Music royalties investment offers consistent passive income through song earnings, benefiting from streaming growth and catalog appreciation. Sports memorabilia investment captures value through rare collectibles and fan enthusiasm, driven by athlete legacy and market trends. Explore the unique advantages and risks of each asset class to determine the best fit for your portfolio.

Why it is important

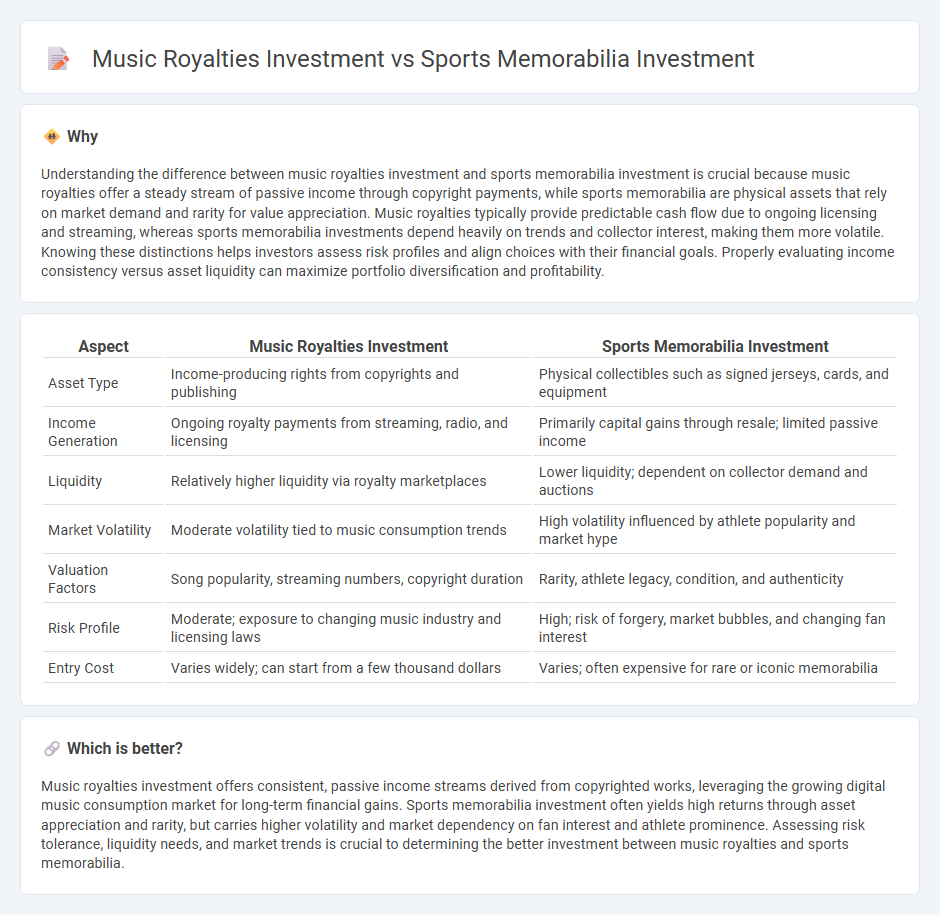

Understanding the difference between music royalties investment and sports memorabilia investment is crucial because music royalties offer a steady stream of passive income through copyright payments, while sports memorabilia are physical assets that rely on market demand and rarity for value appreciation. Music royalties typically provide predictable cash flow due to ongoing licensing and streaming, whereas sports memorabilia investments depend heavily on trends and collector interest, making them more volatile. Knowing these distinctions helps investors assess risk profiles and align choices with their financial goals. Properly evaluating income consistency versus asset liquidity can maximize portfolio diversification and profitability.

Comparison Table

| Aspect | Music Royalties Investment | Sports Memorabilia Investment |

|---|---|---|

| Asset Type | Income-producing rights from copyrights and publishing | Physical collectibles such as signed jerseys, cards, and equipment |

| Income Generation | Ongoing royalty payments from streaming, radio, and licensing | Primarily capital gains through resale; limited passive income |

| Liquidity | Relatively higher liquidity via royalty marketplaces | Lower liquidity; dependent on collector demand and auctions |

| Market Volatility | Moderate volatility tied to music consumption trends | High volatility influenced by athlete popularity and market hype |

| Valuation Factors | Song popularity, streaming numbers, copyright duration | Rarity, athlete legacy, condition, and authenticity |

| Risk Profile | Moderate; exposure to changing music industry and licensing laws | High; risk of forgery, market bubbles, and changing fan interest |

| Entry Cost | Varies widely; can start from a few thousand dollars | Varies; often expensive for rare or iconic memorabilia |

Which is better?

Music royalties investment offers consistent, passive income streams derived from copyrighted works, leveraging the growing digital music consumption market for long-term financial gains. Sports memorabilia investment often yields high returns through asset appreciation and rarity, but carries higher volatility and market dependency on fan interest and athlete prominence. Assessing risk tolerance, liquidity needs, and market trends is crucial to determining the better investment between music royalties and sports memorabilia.

Connection

Music royalties investment and sports memorabilia investment both represent alternative asset classes that generate passive income through intellectual property and tangible collectibles. Investors capitalize on the long-term value appreciation and revenue streams from licensing rights in music and the scarcity of limited-edition sports items. These investments offer portfolio diversification by leveraging cultural trends and fan bases in the entertainment and sports industries.

Key Terms

**Sports Memorabilia Investment:**

Sports memorabilia investment offers unique opportunities through tangible assets such as autographed jerseys, vintage trading cards, and game-used equipment, which frequently appreciate in value due to rarity and historical significance. Market trends indicate increased global demand, driven by growing fan engagement and the rise of authenticated digital certificates enhancing security and provenance. Explore the advantages and risks of sports memorabilia investment to make informed decisions in this dynamic market.

Provenance

Sports memorabilia investment gains value through verified provenance, such as authenticated signatures, game-used equipment, and documented history tied to iconic athletes and events. Music royalties investment depends on clear ownership rights and royalty tracking, ensuring investors receive accurate payments from licensed uses and streaming platforms. Explore deeper insights on how provenance impacts investment security and potential returns in both sectors.

Authentication

Authentication plays a crucial role in sports memorabilia investment by verifying the origin, condition, and rarity of items, ensuring their value and preventing fraud. In music royalties investment, authentication involves validating the ownership rights and royalty stream, which safeguards income and confirms legitimacy. Explore deeper insights on how authentication impacts the security and profitability of these unique investment opportunities.

Source and External Links

How to Invest in Sports Memorabilia - SmartAsset - Sports memorabilia investment requires a clear strategy focusing on authenticated items with historical value, offering potential financial returns and portfolio diversification, with examples like Babe Ruth's jersey and Mickey Mantle baseball cards selling for millions.

Is Sports Memorabilia A Good Investment - The Highland Mint - Best investments include rookie sports cards, autographed items, game-worn gear, and championship memorabilia, where careful selection and authentication can yield significant returns despite market volatility.

Sports | Rally | Alternative Asset Investment - Sports memorabilia is a $15 billion market with highly valued items like Michael Jordan's sneakers and Kobe Bryant's signed hardwood seeing substantial appreciation, illustrating strong demand and growth potential in alternative asset markets.

dowidth.com

dowidth.com