Fractional farmland ownership enables investors to directly hold a share of agricultural land, offering tangible asset control and potential income from crop yields. Farmland investment funds aggregate capital from multiple investors to purchase and manage farmland professionally, providing diversified exposure without the need for hands-on involvement. Discover the benefits and differences between these models to identify the best farmland investment strategy for your portfolio.

Why it is important

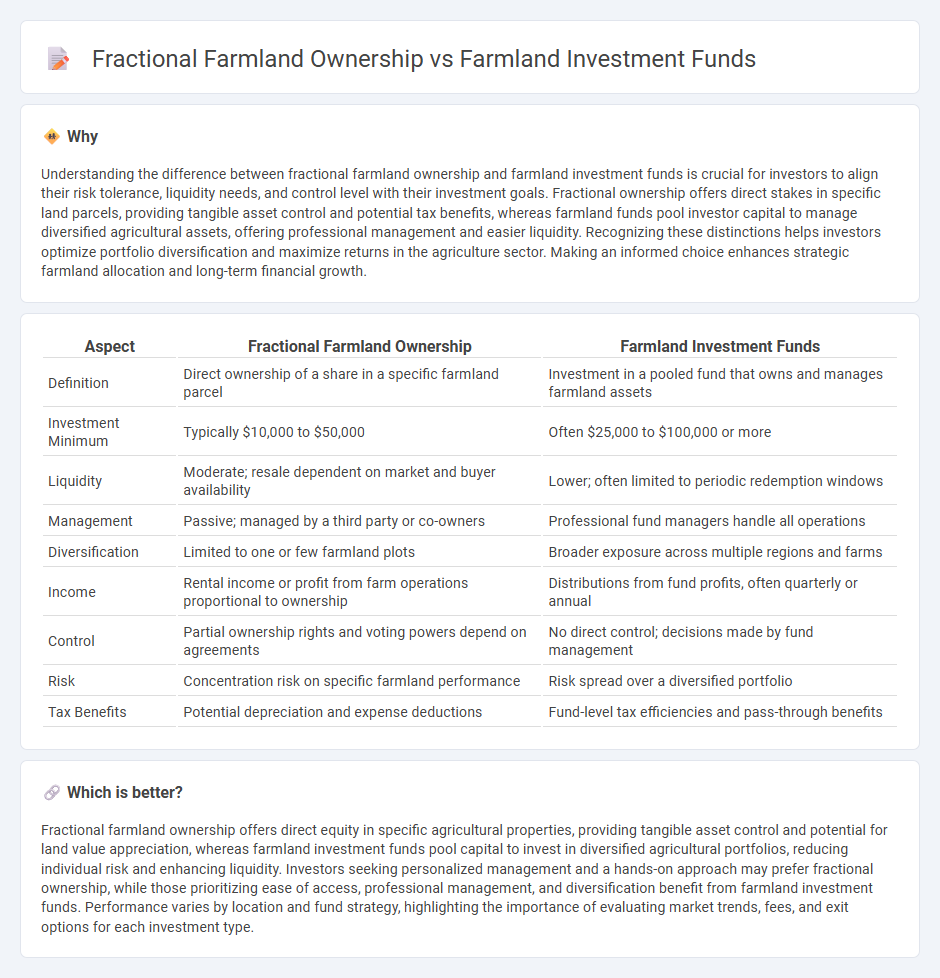

Understanding the difference between fractional farmland ownership and farmland investment funds is crucial for investors to align their risk tolerance, liquidity needs, and control level with their investment goals. Fractional ownership offers direct stakes in specific land parcels, providing tangible asset control and potential tax benefits, whereas farmland funds pool investor capital to manage diversified agricultural assets, offering professional management and easier liquidity. Recognizing these distinctions helps investors optimize portfolio diversification and maximize returns in the agriculture sector. Making an informed choice enhances strategic farmland allocation and long-term financial growth.

Comparison Table

| Aspect | Fractional Farmland Ownership | Farmland Investment Funds |

|---|---|---|

| Definition | Direct ownership of a share in a specific farmland parcel | Investment in a pooled fund that owns and manages farmland assets |

| Investment Minimum | Typically $10,000 to $50,000 | Often $25,000 to $100,000 or more |

| Liquidity | Moderate; resale dependent on market and buyer availability | Lower; often limited to periodic redemption windows |

| Management | Passive; managed by a third party or co-owners | Professional fund managers handle all operations |

| Diversification | Limited to one or few farmland plots | Broader exposure across multiple regions and farms |

| Income | Rental income or profit from farm operations proportional to ownership | Distributions from fund profits, often quarterly or annual |

| Control | Partial ownership rights and voting powers depend on agreements | No direct control; decisions made by fund management |

| Risk | Concentration risk on specific farmland performance | Risk spread over a diversified portfolio |

| Tax Benefits | Potential depreciation and expense deductions | Fund-level tax efficiencies and pass-through benefits |

Which is better?

Fractional farmland ownership offers direct equity in specific agricultural properties, providing tangible asset control and potential for land value appreciation, whereas farmland investment funds pool capital to invest in diversified agricultural portfolios, reducing individual risk and enhancing liquidity. Investors seeking personalized management and a hands-on approach may prefer fractional ownership, while those prioritizing ease of access, professional management, and diversification benefit from farmland investment funds. Performance varies by location and fund strategy, highlighting the importance of evaluating market trends, fees, and exit options for each investment type.

Connection

Fractional farmland ownership allows multiple investors to own a portion of agricultural land, enabling diversified exposure to the farmland asset class without the need for full property acquisition. Farmland investment funds pool capital from numerous investors to purchase and manage farmland, often structuring ownership into fractional shares to enhance liquidity and accessibility. This connection facilitates scalable investment strategies, risk dispersion, and broader participation in the agricultural real estate market.

Key Terms

Farmland Investment Funds:

Farmland investment funds pool capital from multiple investors to acquire and manage large agricultural properties, offering diversification and professional asset management with minimal direct involvement. These funds provide liquidity through structured exit options and typically target institutional and sophisticated investors seeking long-term stable returns tied to agricultural land appreciation and income generation. Explore how farmland investment funds can fit your portfolio and optimize agricultural asset exposure.

Pooled Capital

Pooled capital in farmland investment funds aggregates resources from multiple investors, enabling large-scale agricultural asset acquisition and professional management, while fractional farmland ownership allows investors to own specific land portions directly, offering more tangible asset control but often less liquidity. Farmland investment funds benefit from economies of scale and diversification across regions and crops, enhancing risk mitigation compared to the concentrated risk profile typical in fractional ownership. Explore detailed comparisons and investment strategies to determine which pooled capital approach aligns best with your financial goals.

Professional Management

Farmland investment funds provide investors with professional management, leveraging expert agronomists and asset managers to optimize crop yields and land value, ensuring efficient operations and risk mitigation. Fractional farmland ownership allows individuals to directly own portions of farmland but often lacks the comprehensive professional oversight found in investment funds, potentially increasing management burdens and operational risks. Explore the benefits and differences between these investment approaches to determine which aligns best with your financial goals.

Source and External Links

Farmland Investment Fund: 7 Powerful Trends Shaping 2025 - Global farmland investment funds are projected to reach $60 billion in 2025, with farmland investments averaging 11% annual returns over the past decade, driven by trends in agriculture and forestry capital flows.

FarmTogether - Invest in US Farmland - Offers fractional farmland ownership for accredited investors with historically attractive risk-adjusted returns, low volatility, inflation hedging, and access to professionally managed US farmland assets.

Investing in farmland | Nuveen - Institutional investors find farmland appealing for diversification, inflation protection, and resilient returns with investment strategies spanning domestic and global agricultural assets including row crops and permanent crops.

dowidth.com

dowidth.com