Music royalties generate ongoing income by rewarding artists for the use and distribution of their work, providing a passive revenue stream tied to licensing, streaming, and sales performance. Crowdfunding involves raising capital directly from fans or investors, allowing artists to finance projects upfront in exchange for rewards or future earnings. Discover how these investment strategies differ in risk, return, and engagement by exploring their unique benefits and challenges.

Why it is important

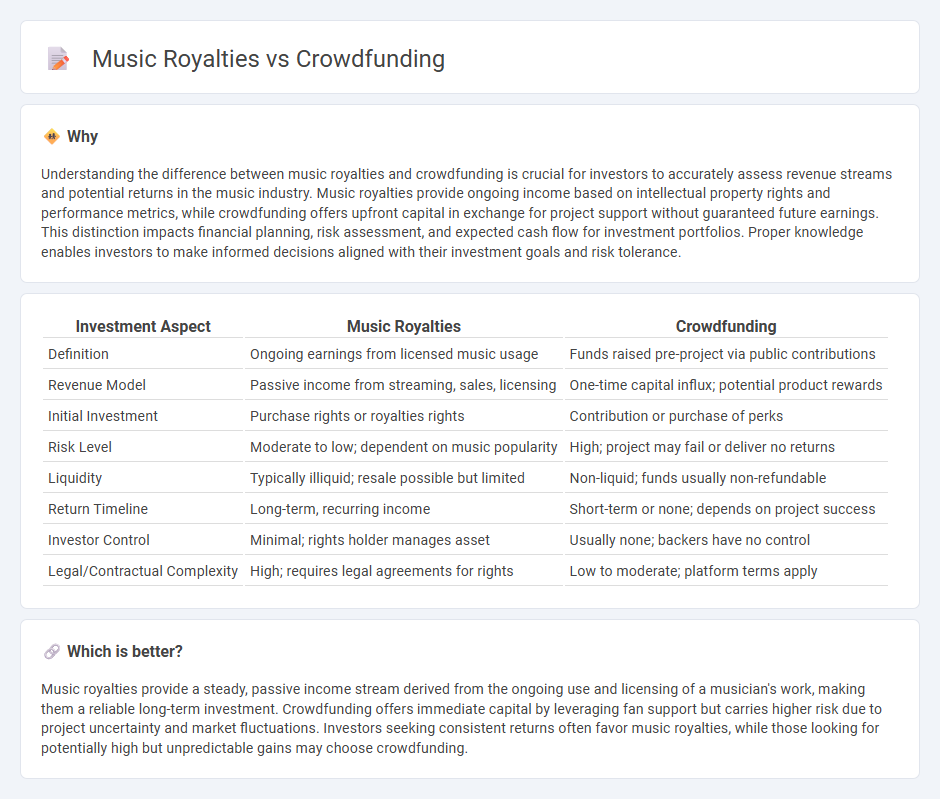

Understanding the difference between music royalties and crowdfunding is crucial for investors to accurately assess revenue streams and potential returns in the music industry. Music royalties provide ongoing income based on intellectual property rights and performance metrics, while crowdfunding offers upfront capital in exchange for project support without guaranteed future earnings. This distinction impacts financial planning, risk assessment, and expected cash flow for investment portfolios. Proper knowledge enables investors to make informed decisions aligned with their investment goals and risk tolerance.

Comparison Table

| Investment Aspect | Music Royalties | Crowdfunding |

|---|---|---|

| Definition | Ongoing earnings from licensed music usage | Funds raised pre-project via public contributions |

| Revenue Model | Passive income from streaming, sales, licensing | One-time capital influx; potential product rewards |

| Initial Investment | Purchase rights or royalties rights | Contribution or purchase of perks |

| Risk Level | Moderate to low; dependent on music popularity | High; project may fail or deliver no returns |

| Liquidity | Typically illiquid; resale possible but limited | Non-liquid; funds usually non-refundable |

| Return Timeline | Long-term, recurring income | Short-term or none; depends on project success |

| Investor Control | Minimal; rights holder manages asset | Usually none; backers have no control |

| Legal/Contractual Complexity | High; requires legal agreements for rights | Low to moderate; platform terms apply |

Which is better?

Music royalties provide a steady, passive income stream derived from the ongoing use and licensing of a musician's work, making them a reliable long-term investment. Crowdfunding offers immediate capital by leveraging fan support but carries higher risk due to project uncertainty and market fluctuations. Investors seeking consistent returns often favor music royalties, while those looking for potentially high but unpredictable gains may choose crowdfunding.

Connection

Music royalties provide artists with ongoing revenue streams from their creative work, creating valuable assets that can attract investment. Crowdfunding platforms enable musicians to raise capital by pre-selling future royalty rights or projects, directly engaging fans as investors. This synergy between royalties and crowdfunding enhances financial access and diversifies income sources within the music industry.

Key Terms

Equity

Equity crowdfunding offers musicians a way to raise capital by selling shares of their career or project, providing investors with ownership stakes and potential profits from future earnings. Music royalties generate income based on the performance, sales, or usage of a song, but do not grant any ownership interest in the artist's work or rights. Explore more about how equity crowdfunding can transform artist financing and investment opportunities.

Royalty Streams

Royalty Streams offers a unique alternative to crowdfunding by allowing music creators and investors to share direct income from music royalties, providing continuous earnings rather than one-time funding. Platforms like Royalty Streams facilitate transparent transactions and immediate royalty payments from global streaming services, boosting financial stability for artists. Explore how Royalty Streams can transform your approach to music investment and income generation.

Platform Fees

Platform fees on crowdfunding sites typically range from 5% to 12%, significantly impacting the net funds musicians receive. Music royalty platforms often charge lower fees, around 1% to 5%, preserving a larger share of earnings for artists. Explore detailed comparisons of platform fees to optimize your music funding strategy.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, involving a project initiator, supporters, and a platform connecting them, with over $34 billion raised worldwide in 2015.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding is a way of raising money to finance projects and businesses through collective efforts of individuals online, providing startups an alternative to traditional financing methods.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts of money from many individuals and includes models such as donation-based, rewards-based, and equity-based crowdfunding for various funding needs.

dowidth.com

dowidth.com