Vintage sneaker portfolios capitalize on the booming resale market driven by limited releases and cultural trends, delivering high liquidity and rapid appreciation potential compared to traditional asset classes. Fine art collections offer long-term value growth, historical significance, and diversification benefits, often serving as hedge assets during market volatility. Explore the unique advantages and risks associated with each investment to determine the best fit for your portfolio.

Why it is important

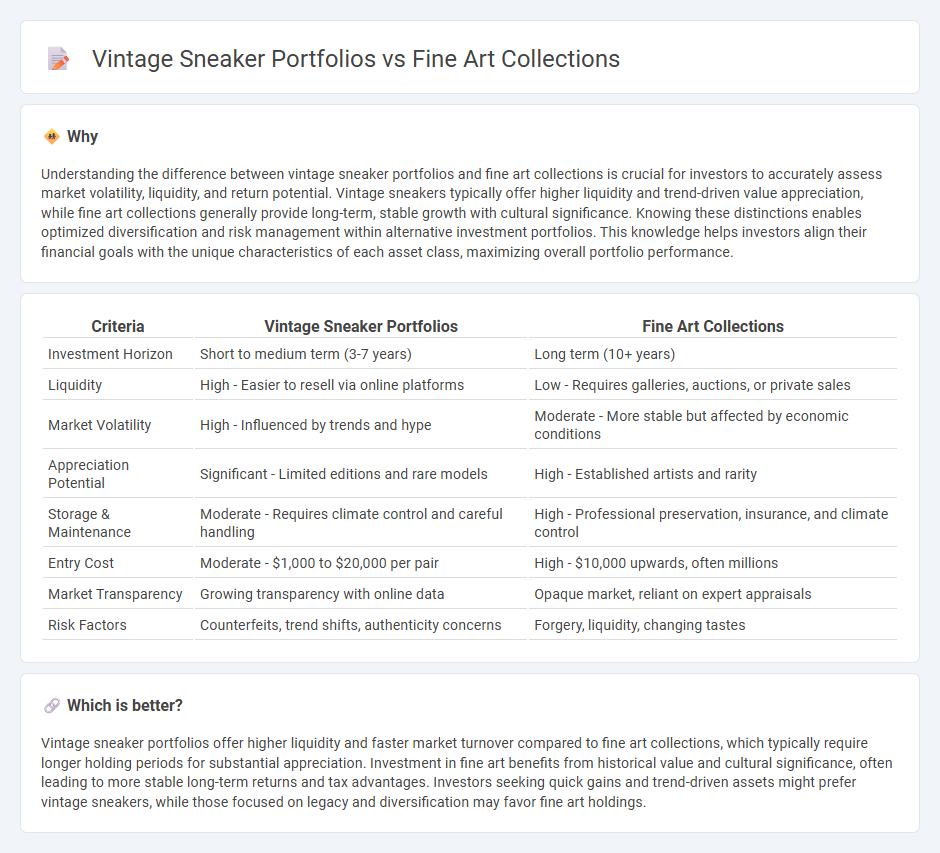

Understanding the difference between vintage sneaker portfolios and fine art collections is crucial for investors to accurately assess market volatility, liquidity, and return potential. Vintage sneakers typically offer higher liquidity and trend-driven value appreciation, while fine art collections generally provide long-term, stable growth with cultural significance. Knowing these distinctions enables optimized diversification and risk management within alternative investment portfolios. This knowledge helps investors align their financial goals with the unique characteristics of each asset class, maximizing overall portfolio performance.

Comparison Table

| Criteria | Vintage Sneaker Portfolios | Fine Art Collections |

|---|---|---|

| Investment Horizon | Short to medium term (3-7 years) | Long term (10+ years) |

| Liquidity | High - Easier to resell via online platforms | Low - Requires galleries, auctions, or private sales |

| Market Volatility | High - Influenced by trends and hype | Moderate - More stable but affected by economic conditions |

| Appreciation Potential | Significant - Limited editions and rare models | High - Established artists and rarity |

| Storage & Maintenance | Moderate - Requires climate control and careful handling | High - Professional preservation, insurance, and climate control |

| Entry Cost | Moderate - $1,000 to $20,000 per pair | High - $10,000 upwards, often millions |

| Market Transparency | Growing transparency with online data | Opaque market, reliant on expert appraisals |

| Risk Factors | Counterfeits, trend shifts, authenticity concerns | Forgery, liquidity, changing tastes |

Which is better?

Vintage sneaker portfolios offer higher liquidity and faster market turnover compared to fine art collections, which typically require longer holding periods for substantial appreciation. Investment in fine art benefits from historical value and cultural significance, often leading to more stable long-term returns and tax advantages. Investors seeking quick gains and trend-driven assets might prefer vintage sneakers, while those focused on legacy and diversification may favor fine art holdings.

Connection

Vintage sneaker portfolios and fine art collections both serve as alternative investment assets that appreciate in value over time due to rarity, cultural significance, and market demand. Investors leverage provenance, condition, and exclusivity to drive market value in each category, creating diversified portfolios beyond traditional equities. The convergence of fashion and art markets highlights shifting consumer behavior toward tangible, collectible assets with high liquidity potential.

Key Terms

Provenance

Provenance plays a critical role in establishing value for both fine art collections and vintage sneaker portfolios, as it verifies authenticity and historical significance. Fine art relies on documented ownership history and expert certifications, while vintage sneakers emphasize limited edition releases, original packaging, and wear patterns linked to notable figures. Explore the nuances of provenance to understand how it shapes investment potential in these distinct but increasingly intersecting markets.

Market Liquidity

Fine art collections often face lower market liquidity due to lengthy authentication processes and niche buyer markets, whereas vintage sneaker portfolios benefit from higher liquidity through faster sales and wider online marketplaces. The vintage sneaker market's dynamic pricing and frequent trend fluctuations foster quicker turnover compared to the typically slower, valuation-driven art market. Explore more about how liquidity impacts investment strategies in these two asset classes.

Authentication

Authentication in fine art collections relies heavily on expert provenance verification, scientific analysis, and certificates of authenticity to establish originality and value. Vintage sneaker portfolios use detailed examination of materials, stitching patterns, and serial numbers alongside blockchain and RFID technology to ensure genuine status. Explore the evolving methods and technologies that secure these valuable investments.

Source and External Links

Collections | Museum of Fine Arts Boston - The Museum of Fine Arts Boston houses one of the most comprehensive fine art collections globally, with nearly 500,000 works of art covering diverse cultures and periods.

The Met Collection - The Metropolitan Museum of Art - The Metropolitan Museum of Art offers an extensive collection of over 490,000 fine art objects spanning 5,000 years, including ancient, medieval, modern, and contemporary art.

Collections - Google Arts & Culture - Google Arts & Culture provides access to fine art collections from hundreds of world-renowned museums such as MoMA, Musee d'Orsay, Tate Britain, and others, offering a diverse exploration of global art heritage.

dowidth.com

dowidth.com