Sports team ownership shares offer investors the potential for long-term value appreciation, revenue from ticket sales, merchandising, and broadcasting rights. Film production investments can yield substantial returns through box office success and licensing, but carry higher risks due to variable audience reception and production costs. Explore the nuances of these investment avenues to determine the best fit for your portfolio.

Why it is important

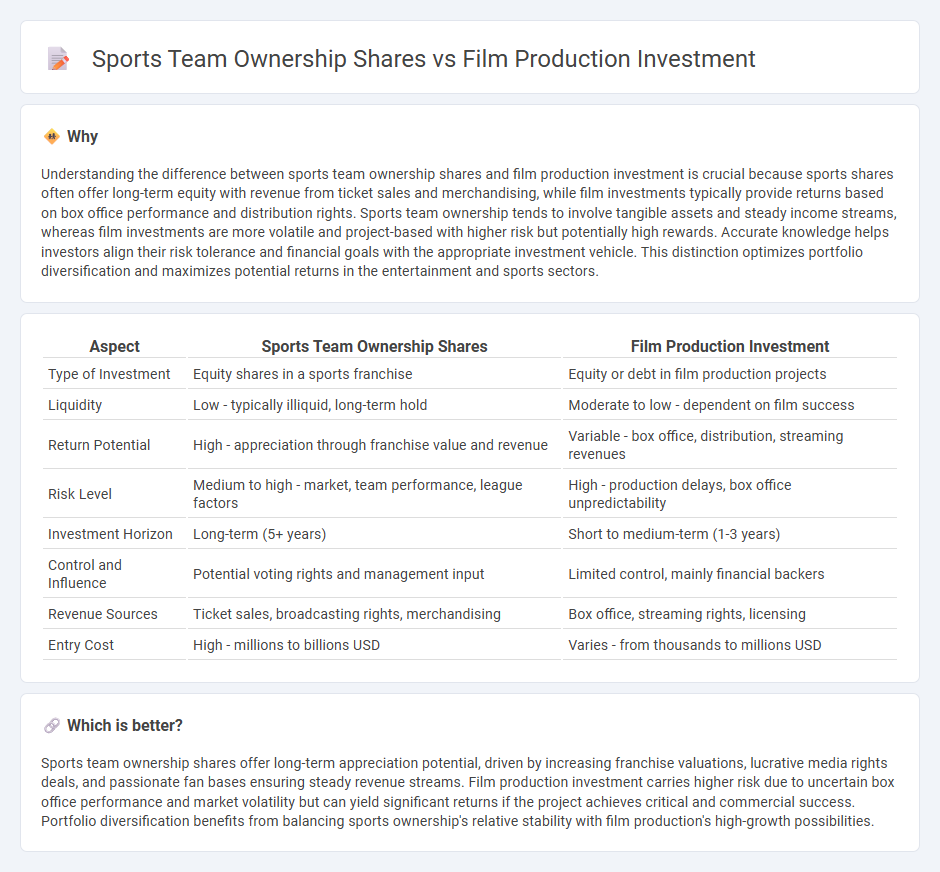

Understanding the difference between sports team ownership shares and film production investment is crucial because sports shares often offer long-term equity with revenue from ticket sales and merchandising, while film investments typically provide returns based on box office performance and distribution rights. Sports team ownership tends to involve tangible assets and steady income streams, whereas film investments are more volatile and project-based with higher risk but potentially high rewards. Accurate knowledge helps investors align their risk tolerance and financial goals with the appropriate investment vehicle. This distinction optimizes portfolio diversification and maximizes potential returns in the entertainment and sports sectors.

Comparison Table

| Aspect | Sports Team Ownership Shares | Film Production Investment |

|---|---|---|

| Type of Investment | Equity shares in a sports franchise | Equity or debt in film production projects |

| Liquidity | Low - typically illiquid, long-term hold | Moderate to low - dependent on film success |

| Return Potential | High - appreciation through franchise value and revenue | Variable - box office, distribution, streaming revenues |

| Risk Level | Medium to high - market, team performance, league factors | High - production delays, box office unpredictability |

| Investment Horizon | Long-term (5+ years) | Short to medium-term (1-3 years) |

| Control and Influence | Potential voting rights and management input | Limited control, mainly financial backers |

| Revenue Sources | Ticket sales, broadcasting rights, merchandising | Box office, streaming rights, licensing |

| Entry Cost | High - millions to billions USD | Varies - from thousands to millions USD |

Which is better?

Sports team ownership shares offer long-term appreciation potential, driven by increasing franchise valuations, lucrative media rights deals, and passionate fan bases ensuring steady revenue streams. Film production investment carries higher risk due to uncertain box office performance and market volatility but can yield significant returns if the project achieves critical and commercial success. Portfolio diversification benefits from balancing sports ownership's relative stability with film production's high-growth possibilities.

Connection

Sports team ownership shares and film production investment intersect as both represent alternative asset classes attracting high-net-worth investors seeking diversification beyond traditional equities. Ownership stakes in sports franchises offer potential capital appreciation and revenue from media rights, merchandising, and ticket sales, paralleling film investment returns driven by box office performance, streaming deals, and intellectual property licensing. Both markets leverage brand value and audience engagement, with financial success often tied to market trends, consumer demand, and strategic management.

Key Terms

**Film production investment:**

Investing in film production offers potential high returns through box office revenues, streaming rights, and international distribution, although it carries significant risks due to market unpredictability and production delays. Unlike sports team ownership shares, film investments can be diversified across multiple projects to mitigate risk and capitalize on various genres and markets. Explore the detailed advantages and strategies of film production investment to make informed financial decisions.

Box Office Revenue

Investing in film production offers returns directly linked to box office revenue, where success depends on factors like genre, star power, and distribution reach. Sports team ownership shares provide value tied to franchise performance, ticket sales, and media rights but are less influenced by box office metrics. Explore how these investment avenues compare in generating revenue and long-term profitability.

Profit Participation

Profit participation in film production investment typically involves receiving a percentage of box office revenues, streaming deals, and ancillary markets, often offering higher volatility but potentially greater returns. Sports team ownership shares offer equity stakes providing dividends from franchise earnings, merchandising, and media rights with relatively stable long-term appreciation and branding value. Explore detailed comparisons of risk profiles and profit streams to optimize your investment strategy.

Source and External Links

Investing in Movies and the Film Industry - SoFi - Film production investment can be done via stocks in production companies, film funds, or slate financing, where investors finance multiple films together to diversify risk and potentially lower costs, though slate investments typically involve private equity and higher risk.

Essential Guide: Film Financing | Wrapbook - Film financing falls into three categories: equity investment (ownership stakes), debt (loans to be repaid), and soft money (non-repayable funds such as tax incentives and in-kind contributions), with equity investors usually sharing proportional profits from the film.

Independent Film Financing - How It Works - Hrbek Law - Independent film financing involves raising money from investors who are paid back only after all production costs are covered, with profits distributed proportionally and often including interest; income sources include box office, sales, and licensing.

dowidth.com

dowidth.com