Social token investments focus on community engagement and personal brand value, allowing creators to monetize influence through blockchain-based tokens. Security token investments represent ownership in real-world assets or financial instruments, regulated to ensure compliance and investor protection. Explore the differences and benefits of social token versus security token investment strategies.

Why it is important

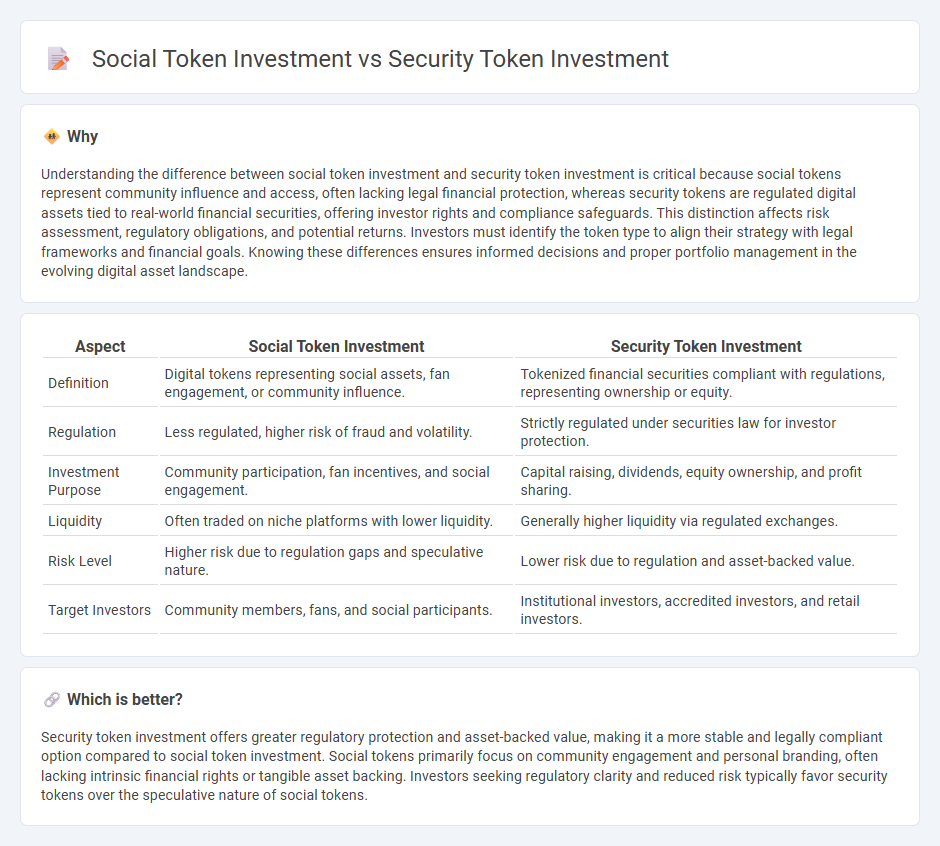

Understanding the difference between social token investment and security token investment is critical because social tokens represent community influence and access, often lacking legal financial protection, whereas security tokens are regulated digital assets tied to real-world financial securities, offering investor rights and compliance safeguards. This distinction affects risk assessment, regulatory obligations, and potential returns. Investors must identify the token type to align their strategy with legal frameworks and financial goals. Knowing these differences ensures informed decisions and proper portfolio management in the evolving digital asset landscape.

Comparison Table

| Aspect | Social Token Investment | Security Token Investment |

|---|---|---|

| Definition | Digital tokens representing social assets, fan engagement, or community influence. | Tokenized financial securities compliant with regulations, representing ownership or equity. |

| Regulation | Less regulated, higher risk of fraud and volatility. | Strictly regulated under securities law for investor protection. |

| Investment Purpose | Community participation, fan incentives, and social engagement. | Capital raising, dividends, equity ownership, and profit sharing. |

| Liquidity | Often traded on niche platforms with lower liquidity. | Generally higher liquidity via regulated exchanges. |

| Risk Level | Higher risk due to regulation gaps and speculative nature. | Lower risk due to regulation and asset-backed value. |

| Target Investors | Community members, fans, and social participants. | Institutional investors, accredited investors, and retail investors. |

Which is better?

Security token investment offers greater regulatory protection and asset-backed value, making it a more stable and legally compliant option compared to social token investment. Social tokens primarily focus on community engagement and personal branding, often lacking intrinsic financial rights or tangible asset backing. Investors seeking regulatory clarity and reduced risk typically favor security tokens over the speculative nature of social tokens.

Connection

Social token investment and security token investment intersect through blockchain technology, enabling fractional ownership and enhanced liquidity in digital and real-world assets. Social tokens often represent community influence or brand engagement, while security tokens are regulated digital securities compliant with financial laws. Both investment types leverage tokenization to democratize access, streamline transactions, and attract diverse investors in evolving markets.

Key Terms

**Security token investment:**

Security token investment involves purchasing digital assets backed by real-world securities such as stocks, bonds, or real estate, providing investors with regulated ownership rights and potential dividends. These tokens operate on blockchain technology, ensuring transparency, liquidity, and enhanced security through smart contracts. Explore the benefits and risks of security token investments to make informed financial decisions.

Regulatory compliance

Security token investments adhere to strict regulatory frameworks established by agencies like the SEC, ensuring compliance with securities laws and investor protections. Social tokens, often issued on decentralized platforms, face fewer regulations but carry higher risks due to lack of standardized oversight and potential legal ambiguities. Explore detailed regulatory comparisons and risk assessments for both investment types to make informed decisions.

Asset-backed

Security token investments are asset-backed digital securities representing ownership in real-world assets such as real estate, equity, or commodities, providing regulatory compliance and investor protection. Social tokens, in contrast, typically represent community membership or creator interaction but lack intrinsic asset backing, which can impact their valuation stability and risk profile. Explore deeper insights on how asset-backed security tokens can transform investment strategies.

Source and External Links

Security token offering - Wikipedia - A security token offering (STO) involves selling tokenized digital securities on blockchain-based exchanges, offering a regulated, secure investment alternative to ICOs with the potential to trade real financial assets efficiently.

What is a security token offering (STO)? - Hedera - A security token represents a stake in an external asset on the blockchain, enabling new investment possibilities such as selling dividend portions or voting rights, though the infrastructure remains relatively nascent.

Complete Guide to Security Tokens (2025) - Tokenist - Security tokens typically represent company shares and offer institutional investors a regulated, blockchain-based investment vehicle combining traditional market security with crypto speed and flexibility.

dowidth.com

dowidth.com