Farmland funds offer investors exposure to agricultural land assets with typically lower volatility and steady income through crop yields and land appreciation, contrasting with private equity's focus on buying, managing, and exiting companies for potentially higher but less predictable returns. Farmland investments provide diversification and inflation hedging benefits, while private equity often requires longer lock-up periods and involves higher risk levels due to market and operational factors. Explore the advantages and challenges of each investment type to determine the best fit for your portfolio goals.

Why it is important

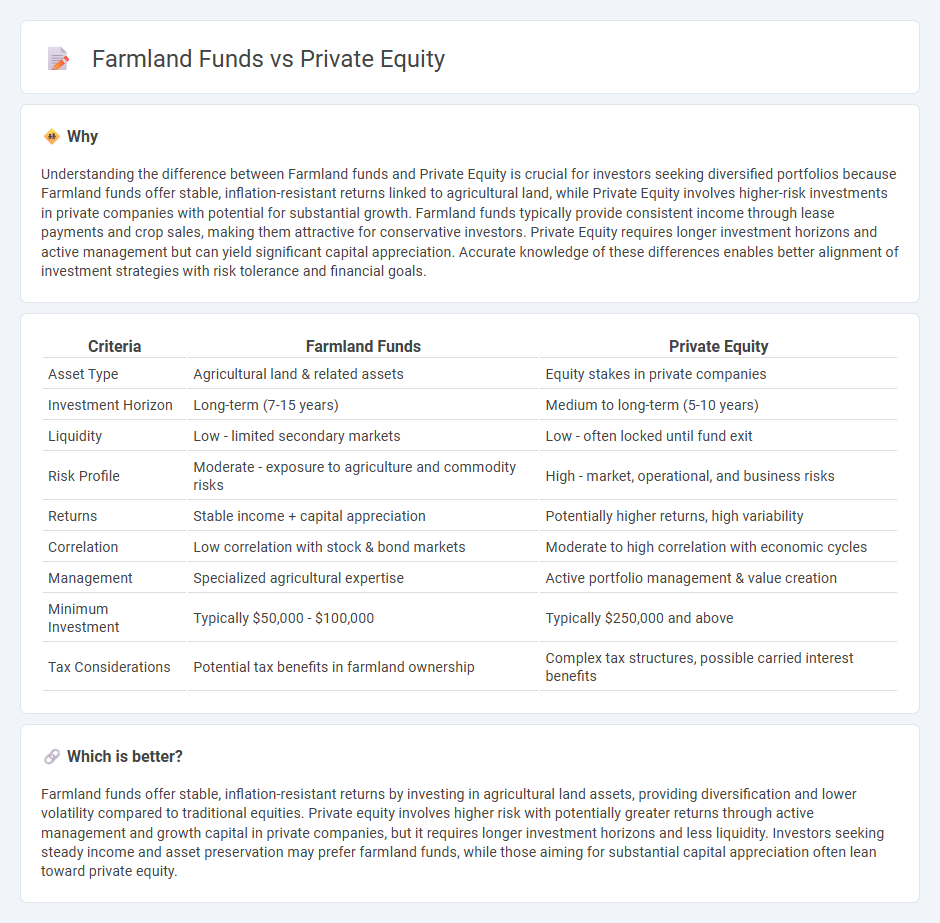

Understanding the difference between Farmland funds and Private Equity is crucial for investors seeking diversified portfolios because Farmland funds offer stable, inflation-resistant returns linked to agricultural land, while Private Equity involves higher-risk investments in private companies with potential for substantial growth. Farmland funds typically provide consistent income through lease payments and crop sales, making them attractive for conservative investors. Private Equity requires longer investment horizons and active management but can yield significant capital appreciation. Accurate knowledge of these differences enables better alignment of investment strategies with risk tolerance and financial goals.

Comparison Table

| Criteria | Farmland Funds | Private Equity |

|---|---|---|

| Asset Type | Agricultural land & related assets | Equity stakes in private companies |

| Investment Horizon | Long-term (7-15 years) | Medium to long-term (5-10 years) |

| Liquidity | Low - limited secondary markets | Low - often locked until fund exit |

| Risk Profile | Moderate - exposure to agriculture and commodity risks | High - market, operational, and business risks |

| Returns | Stable income + capital appreciation | Potentially higher returns, high variability |

| Correlation | Low correlation with stock & bond markets | Moderate to high correlation with economic cycles |

| Management | Specialized agricultural expertise | Active portfolio management & value creation |

| Minimum Investment | Typically $50,000 - $100,000 | Typically $250,000 and above |

| Tax Considerations | Potential tax benefits in farmland ownership | Complex tax structures, possible carried interest benefits |

Which is better?

Farmland funds offer stable, inflation-resistant returns by investing in agricultural land assets, providing diversification and lower volatility compared to traditional equities. Private equity involves higher risk with potentially greater returns through active management and growth capital in private companies, but it requires longer investment horizons and less liquidity. Investors seeking steady income and asset preservation may prefer farmland funds, while those aiming for substantial capital appreciation often lean toward private equity.

Connection

Farmland funds and private equity intersect as institutional investors leverage private equity structures to acquire and manage agricultural land assets for long-term returns. These funds pool capital to invest in farmland, benefiting from private equity's active management and strategic operational improvements in the agricultural sector. The integration of farmland assets within private equity portfolios offers diversification and inflation hedge, driven by rising global food demand and sustainable agriculture trends.

Key Terms

Illiquidity

Private equity and farmland funds both feature illiquidity, but private equity typically involves longer lock-up periods averaging 7 to 10 years with limited secondary market options, whereas farmland funds offer more flexible liquidity through periodic redemptions or partial sales of land assets. Illiquidity risk in farmland investment is offset by stable returns from crop production and land appreciation, contrasting with private equity's higher volatility and potential for substantial capital gains upon exit. Explore how liquidity profiles impact portfolio diversification and risk management in alternative asset classes.

Asset Diversification

Private equity funds typically invest in a broad range of industries, offering diversified exposure across sectors such as technology, healthcare, and consumer goods, which helps mitigate industry-specific risks. Farmland funds provide diversification through agricultural asset classes, offering stability and inflation hedging by investing in crop and livestock production across various geographic regions. Discover how combining these asset classes can enhance portfolio resilience and long-term growth potential.

Return Profile

Private equity funds typically target higher returns with greater risk and illiquidity, aiming for significant capital appreciation through active management and operational improvements. Farmland funds offer more stable, inflation-hedged returns driven by land value appreciation and agricultural income, with lower volatility and consistent cash flow. Explore detailed comparisons to understand which investment aligns with your risk tolerance and financial goals.

Source and External Links

Private equity - Wikipedia - Private equity involves investment in companies through equity ownership, typically pursuing value creation via revenue growth, margin expansion, debt paydown, and multiple expansion over a 4-7 year horizon by private equity firms raising capital from institutional investors and using a mix of equity and debt financing.

What is Private Equity? - BVCA - Private equity is medium-to-long-term finance exchanged for equity in mature companies, characterized by an active ownership model where private equity managers work closely with company management to drive business growth and operational improvements before exiting in 4-7 years.

Private Equity: What You Need to Know - KKR - Private equity typically invests in non-public companies aiming to generate returns through enhancing management, strategy, operations, and capital structure, providing diversification benefits amid a shrinking public company universe.

dowidth.com

dowidth.com