Royalty streams generate passive income by earning a percentage of revenue from intellectual property or natural resources, offering consistent cash flow with lower risk compared to traditional equity investments. Angel investing involves providing capital to early-stage startups in exchange for equity, presenting higher potential returns but with increased risk and longer exit timelines. Explore the differences between these investment strategies to determine which best aligns with your financial goals.

Why it is important

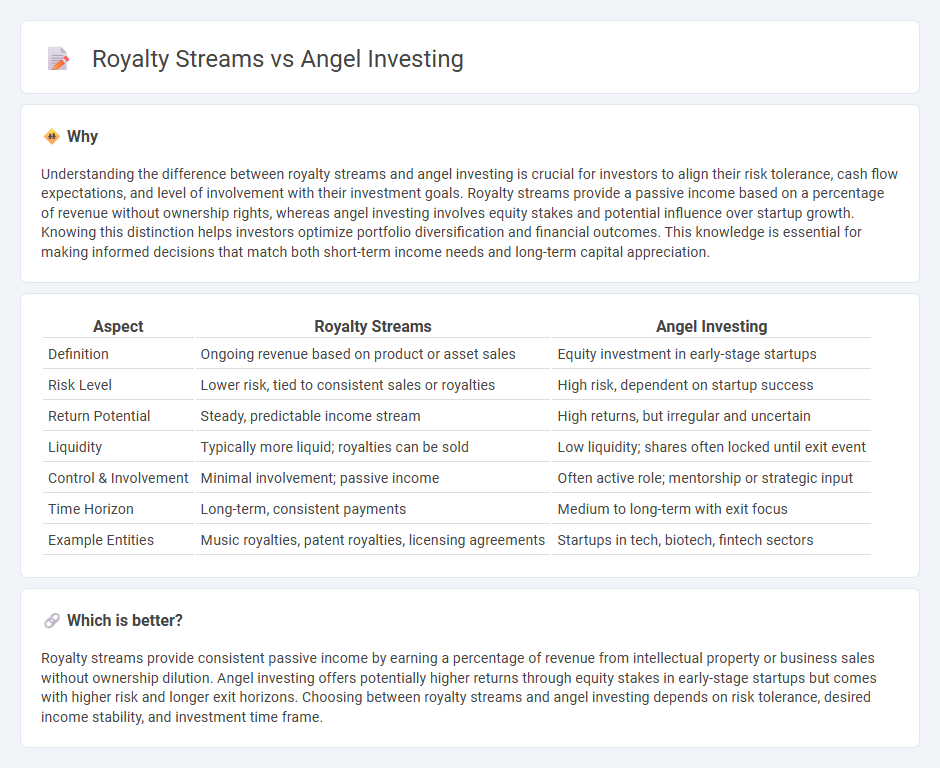

Understanding the difference between royalty streams and angel investing is crucial for investors to align their risk tolerance, cash flow expectations, and level of involvement with their investment goals. Royalty streams provide a passive income based on a percentage of revenue without ownership rights, whereas angel investing involves equity stakes and potential influence over startup growth. Knowing this distinction helps investors optimize portfolio diversification and financial outcomes. This knowledge is essential for making informed decisions that match both short-term income needs and long-term capital appreciation.

Comparison Table

| Aspect | Royalty Streams | Angel Investing |

|---|---|---|

| Definition | Ongoing revenue based on product or asset sales | Equity investment in early-stage startups |

| Risk Level | Lower risk, tied to consistent sales or royalties | High risk, dependent on startup success |

| Return Potential | Steady, predictable income stream | High returns, but irregular and uncertain |

| Liquidity | Typically more liquid; royalties can be sold | Low liquidity; shares often locked until exit event |

| Control & Involvement | Minimal involvement; passive income | Often active role; mentorship or strategic input |

| Time Horizon | Long-term, consistent payments | Medium to long-term with exit focus |

| Example Entities | Music royalties, patent royalties, licensing agreements | Startups in tech, biotech, fintech sectors |

Which is better?

Royalty streams provide consistent passive income by earning a percentage of revenue from intellectual property or business sales without ownership dilution. Angel investing offers potentially higher returns through equity stakes in early-stage startups but comes with higher risk and longer exit horizons. Choosing between royalty streams and angel investing depends on risk tolerance, desired income stability, and investment time frame.

Connection

Royalty streams provide ongoing passive income by allowing investors to earn a percentage of revenue generated from intellectual property or product sales, aligning closely with angel investing, where early-stage capital is infused into startups with high growth potential. Angel investors often seek ventures offering royalty agreements to mitigate risk and secure continuous returns, blending equity stakes with revenue-based financing. This hybrid investment strategy leverages the scalability of royalty streams and the capital appreciation potential typical of angel investments.

Key Terms

Equity Ownership

Angel investing involves acquiring equity ownership by providing early-stage capital to startups, granting investors voting rights and potential capital gains. Royalty streams generate revenue through a percentage of sales or profits without equity, offering steady cash flow but no ownership control. Explore the advantages and risks of equity ownership and royalty income to make informed investment decisions.

Passive Income

Angel investing offers potential equity growth by funding early-stage startups, often requiring higher risk tolerance and longer time horizons, while royalty streams provide consistent passive income through a share of revenue from intellectual property or natural resources. Royalty streams typically generate predictable cash flow with minimal active management, making them attractive for investors seeking steady income without ongoing business involvement. Explore how these strategies compare to find the best path for your passive income goals.

Exit Strategy

Angel investing typically involves purchasing equity in early-stage startups with the goal of a profitable exit via acquisition or IPO, offering potentially high returns but higher risks and longer time horizons. Royalty streams provide investors with a share of ongoing revenue generated by a company or product, delivering steady cash flow without the need for an exit event but often with capped upside. Explore detailed strategies and risk profiles to determine which investment aligns best with your financial goals.

Source and External Links

Understanding Angel Financing and Investing - This article explains the role of angel investors in providing early-stage funding to startups by exchanging money for equity or convertible debt.

Angel Investors - This resource details how angel investors, as wealthy private individuals, invest in small businesses in exchange for equity and often provide smaller amounts with a longer investment horizon.

Angel Investor - This Wikipedia page describes angel investors as individuals who provide capital to early-stage businesses in exchange for equity, often bringing industry experience and mentorship to the ventures.

dowidth.com

dowidth.com