Music royalties investing offers investors a unique opportunity to earn passive income by acquiring rights to song royalties, which generate consistent revenue streams from streaming, radio plays, and licensing. Intellectual property investing encompasses a broader range of assets, including patents, trademarks, and copyrights, with potential for higher long-term value appreciation but often involves more complex legal and market considerations. Explore the nuances and benefits of each investment type to make informed decisions tailored to your financial goals.

Why it is important

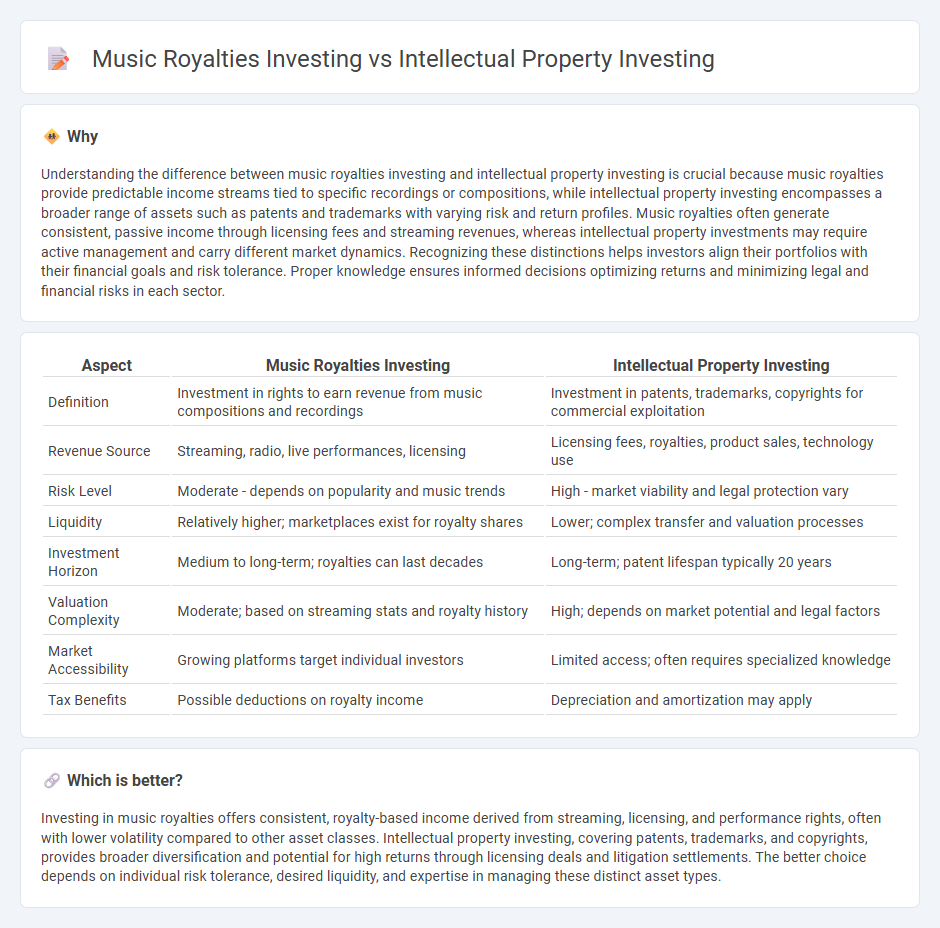

Understanding the difference between music royalties investing and intellectual property investing is crucial because music royalties provide predictable income streams tied to specific recordings or compositions, while intellectual property investing encompasses a broader range of assets such as patents and trademarks with varying risk and return profiles. Music royalties often generate consistent, passive income through licensing fees and streaming revenues, whereas intellectual property investments may require active management and carry different market dynamics. Recognizing these distinctions helps investors align their portfolios with their financial goals and risk tolerance. Proper knowledge ensures informed decisions optimizing returns and minimizing legal and financial risks in each sector.

Comparison Table

| Aspect | Music Royalties Investing | Intellectual Property Investing |

|---|---|---|

| Definition | Investment in rights to earn revenue from music compositions and recordings | Investment in patents, trademarks, copyrights for commercial exploitation |

| Revenue Source | Streaming, radio, live performances, licensing | Licensing fees, royalties, product sales, technology use |

| Risk Level | Moderate - depends on popularity and music trends | High - market viability and legal protection vary |

| Liquidity | Relatively higher; marketplaces exist for royalty shares | Lower; complex transfer and valuation processes |

| Investment Horizon | Medium to long-term; royalties can last decades | Long-term; patent lifespan typically 20 years |

| Valuation Complexity | Moderate; based on streaming stats and royalty history | High; depends on market potential and legal factors |

| Market Accessibility | Growing platforms target individual investors | Limited access; often requires specialized knowledge |

| Tax Benefits | Possible deductions on royalty income | Depreciation and amortization may apply |

Which is better?

Investing in music royalties offers consistent, royalty-based income derived from streaming, licensing, and performance rights, often with lower volatility compared to other asset classes. Intellectual property investing, covering patents, trademarks, and copyrights, provides broader diversification and potential for high returns through licensing deals and litigation settlements. The better choice depends on individual risk tolerance, desired liquidity, and expertise in managing these distinct asset types.

Connection

Music royalties investing and intellectual property investing are interconnected through the ownership and monetization of intangible assets such as copyrights and trademarks. Both investment types generate revenue streams by leveraging the legal rights to creative works, including songs, compositions, and recordings. Investors capitalize on predictable cash flows derived from licensing fees, royalties, and rights management, positioning these assets as alternative investments in diversified portfolios.

Key Terms

**Intellectual property investing:**

Intellectual property investing involves acquiring rights to patents, trademarks, copyrights, and trade secrets that generate revenue through licensing fees, royalties, or litigation settlements. This asset class offers diversification and potential for passive income growth based on the underlying innovation or brand value. Discover how to leverage intellectual property investing for portfolio enhancement and consistent returns.

Patent rights

Investing in patent rights offers protection for innovative inventions and allows monetization through licensing or sale, providing a high-value asset class with potential for long-term returns. Music royalties investing focuses on earning income from copyrighted musical works, often generating consistent cash flow but with different risk and valuation factors compared to patents. Explore the nuances of intellectual property investing to understand how patent rights can enhance a diversified portfolio.

Licensing agreements

Licensing agreements in intellectual property investing grant rights to use patents, copyrights, or trademarks, generating revenue streams through royalties or fees while protecting the investor's interests. In music royalties investing, licensing agreements specifically cover the use of compositions and sound recordings across various platforms including streaming services, radio, and synchronization in media, creating consistent income based on usage metrics. Explore how these licensing frameworks differ in terms of legal structures and financial models to optimize your investment strategy.

Source and External Links

Investing in Intellectual Property - Chicago-Kent - Intellectual property provides a competitive advantage with potential for high profit margins and value growth over time, and can be leveraged through licensing; investing in IP is high risk and high reward, stimulating innovation and enhancing company positions in the market.

Opportunities to finance innovation with IP - Intellectual property rights like patents are crucial in attracting investment, reflecting the shift toward knowledge-based economies where intangible assets comprise the majority of firm value, and IP serves as both insurance and a proactive tool to finance innovation and generate revenue.

An Investor's Guide to Investing in Intellectual Property (IP) - Investing in IP demands thorough due diligence on quality, protection strength, and market potential of IP assets, which are key for business growth and generating sustainable revenue streams, while recognizing IP value helps investors uncover often hidden off-balance-sheet worth.

dowidth.com

dowidth.com