Fractional real estate investing allows multiple investors to own shares of high-value properties, offering diversified exposure and lower entry costs. Raw land investing involves purchasing undeveloped land with the potential for future appreciation, development, or resale, but it requires patience and market knowledge. Explore our detailed analysis to determine which investment suits your financial goals.

Why it is important

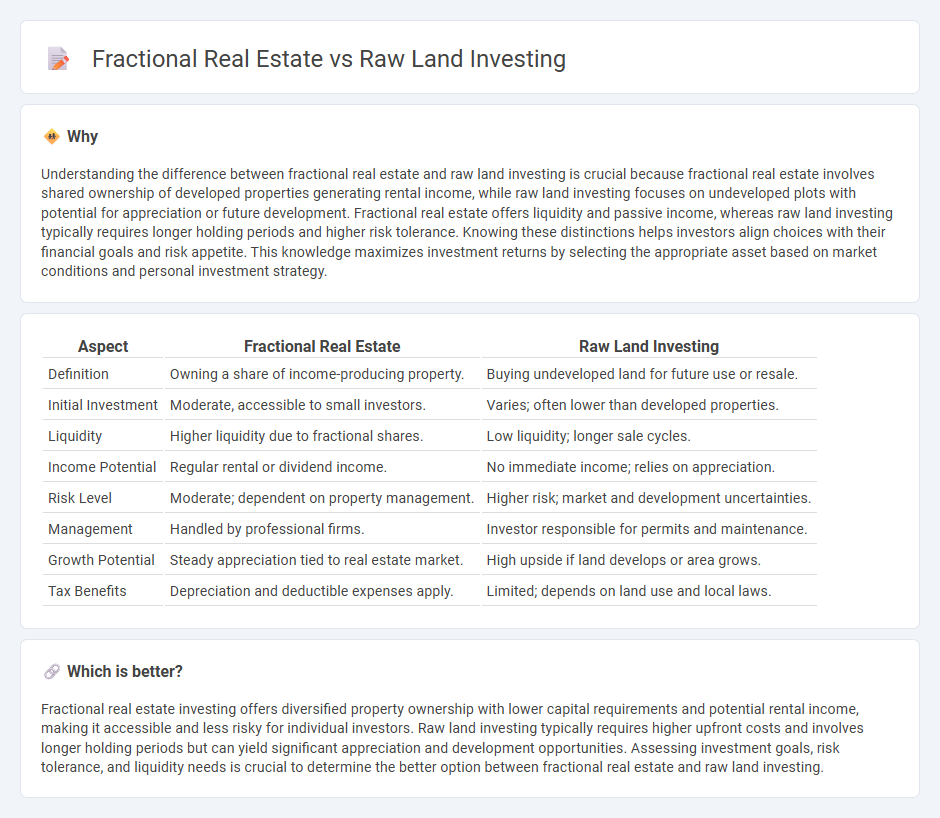

Understanding the difference between fractional real estate and raw land investing is crucial because fractional real estate involves shared ownership of developed properties generating rental income, while raw land investing focuses on undeveloped plots with potential for appreciation or future development. Fractional real estate offers liquidity and passive income, whereas raw land investing typically requires longer holding periods and higher risk tolerance. Knowing these distinctions helps investors align choices with their financial goals and risk appetite. This knowledge maximizes investment returns by selecting the appropriate asset based on market conditions and personal investment strategy.

Comparison Table

| Aspect | Fractional Real Estate | Raw Land Investing |

|---|---|---|

| Definition | Owning a share of income-producing property. | Buying undeveloped land for future use or resale. |

| Initial Investment | Moderate, accessible to small investors. | Varies; often lower than developed properties. |

| Liquidity | Higher liquidity due to fractional shares. | Low liquidity; longer sale cycles. |

| Income Potential | Regular rental or dividend income. | No immediate income; relies on appreciation. |

| Risk Level | Moderate; dependent on property management. | Higher risk; market and development uncertainties. |

| Management | Handled by professional firms. | Investor responsible for permits and maintenance. |

| Growth Potential | Steady appreciation tied to real estate market. | High upside if land develops or area grows. |

| Tax Benefits | Depreciation and deductible expenses apply. | Limited; depends on land use and local laws. |

Which is better?

Fractional real estate investing offers diversified property ownership with lower capital requirements and potential rental income, making it accessible and less risky for individual investors. Raw land investing typically requires higher upfront costs and involves longer holding periods but can yield significant appreciation and development opportunities. Assessing investment goals, risk tolerance, and liquidity needs is crucial to determine the better option between fractional real estate and raw land investing.

Connection

Fractional real estate and raw land investing intersect through shared opportunities in diversification and accessibility within property markets. Fractional real estate enables investors to purchase a share of high-value raw land parcels, reducing entry costs and spreading risk. Both investment types benefit from long-term appreciation potential and portfolio diversification in tangible assets.

Key Terms

**Raw land investing:**

Raw land investing involves purchasing undeveloped property with the potential for future appreciation, development, or resale. Key advantages include lower entry costs, minimal maintenance, and flexibility for various uses such as agriculture, residential, or commercial projects. Explore comprehensive strategies and market insights to maximize returns in raw land investment.

Zoning

Zoning regulations are a critical factor in raw land investing, as they dictate the permissible uses of the property, impacting its development potential and resale value. Fractional real estate investments typically involve already developed properties with established zoning, reducing regulatory risks for investors. Explore detailed zoning considerations for each investment type to optimize your real estate portfolio.

Land Entitlement

Raw land investing involves purchasing undeveloped property without any zoning or permits, requiring a deep understanding of land entitlement processes to unlock its full value through approvals and infrastructure development. Fractional real estate investment offers a shared ownership model, allowing investors to benefit from entitled land assets managed by professionals, reducing individual risk and complexity. Discover how mastering land entitlement can maximize returns in both raw land and fractional real estate opportunities.

Source and External Links

Raw Land Investing - This webpage provides insights into the benefits and challenges of investing in raw land, including its simplicity, security, and long-term potential.

How to Invest in Raw Land - Offers strategic tips on maximizing profits from raw land investments, such as subdividing, developing, buying and holding, or leasing the land.

Buying Undeveloped Land - Discusses the pros and cons of purchasing undeveloped land, highlighting its potential for long-term growth but lack of immediate income.

dowidth.com

dowidth.com