Psychedelic stocks focus on companies developing treatments using psychedelic compounds for mental health conditions, showing significant growth potential amid rising interest and regulatory shifts. Biotech stocks encompass a broader range of firms involved in genetic research, drug development, and innovative therapies targeting various diseases, often driven by cutting-edge scientific advancements. Explore the differences and investment opportunities between these dynamic sectors to make informed financial decisions.

Why it is important

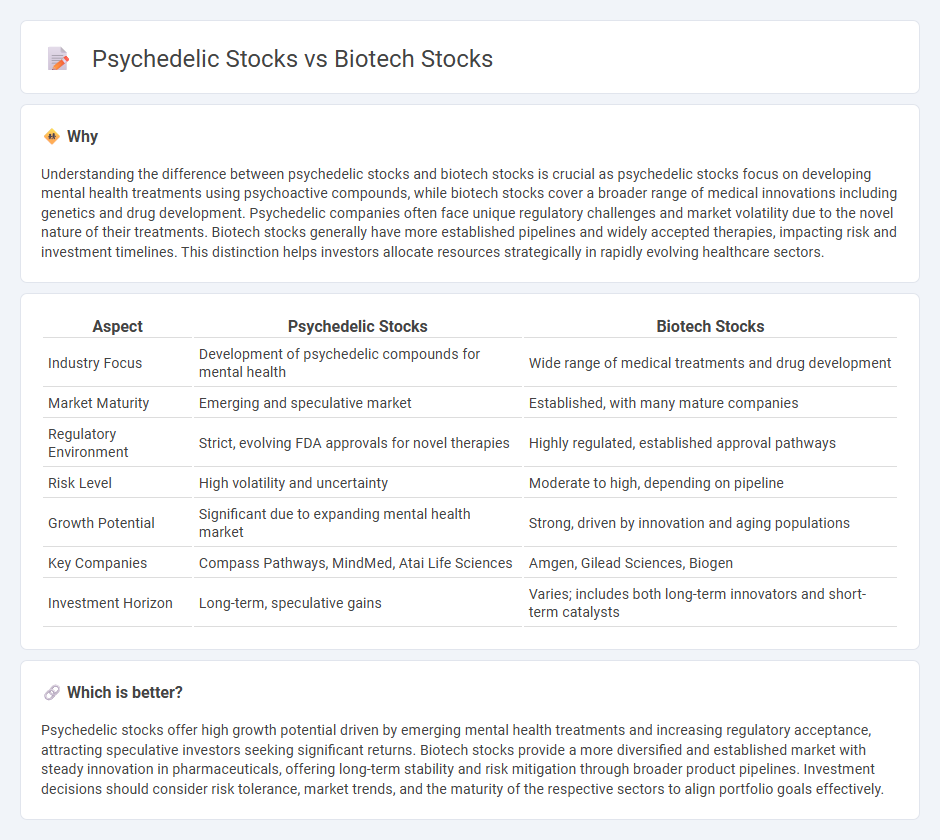

Understanding the difference between psychedelic stocks and biotech stocks is crucial as psychedelic stocks focus on developing mental health treatments using psychoactive compounds, while biotech stocks cover a broader range of medical innovations including genetics and drug development. Psychedelic companies often face unique regulatory challenges and market volatility due to the novel nature of their treatments. Biotech stocks generally have more established pipelines and widely accepted therapies, impacting risk and investment timelines. This distinction helps investors allocate resources strategically in rapidly evolving healthcare sectors.

Comparison Table

| Aspect | Psychedelic Stocks | Biotech Stocks |

|---|---|---|

| Industry Focus | Development of psychedelic compounds for mental health | Wide range of medical treatments and drug development |

| Market Maturity | Emerging and speculative market | Established, with many mature companies |

| Regulatory Environment | Strict, evolving FDA approvals for novel therapies | Highly regulated, established approval pathways |

| Risk Level | High volatility and uncertainty | Moderate to high, depending on pipeline |

| Growth Potential | Significant due to expanding mental health market | Strong, driven by innovation and aging populations |

| Key Companies | Compass Pathways, MindMed, Atai Life Sciences | Amgen, Gilead Sciences, Biogen |

| Investment Horizon | Long-term, speculative gains | Varies; includes both long-term innovators and short-term catalysts |

Which is better?

Psychedelic stocks offer high growth potential driven by emerging mental health treatments and increasing regulatory acceptance, attracting speculative investors seeking significant returns. Biotech stocks provide a more diversified and established market with steady innovation in pharmaceuticals, offering long-term stability and risk mitigation through broader product pipelines. Investment decisions should consider risk tolerance, market trends, and the maturity of the respective sectors to align portfolio goals effectively.

Connection

Psychedelic stocks and biotech stocks are interconnected through their shared focus on innovative drug development and medical research targeting mental health disorders. Both sectors invest heavily in clinical trials and regulatory approvals to bring novel therapies, such as psilocybin-based treatments, to market. The growth potential in these stocks is driven by increasing acceptance of psychedelics in psychiatric applications and advancements in biotechnology.

Key Terms

Clinical Trials

Biotech stocks often lead in clinical trials across a wide range of therapeutic areas, demonstrating robust R&D pipelines and FDA approval potential. Psychedelic stocks, a niche within biotech, focus specifically on mental health applications, with several Phase 2 and Phase 3 trials targeting conditions like PTSD, depression, and anxiety showing promising results. Explore detailed insights into how clinical trial advancements shape investment opportunities in these dynamic sectors.

Regulatory Approval

Biotech stocks often rely on rigorous clinical trial phases and FDA regulatory approval, resulting in significant market volatility tied to drug approval outcomes. Psychedelic stocks, although also dependent on regulatory pathways, navigate emerging frameworks as governments reconsider substance classifications and therapeutic uses. Explore the evolving landscape of regulatory approval to understand investment potential in these sectors.

Market Capitalization

Biotech stocks generally have larger market capitalizations compared to psychedelic stocks, reflecting the established nature and broader applications of biotechnology in pharmaceuticals, agriculture, and healthcare sectors. Psychedelic stocks, while smaller in market cap, show rapid growth potential driven by increasing research in mental health treatments and regulatory shifts. Explore our detailed analysis to understand investment opportunities in these dynamic markets.

Source and External Links

Ultragenyx's SWOT analysis: rare disease biotech stock faces pivotal trials - Ultragenyx is a biotech company focused on rare diseases with a strong pipeline, currently valued at $2.58 billion, facing key Phase 3 trials in 2025 that could impact its future significantly.

A List of Stocks in the Biotechnology Industry - Stock Analysis - The biotechnology sector comprises 637 stocks with a combined market cap of $859.28 billion, but overall shows negative profits and a modest dividend yield.

Danaher stock price target raised to $226 by Baird on biotech strength - Danaher, with a $135.6 billion market cap, is highly rated due to its strong biotechnology segment growth and solid financial health as of 2025.

dowidth.com

dowidth.com