Royalty streams provide investors with a percentage of revenue from intellectual property or natural resources, offering potential for passive income tied to asset performance unlike bonds, which are debt instruments with fixed interest payments and maturity dates. Bonds tend to be less volatile and offer predictable returns, while royalty streams can vary based on the success of the underlying asset. Explore the nuances of these investment options to determine which aligns best with your financial goals.

Why it is important

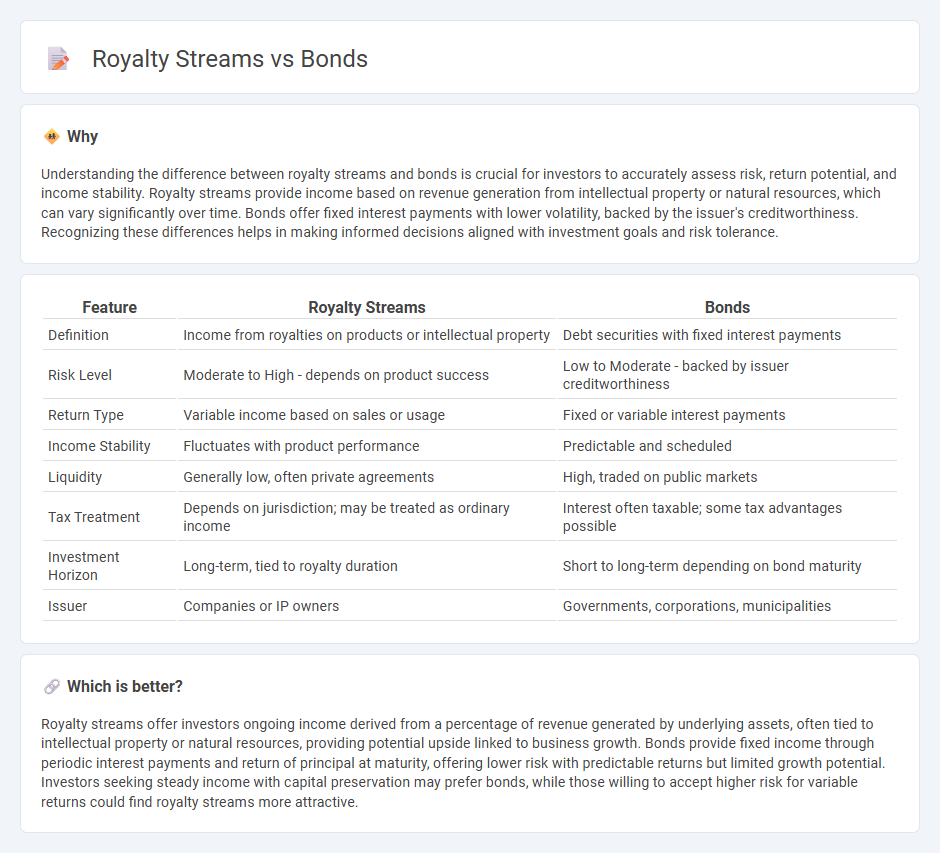

Understanding the difference between royalty streams and bonds is crucial for investors to accurately assess risk, return potential, and income stability. Royalty streams provide income based on revenue generation from intellectual property or natural resources, which can vary significantly over time. Bonds offer fixed interest payments with lower volatility, backed by the issuer's creditworthiness. Recognizing these differences helps in making informed decisions aligned with investment goals and risk tolerance.

Comparison Table

| Feature | Royalty Streams | Bonds |

|---|---|---|

| Definition | Income from royalties on products or intellectual property | Debt securities with fixed interest payments |

| Risk Level | Moderate to High - depends on product success | Low to Moderate - backed by issuer creditworthiness |

| Return Type | Variable income based on sales or usage | Fixed or variable interest payments |

| Income Stability | Fluctuates with product performance | Predictable and scheduled |

| Liquidity | Generally low, often private agreements | High, traded on public markets |

| Tax Treatment | Depends on jurisdiction; may be treated as ordinary income | Interest often taxable; some tax advantages possible |

| Investment Horizon | Long-term, tied to royalty duration | Short to long-term depending on bond maturity |

| Issuer | Companies or IP owners | Governments, corporations, municipalities |

Which is better?

Royalty streams offer investors ongoing income derived from a percentage of revenue generated by underlying assets, often tied to intellectual property or natural resources, providing potential upside linked to business growth. Bonds provide fixed income through periodic interest payments and return of principal at maturity, offering lower risk with predictable returns but limited growth potential. Investors seeking steady income with capital preservation may prefer bonds, while those willing to accept higher risk for variable returns could find royalty streams more attractive.

Connection

Royalty streams generate consistent cash flow from intellectual property or natural resources, making them attractive investment assets with predictable returns. Bonds are debt securities offering fixed interest payments, often backed by reliable income sources like royalty streams to enhance creditworthiness. Combining royalty streams with bonds enables issuers to secure funding while providing investors stable, risk-mitigated income through structured debt instruments.

Key Terms

Fixed Income

Bonds offer investors fixed income through regular interest payments and principal repayment at maturity, providing predictable cash flows and lower risk. Royalty streams generate income based on revenue or sales performance, often linked to intellectual property or natural resources, which can yield higher returns but with increased variability. Explore detailed comparisons to determine which fixed income investment aligns best with your financial goals.

Residual Payments

Bonds provide fixed interest payments based on principal amounts, while royalty streams offer residual payments tied to ongoing revenue from intellectual property or natural resources. Residual payments from royalty streams can vary with the success of underlying assets, enabling potential long-term income growth. Explore how these financial instruments compare in generating steady versus variable residual payments.

Yield

Bonds typically offer fixed yields based on interest payments, providing predictable income streams with lower risk profiles, while royalty streams yield variable returns tied directly to the revenue generated by underlying assets, often resulting in higher potential gains with increased risk. Investors seeking stable, consistent yield may prefer bonds, whereas those aiming for growth and income diversification might find royalty streams more attractive. Explore more about yield optimization strategies to determine the best fit for your investment portfolio.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities where investors lend money to issuers like governments or corporations, who pay interest and repay principal at maturity, providing predictable income and capital preservation.

Bond (finance) - Wikipedia - Bonds serve as loans for long-term investments with generally lower volatility than stocks, offering fixed interest payments and legal protection in bankruptcy, and are often held by institutions to match liabilities.

What is a Bond and How do they Work? - Vanguard - Bonds are loans to issuers who pay fixed interest periodically and repay face value at maturity, providing income and helping reduce portfolio volatility without conferring ownership like stocks.

dowidth.com

dowidth.com