Royalty streams provide investors with a steady income derived from a percentage of revenue generated by a project or asset, often seen in natural resources and intellectual property sectors. Master Limited Partnerships (MLPs) offer tax-advantaged investment opportunities primarily in energy infrastructure, combining the liquidity of publicly traded stocks with the income benefits of limited partnerships. Explore the distinct benefits and risks of royalty streams versus MLPs to enhance your investment portfolio strategy.

Why it is important

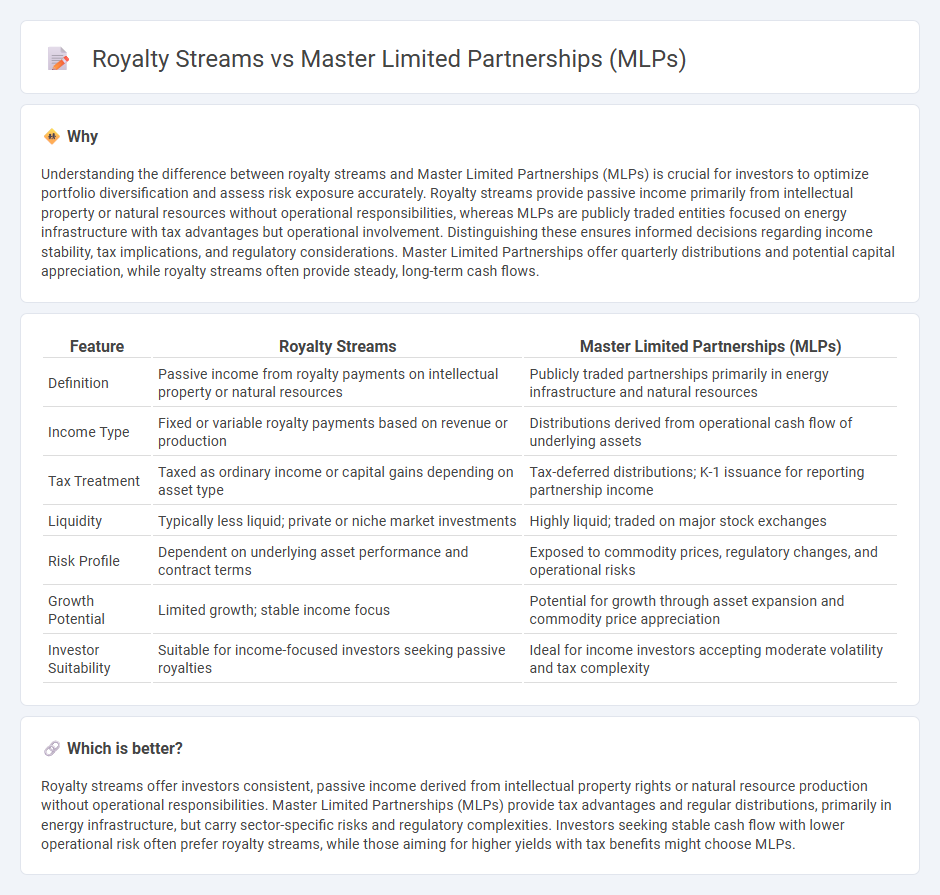

Understanding the difference between royalty streams and Master Limited Partnerships (MLPs) is crucial for investors to optimize portfolio diversification and assess risk exposure accurately. Royalty streams provide passive income primarily from intellectual property or natural resources without operational responsibilities, whereas MLPs are publicly traded entities focused on energy infrastructure with tax advantages but operational involvement. Distinguishing these ensures informed decisions regarding income stability, tax implications, and regulatory considerations. Master Limited Partnerships offer quarterly distributions and potential capital appreciation, while royalty streams often provide steady, long-term cash flows.

Comparison Table

| Feature | Royalty Streams | Master Limited Partnerships (MLPs) |

|---|---|---|

| Definition | Passive income from royalty payments on intellectual property or natural resources | Publicly traded partnerships primarily in energy infrastructure and natural resources |

| Income Type | Fixed or variable royalty payments based on revenue or production | Distributions derived from operational cash flow of underlying assets |

| Tax Treatment | Taxed as ordinary income or capital gains depending on asset type | Tax-deferred distributions; K-1 issuance for reporting partnership income |

| Liquidity | Typically less liquid; private or niche market investments | Highly liquid; traded on major stock exchanges |

| Risk Profile | Dependent on underlying asset performance and contract terms | Exposed to commodity prices, regulatory changes, and operational risks |

| Growth Potential | Limited growth; stable income focus | Potential for growth through asset expansion and commodity price appreciation |

| Investor Suitability | Suitable for income-focused investors seeking passive royalties | Ideal for income investors accepting moderate volatility and tax complexity |

Which is better?

Royalty streams offer investors consistent, passive income derived from intellectual property rights or natural resource production without operational responsibilities. Master Limited Partnerships (MLPs) provide tax advantages and regular distributions, primarily in energy infrastructure, but carry sector-specific risks and regulatory complexities. Investors seeking stable cash flow with lower operational risk often prefer royalty streams, while those aiming for higher yields with tax benefits might choose MLPs.

Connection

Royalty streams generate consistent income by entitling investors to a percentage of revenue from natural resources or intellectual property, while Master Limited Partnerships (MLPs) are publicly traded entities that combine tax benefits with steady cash flow from energy infrastructure assets. Both investment vehicles offer predictable distributions backed by tangible assets, making them attractive for income-oriented portfolios seeking diversification and inflation hedges. By investing in MLPs that own royalty interests, investors can access hybrid exposure to long-term royalties and partnership income.

Key Terms

Pass-through income

Master Limited Partnerships (MLPs) generate pass-through income by distributing earnings directly to investors, allowing them to avoid corporate income tax and benefit from tax-deferred returns. Royalty streams provide a steady income based on the sales or production of underlying assets, with income also passed through to investors but often subject to different tax treatments depending on the structure. Explore the distinctions between MLPs and royalty streams to optimize your investment strategy and tax efficiency.

Tax treatment

Master Limited Partnerships (MLPs) benefit from pass-through taxation, avoiding corporate income tax and allowing investors to receive distributions taxed at the individual level, often as a return of capital which defers taxes. Royalty streams typically generate ordinary income, taxed at the individual's income tax rate without the deferral advantages seen in MLPs. Explore further details on tax implications and investment strategies between MLPs and royalty streams.

Asset ownership

Master Limited Partnerships (MLPs) provide investors with direct ownership of tangible assets such as pipelines, storage facilities, and energy infrastructure, generating steady cash flows through operation and management. Royalty streams, conversely, grant revenue rights derived from underlying assets without conferring direct ownership or operational control, typically linked to natural resources or intellectual property. Explore the nuances of asset control and income generation between MLPs and royalty streams to make informed investment decisions.

Source and External Links

What Is A Master Limited Partnership (MLP)? - Master limited partnerships (MLPs) are publicly traded limited partnerships primarily in industries like energy that combine partnership tax benefits with stock-like liquidity, featuring general partners who manage and limited partners as investors receiving tax-efficient distributions.

MLP 101: The Basics - An MLP is a publicly traded limited partnership with general partners who manage the business and limited partners who invest, mostly active in energy, providing investors with units that trade like stocks but represent partnership interests.

Master limited partnership - In the U.S., MLPs are publicly traded partnerships taxed as partnerships, requiring at least 90% of income from qualifying sources like natural resources, offering tax advantages and liquidity distinct from traditional corporations.

dowidth.com

dowidth.com