (years to decades) |

| Storage & Handling | Handled and stored by platform securely | Professional wine storage with controlled environment |

| Risk Factors | Market volatility, card authenticity, grading accuracy | Wine spoilage risk, market trends, storage quality |

| Entry Barrier | Low to moderate, some platforms require minimum shares | Moderate, minimum investment often higher due to wine value |

| Returns Potential | Variable; dependent on card demand and sports trends | Stable to appreciating, linked to wine rarity and aging |

| Transparency & Regulation | Increasing platform transparency; regulated trading platforms emerging | Moderate transparency; regulation varies by region |

Which is better?

Sports card fractionalization offers higher liquidity and potential for rapid value appreciation due to the growing interest in collectible markets and ease of trading shares on specialized platforms. Wine investment platforms provide stable, long-term returns driven by the rarity and aging potential of fine wines, appealing to investors seeking lower volatility and tangible assets. Choosing between the two depends on investment goals: sports cards suit aggressive, short-to-mid-term growth strategies, while wine investments align with conservative, long-term wealth preservation.

Connection

Sports card fractionalization and wine investment platforms both leverage blockchain technology to democratize ownership of high-value assets, allowing investors to purchase shares of expensive collectibles. These platforms increase liquidity and accessibility by enabling fractional ownership, which reduces entry barriers and diversifies investment portfolios. By tokenizing assets, they provide transparent provenance and secure transactions, appealing to collectors and investors seeking alternative investment opportunities.

Key Terms

Asset Authentication

Wine investment platforms utilize advanced techniques such as DNA profiling and spectroscopy to ensure the authenticity and provenance of rare wines. Sports card fractionalization leverages blockchain technology to provide transparent ownership records and reduce fraud in collectible card trading. Explore the intricacies of asset authentication to understand how technology secures value in both markets.

Market Liquidity

Wine investment platforms offer relatively stable market liquidity due to consistent global demand and expert valuation processes, allowing investors to buy and sell shares with moderate ease. Sports card fractionalization experiences higher liquidity volatility, driven by fluctuating collector interest, event-specific hype, and trending athlete performance impacting market activity. Explore detailed comparisons and real-time data to understand which investment suits your liquidity preferences.

Regulatory Compliance

Wine investment platforms operate under stringent regulatory frameworks enforced by the Alcohol and Tobacco Tax and Trade Bureau (TTB) and Securities and Exchange Commission (SEC), ensuring compliance with alcohol distribution and investment laws. Sports card fractionalization involves SEC oversight due to its classification as a security, requiring adherence to investor protection regulations and accurate disclosures. Explore the key regulatory distinctions and compliance strategies between these two alternative investment sectors to make informed decisions.

Source and External Links

Best Wine Investment Apps (2025): Features, Benefits - Vinovest - Notable wine investment platforms include Vinovest, which offers easy investment in fine wines globally with no minimum account balance, Vindome, a blockchain-based trading platform with secure bonded storage, and Cult Wine Investment, a London-based AI-driven platform with a minimum investment starting at PS25,000 and tiers including elite options with exclusive club access.

Understanding Online Wine Investments And Investing Platforms - Key platforms like Vinovest and Vindome allow investors to buy, store, and sell fine wine seamlessly with benefits such as transparent pricing, real-time market access, blockchain-recorded provenance, and insured bonded warehousing, supporting both beginners and experienced investors.

Top Wine Investing Platforms 2024 - Wine International Association - Leading platforms include Vint offering fractional investing starting at $2,500, Cult Wine Investment with AI portfolio management and global storage, Vindome mixing blockchain technology and traditional storage for flexible buying options, and Vinovest focusing on authentication and active management with low minimums.

dowidth.com

dowidth.com