Sneaker flipping and sports card investing offer unique opportunities for capital growth by leveraging niche markets with passionate collectors. Both require market knowledge, timing, and an understanding of rarity and demand to maximize returns. Explore the key differences and strategies to decide which investment aligns best with your financial goals.

Why it is important

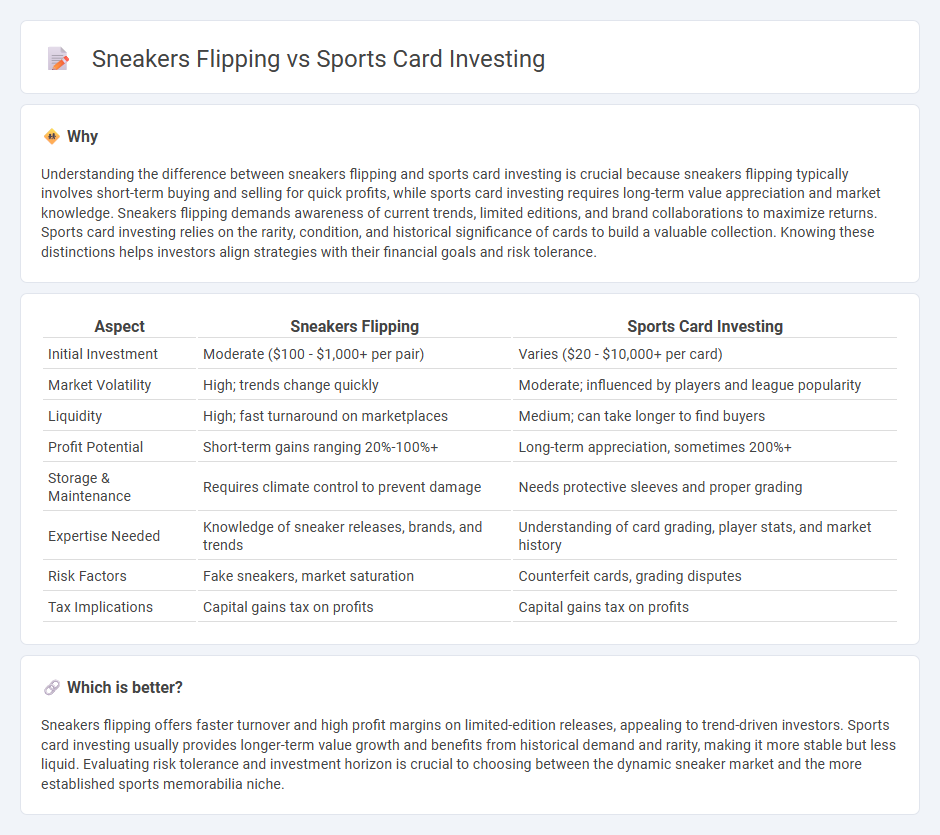

Understanding the difference between sneakers flipping and sports card investing is crucial because sneakers flipping typically involves short-term buying and selling for quick profits, while sports card investing requires long-term value appreciation and market knowledge. Sneakers flipping demands awareness of current trends, limited editions, and brand collaborations to maximize returns. Sports card investing relies on the rarity, condition, and historical significance of cards to build a valuable collection. Knowing these distinctions helps investors align strategies with their financial goals and risk tolerance.

Comparison Table

| Aspect | Sneakers Flipping | Sports Card Investing |

|---|---|---|

| Initial Investment | Moderate ($100 - $1,000+ per pair) | Varies ($20 - $10,000+ per card) |

| Market Volatility | High; trends change quickly | Moderate; influenced by players and league popularity |

| Liquidity | High; fast turnaround on marketplaces | Medium; can take longer to find buyers |

| Profit Potential | Short-term gains ranging 20%-100%+ | Long-term appreciation, sometimes 200%+ |

| Storage & Maintenance | Requires climate control to prevent damage | Needs protective sleeves and proper grading |

| Expertise Needed | Knowledge of sneaker releases, brands, and trends | Understanding of card grading, player stats, and market history |

| Risk Factors | Fake sneakers, market saturation | Counterfeit cards, grading disputes |

| Tax Implications | Capital gains tax on profits | Capital gains tax on profits |

Which is better?

Sneakers flipping offers faster turnover and high profit margins on limited-edition releases, appealing to trend-driven investors. Sports card investing usually provides longer-term value growth and benefits from historical demand and rarity, making it more stable but less liquid. Evaluating risk tolerance and investment horizon is crucial to choosing between the dynamic sneaker market and the more established sports memorabilia niche.

Connection

Sneakers flipping and sports card investing both capitalize on limited-edition releases and high demand within niche collector markets, driving significant resale value increases. Investors analyze market trends, rarity, and brand collaboration to predict future appreciation of sneakers and sports cards. Both asset classes offer liquidity and diversification opportunities for alternative investment portfolios.

Key Terms

Market Liquidity

Sports card investing offers high market liquidity due to established online platforms like eBay and dedicated card marketplaces, allowing quick transactions and transparent pricing. Sneakers flipping relies on trend-driven demand and limited releases, creating periodic spikes in liquidity but often facing slow turnover outside peak hype cycles. Explore deeper insights on liquidity dynamics in sports card investing and sneaker flipping markets.

Condition Grading

Condition grading plays a crucial role in sports card investing, where factors like centering, corners, edges, and surface determine a card's grade from companies such as PSA, BGS, or SGC, directly impacting its market value. In sneakers flipping, condition grading assesses wear, creasing, sole quality, and authenticity, often graded by platforms like StockX or GOAT, influencing resale prices significantly. Explore deeper insights on how precise grading affects your investment returns in both markets.

Limited Editions

Limited edition sports cards and limited edition sneakers both hold significant value in their respective markets due to their rarity and demand. Limited edition sports cards often feature exclusive autographs, serial numbering, and are tied to iconic moments or players, which enhances their long-term investment potential. Explore the unique advantages of limited edition collectibles and how they can diversify your investment portfolio.

Source and External Links

Investing in Sports Cards in 2025 - Sports card investing offers portfolio diversification and flexibility, with options in vintage, modern, and niche sports cards; success requires research, starting small, and wise investing.

Are sports cards a good investment? What you need to know - Key tips include doing thorough research, starting with lower-cost cards, buying graded cards for authenticity, diversifying between vintage and modern cards, and storing them properly.

Sports Card Investing & Collecting for Beginners - YouTube - Highlights that key cards of all-time great players are the best long-term investments, including vintage cards and some modern iconic rookie cards with potential for growth.

dowidth.com

dowidth.com