Esports franchises represent a dynamic and rapidly growing sector within the entertainment industry, attracting investments fueled by skyrocketing viewership and sponsorship deals. Private equity funds, characterized by their substantial capital pools and strategic investment approaches, are increasingly targeting esports as a high-potential asset class to diversify portfolios and capitalize on market expansion. Explore how these investment vehicles differ in risk, return, and growth strategies to make informed financial decisions.

Why it is important

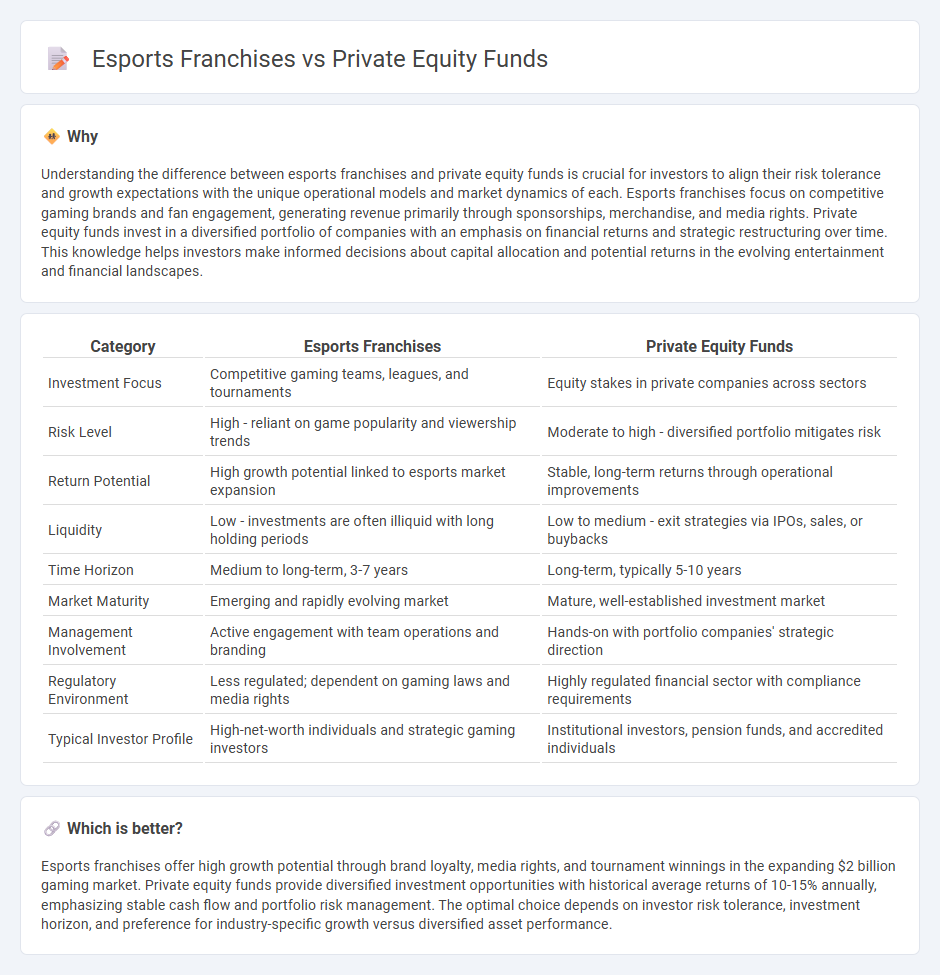

Understanding the difference between esports franchises and private equity funds is crucial for investors to align their risk tolerance and growth expectations with the unique operational models and market dynamics of each. Esports franchises focus on competitive gaming brands and fan engagement, generating revenue primarily through sponsorships, merchandise, and media rights. Private equity funds invest in a diversified portfolio of companies with an emphasis on financial returns and strategic restructuring over time. This knowledge helps investors make informed decisions about capital allocation and potential returns in the evolving entertainment and financial landscapes.

Comparison Table

| Category | Esports Franchises | Private Equity Funds |

|---|---|---|

| Investment Focus | Competitive gaming teams, leagues, and tournaments | Equity stakes in private companies across sectors |

| Risk Level | High - reliant on game popularity and viewership trends | Moderate to high - diversified portfolio mitigates risk |

| Return Potential | High growth potential linked to esports market expansion | Stable, long-term returns through operational improvements |

| Liquidity | Low - investments are often illiquid with long holding periods | Low to medium - exit strategies via IPOs, sales, or buybacks |

| Time Horizon | Medium to long-term, 3-7 years | Long-term, typically 5-10 years |

| Market Maturity | Emerging and rapidly evolving market | Mature, well-established investment market |

| Management Involvement | Active engagement with team operations and branding | Hands-on with portfolio companies' strategic direction |

| Regulatory Environment | Less regulated; dependent on gaming laws and media rights | Highly regulated financial sector with compliance requirements |

| Typical Investor Profile | High-net-worth individuals and strategic gaming investors | Institutional investors, pension funds, and accredited individuals |

Which is better?

Esports franchises offer high growth potential through brand loyalty, media rights, and tournament winnings in the expanding $2 billion gaming market. Private equity funds provide diversified investment opportunities with historical average returns of 10-15% annually, emphasizing stable cash flow and portfolio risk management. The optimal choice depends on investor risk tolerance, investment horizon, and preference for industry-specific growth versus diversified asset performance.

Connection

Esports franchises attract significant investments from private equity funds seeking high-growth opportunities in the digital entertainment sector. These funds provide capital to expand esports teams, infrastructure, and marketing, driving the industry's market valuation toward an expected $2.5 billion by 2025. Strategic investments by private equity firms enable esports franchises to scale operations, secure exclusive content rights, and monetize fan engagement through sponsorships and media deals.

Key Terms

**Private Equity Funds:**

Private equity funds specialize in acquiring significant stakes in companies, optimizing operational efficiencies, and driving long-term value creation through active management and strategic restructuring. These funds typically target mature businesses with stable cash flows, leveraging extensive financial expertise and capital resources to maximize returns. Explore detailed strategies and investment outcomes in private equity to deepen your understanding of this dynamic asset class.

Limited Partners (LPs)

Limited Partners (LPs) in private equity funds typically seek diversified, long-term returns driven by strategic acquisitions and operational improvements across various industries. In contrast, LPs investing in esports franchises often prioritize high-growth potential, brand engagement, and market expansion within the rapidly evolving digital entertainment sector. Explore detailed comparisons of LP investment strategies and risk profiles to understand their distinct approaches.

Leveraged Buyout (LBO)

Private equity funds specialize in leveraged buyouts (LBOs) by acquiring undervalued companies with significant debt, aiming to enhance operational efficiencies and maximize returns over a defined period. Esports franchises, however, are less commonly targets for LBOs due to their reliance on brand value, rapidly changing market dynamics, and less stable cash flows compared to traditional industries. Explore deeper insights into how LBO strategies could reshape the esports investment landscape.

Source and External Links

Private equity fund - A private equity fund is a collective investment vehicle, usually structured as a limited partnership with a typical life of about 10 years, raised and managed by private equity firms to invest primarily in equity securities with the goal of generating returns over time.

Private Equity Funds - Know the Different Types of PE Funds - Private equity funds pool capital from institutional and accredited investors to invest in private companies for a fixed horizon, often 4 to 7 years, with strategies including venture capital and buyout funds aimed at high growth or leveraged buyouts.

Private Equity Funds - These funds pool money from investors to invest in private businesses, often taking controlling interests to actively manage and increase value, typically over a long-term horizon of 10 or more years, though not registered publicly and limited to accredited investors.

dowidth.com

dowidth.com