Investment in the space economy is rapidly expanding, driven by advancements in satellite technology, space exploration, and infrastructure development, attracting billions in venture capital annually. Artificial intelligence investment continues to surge with applications in machine learning, automation, and data analytics transforming industries and generating substantial economic value. Explore the unique opportunities and challenges of these two cutting-edge sectors to optimize your investment strategy.

Why it is important

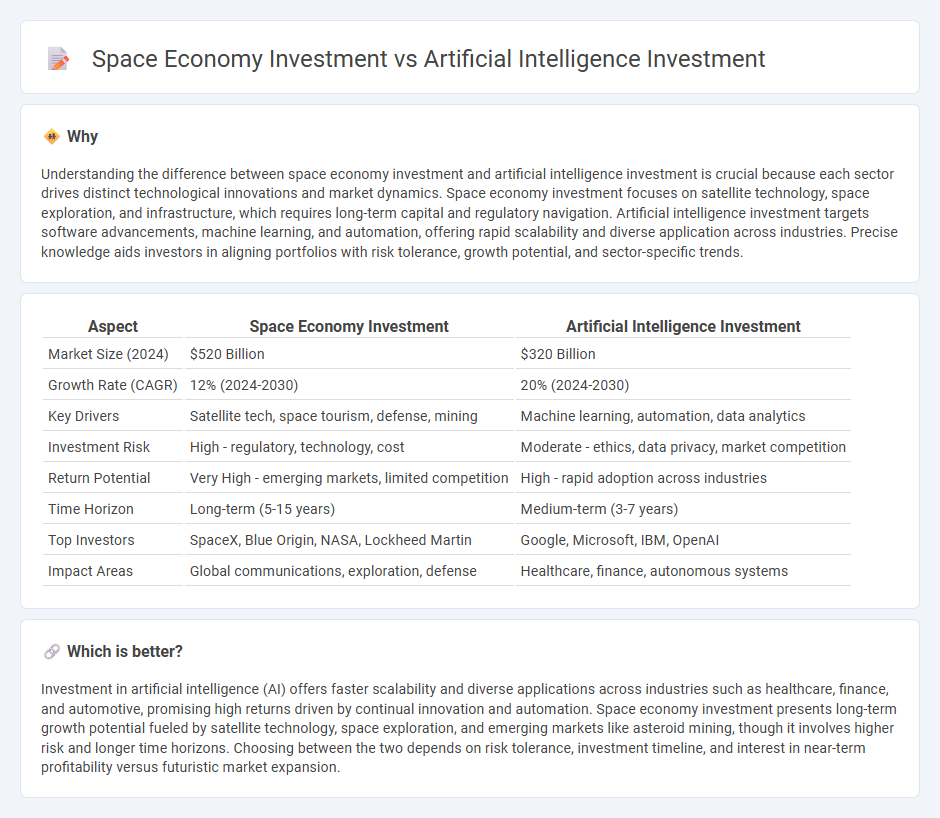

Understanding the difference between space economy investment and artificial intelligence investment is crucial because each sector drives distinct technological innovations and market dynamics. Space economy investment focuses on satellite technology, space exploration, and infrastructure, which requires long-term capital and regulatory navigation. Artificial intelligence investment targets software advancements, machine learning, and automation, offering rapid scalability and diverse application across industries. Precise knowledge aids investors in aligning portfolios with risk tolerance, growth potential, and sector-specific trends.

Comparison Table

| Aspect | Space Economy Investment | Artificial Intelligence Investment |

|---|---|---|

| Market Size (2024) | $520 Billion | $320 Billion |

| Growth Rate (CAGR) | 12% (2024-2030) | 20% (2024-2030) |

| Key Drivers | Satellite tech, space tourism, defense, mining | Machine learning, automation, data analytics |

| Investment Risk | High - regulatory, technology, cost | Moderate - ethics, data privacy, market competition |

| Return Potential | Very High - emerging markets, limited competition | High - rapid adoption across industries |

| Time Horizon | Long-term (5-15 years) | Medium-term (3-7 years) |

| Top Investors | SpaceX, Blue Origin, NASA, Lockheed Martin | Google, Microsoft, IBM, OpenAI |

| Impact Areas | Global communications, exploration, defense | Healthcare, finance, autonomous systems |

Which is better?

Investment in artificial intelligence (AI) offers faster scalability and diverse applications across industries such as healthcare, finance, and automotive, promising high returns driven by continual innovation and automation. Space economy investment presents long-term growth potential fueled by satellite technology, space exploration, and emerging markets like asteroid mining, though it involves higher risk and longer time horizons. Choosing between the two depends on risk tolerance, investment timeline, and interest in near-term profitability versus futuristic market expansion.

Connection

Investments in the space economy and artificial intelligence (AI) are interconnected through the enhancement of satellite data analysis and autonomous spacecraft operations. AI technologies optimize resource allocation, predictive maintenance, and real-time decision-making for space missions, increasing operational efficiency. The convergence of these sectors drives innovation, enabling advanced exploration, data-driven insights, and growth in both industries.

Key Terms

Artificial Intelligence Investment:

Artificial Intelligence investment is rapidly accelerating, with global funding exceeding $150 billion in 2023, driven by advancements in machine learning, natural language processing, and computer vision technologies. Leading sectors attracting AI investments include healthcare, automotive, and finance, where AI improves diagnostics, autonomous driving, and risk assessment. Explore how AI investment trends are reshaping industries and creating unprecedented opportunities worldwide.

Machine Learning Algorithms

Investment in artificial intelligence, particularly in machine learning algorithms, has surged due to their transformative impact on data analysis, automation, and predictive modeling across industries. The space economy investment focuses on satellite technology, space exploration, and related infrastructure with long-term strategic and scientific benefits. Explore in-depth comparisons and emerging trends to understand where opportunities and innovations intersect.

Data Infrastructure

Artificial intelligence investment increasingly targets data infrastructure, emphasizing scalable storage, high-speed processing, and secure data management to optimize machine learning capabilities. In contrast, space economy investment allocates significant resources to data infrastructure supporting satellite communication networks, space-based sensors, and real-time analytics for Earth observation. Explore deeper insights into how data infrastructure shapes these evolving investment sectors.

Source and External Links

Investment companies can use AI responsibly to gain an edge - AI is transforming investment decision-making by enabling richer insights across deal sourcing, due diligence, and risk analysis, with 93% of private equity firms expecting moderate to substantial AI benefits within five years.

Investing in AI: What you should know - Edward Jones - Key AI investment areas include infrastructure like advanced chips and cloud service providers, but investing in AI requires significant computing power, talent, and managing high associated costs and ethical considerations.

7 AI Stocks We're Keeping Our Eye On In July 2025 - NerdWallet - Investors can gain AI exposure through individual stocks or ETFs focused on AI-related companies, with ETFs offering diversified and typically lower-risk ways to invest in AI innovation.

dowidth.com

dowidth.com