Fractional real estate investing allows individuals to own a portion of specific properties, providing direct asset exposure and potential rental income, while Real Estate ETFs offer diversified holdings across multiple properties and real estate companies with enhanced liquidity and lower entry costs. Both investment methods present unique benefits and risks relating to control, fees, and market volatility. Explore more to determine which real estate investment strategy aligns best with your financial goals.

Why it is important

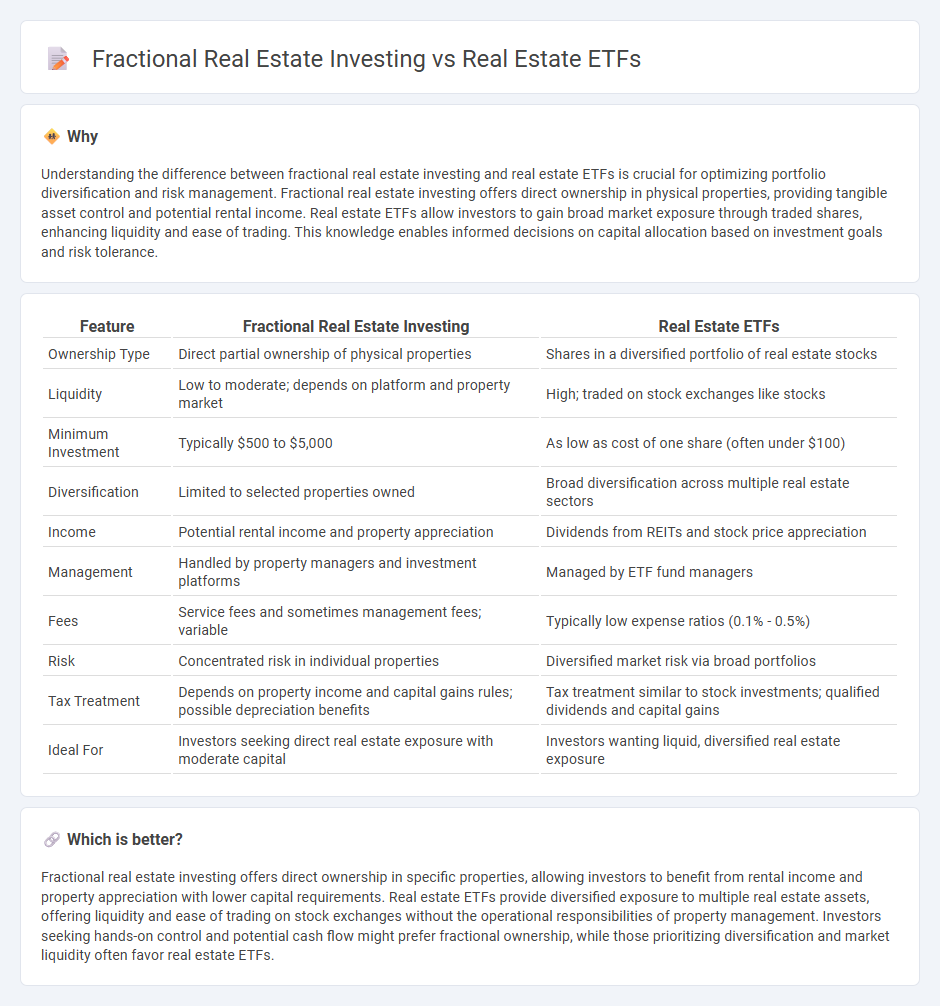

Understanding the difference between fractional real estate investing and real estate ETFs is crucial for optimizing portfolio diversification and risk management. Fractional real estate investing offers direct ownership in physical properties, providing tangible asset control and potential rental income. Real estate ETFs allow investors to gain broad market exposure through traded shares, enhancing liquidity and ease of trading. This knowledge enables informed decisions on capital allocation based on investment goals and risk tolerance.

Comparison Table

| Feature | Fractional Real Estate Investing | Real Estate ETFs |

|---|---|---|

| Ownership Type | Direct partial ownership of physical properties | Shares in a diversified portfolio of real estate stocks |

| Liquidity | Low to moderate; depends on platform and property market | High; traded on stock exchanges like stocks |

| Minimum Investment | Typically $500 to $5,000 | As low as cost of one share (often under $100) |

| Diversification | Limited to selected properties owned | Broad diversification across multiple real estate sectors |

| Income | Potential rental income and property appreciation | Dividends from REITs and stock price appreciation |

| Management | Handled by property managers and investment platforms | Managed by ETF fund managers |

| Fees | Service fees and sometimes management fees; variable | Typically low expense ratios (0.1% - 0.5%) |

| Risk | Concentrated risk in individual properties | Diversified market risk via broad portfolios |

| Tax Treatment | Depends on property income and capital gains rules; possible depreciation benefits | Tax treatment similar to stock investments; qualified dividends and capital gains |

| Ideal For | Investors seeking direct real estate exposure with moderate capital | Investors wanting liquid, diversified real estate exposure |

Which is better?

Fractional real estate investing offers direct ownership in specific properties, allowing investors to benefit from rental income and property appreciation with lower capital requirements. Real estate ETFs provide diversified exposure to multiple real estate assets, offering liquidity and ease of trading on stock exchanges without the operational responsibilities of property management. Investors seeking hands-on control and potential cash flow might prefer fractional ownership, while those prioritizing diversification and market liquidity often favor real estate ETFs.

Connection

Fractional real estate investing and real estate ETFs both enable diversified property exposure with lower capital requirements, making real estate investment accessible to smaller investors. Fractional real estate allows ownership of specific property shares, while real estate ETFs aggregate multiple real estate assets into a tradable fund. Together, they provide liquidity, diversification, and reduced risk compared to direct full-property investment.

Key Terms

Liquidity

Real estate ETFs offer high liquidity, allowing investors to buy and sell shares on major stock exchanges throughout the trading day with minimal transaction costs. Fractional real estate investing provides access to physical properties but typically involves longer lock-in periods and limited resale options, reducing liquidity. Explore the advantages and constraints of each to determine the best fit for your investment strategy.

Diversification

Real estate ETFs offer broad diversification by pooling assets across multiple properties and geographic locations, reducing individual investment risk. Fractional real estate investing allows direct ownership of specific properties but may have limited diversification due to smaller portfolio size. Explore the benefits and drawbacks of each approach to determine the best strategy for your investment goals.

Ownership structure

Real estate ETFs offer diversified ownership through shares in a professionally managed portfolio of properties, providing liquidity and lower entry costs. Fractional real estate investing grants direct ownership in specific properties, allowing investors to influence property management decisions and benefit from rental income. Explore the differences in ownership structures to determine which investment approach aligns with your financial goals.

Source and External Links

5 Best-Performing Real Estate ETFs for July 2025 - NerdWallet - Real estate ETFs provide diversification, liquidity, passive income potential, and can hedge against inflation, with top performers in 2025 including JRE, SRVR, and BYRE.

The Best REIT ETFs to Buy | Morningstar - Vanguard Real Estate ETF is a popular choice for exposure to equity REITs and real estate management firms, offering diversified, low-cost investment with market-cap weighting.

Best Real Estate ETFs Today - TipRanks - Leading real estate ETFs by assets and performance include Vanguard Real Estate ETF, Schwab U.S. REIT ETF, and iShares U.S. Real Estate ETF, with yields around 7-9% over the past year.

dowidth.com

dowidth.com