Whiskey cask investment offers potential for high returns due to aging processes that increase value over time, benefiting from rising global demand and limited supply. Antique furniture investment provides stable appreciation, driven by rarity, craftsmanship, and historical significance in established art markets. Explore the unique advantages and risks of each asset class to make informed investment decisions.

Why it is important

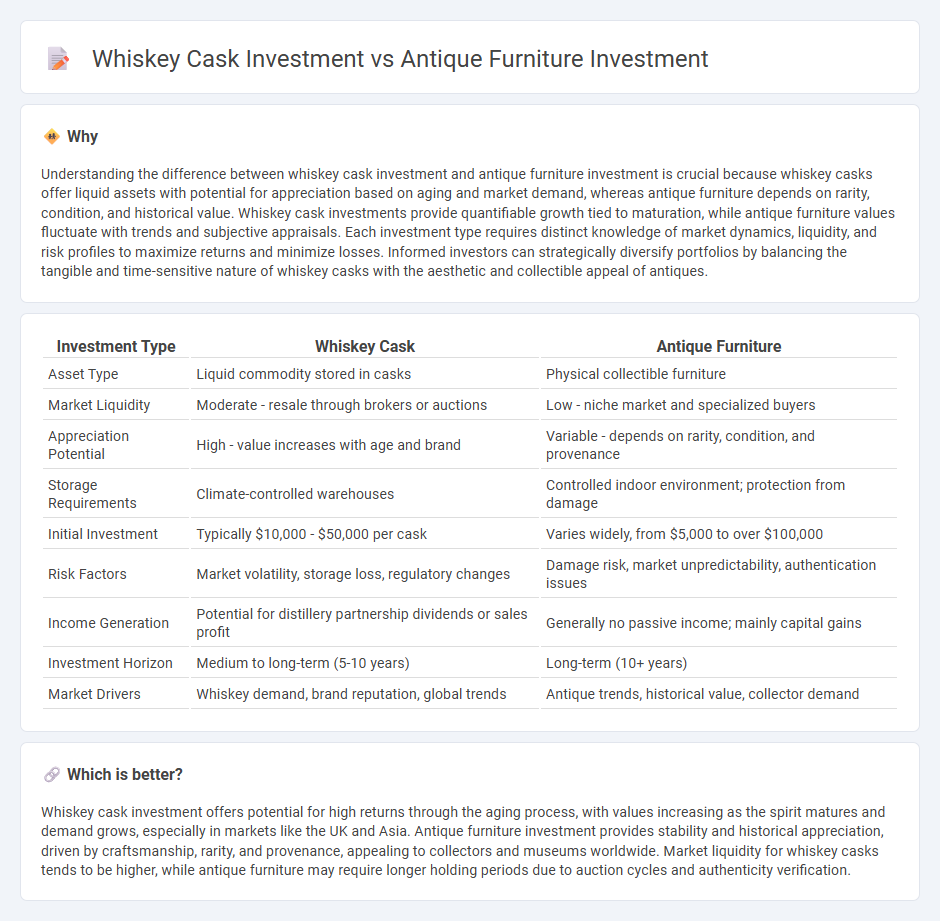

Understanding the difference between whiskey cask investment and antique furniture investment is crucial because whiskey casks offer liquid assets with potential for appreciation based on aging and market demand, whereas antique furniture depends on rarity, condition, and historical value. Whiskey cask investments provide quantifiable growth tied to maturation, while antique furniture values fluctuate with trends and subjective appraisals. Each investment type requires distinct knowledge of market dynamics, liquidity, and risk profiles to maximize returns and minimize losses. Informed investors can strategically diversify portfolios by balancing the tangible and time-sensitive nature of whiskey casks with the aesthetic and collectible appeal of antiques.

Comparison Table

| Investment Type | Whiskey Cask | Antique Furniture |

|---|---|---|

| Asset Type | Liquid commodity stored in casks | Physical collectible furniture |

| Market Liquidity | Moderate - resale through brokers or auctions | Low - niche market and specialized buyers |

| Appreciation Potential | High - value increases with age and brand | Variable - depends on rarity, condition, and provenance |

| Storage Requirements | Climate-controlled warehouses | Controlled indoor environment; protection from damage |

| Initial Investment | Typically $10,000 - $50,000 per cask | Varies widely, from $5,000 to over $100,000 |

| Risk Factors | Market volatility, storage loss, regulatory changes | Damage risk, market unpredictability, authentication issues |

| Income Generation | Potential for distillery partnership dividends or sales profit | Generally no passive income; mainly capital gains |

| Investment Horizon | Medium to long-term (5-10 years) | Long-term (10+ years) |

| Market Drivers | Whiskey demand, brand reputation, global trends | Antique trends, historical value, collector demand |

Which is better?

Whiskey cask investment offers potential for high returns through the aging process, with values increasing as the spirit matures and demand grows, especially in markets like the UK and Asia. Antique furniture investment provides stability and historical appreciation, driven by craftsmanship, rarity, and provenance, appealing to collectors and museums worldwide. Market liquidity for whiskey casks tends to be higher, while antique furniture may require longer holding periods due to auction cycles and authenticity verification.

Connection

Whiskey cask investment and antique furniture investment both capitalize on scarcity and historical value, attracting investors seeking tangible assets that appreciate over time. Each market benefits from expert appraisal and provenance verification to ensure authenticity and maximize returns. Investors diversify portfolios by leveraging the emotional and cultural significance embedded in rare whiskey casks and reclaimed antique furniture.

Key Terms

Provenance

Provenance plays a critical role in the value and authenticity of both antique furniture and whiskey cask investments, often determining their market price and desirability among collectors. Antique furniture with well-documented historical ownership and craftsmanship commands higher returns, while whiskey casks benefit from traceable distillery origins and aging history that assure quality and rarity. Explore detailed insights on how provenance influences these alternative investments to make informed decisions.

Maturity

Antique furniture investments typically appreciate steadily over decades, benefiting from historical and craftsmanship value that matures with age and rarity. Whiskey cask investments mature faster, often within 3 to 10 years, as the aging process directly enhances the cask's market value and flavor profile. Discover the nuances of maturity timelines and returns to determine which asset aligns best with your investment strategy.

Market Liquidity

Antique furniture investment often faces limited market liquidity due to niche demand and lengthy appraisal processes, whereas whiskey cask investment benefits from a more dynamic secondary market with growing global interest and standardized trade platforms. The valuation of antique furniture can be subjective and influenced by provenance and condition, while whiskey casks offer more transparent pricing linked to aging potential and brand reputation. Explore the nuances of market liquidity in these two asset classes to enhance your investment strategy.

Source and External Links

Why Antique Furniture is the Best Investment for Your Home - Antique furniture is often made from high-quality, sustainable materials and can appreciate in value over time, unlike contemporary furniture which typically depreciates.

Investing in Antique Furniture: A Lucrative Portfolio Addition - Antique furniture is valued for its craftsmanship, rarity, and historical significance, making it a potentially profitable and unique addition to an investment portfolio.

Antiques 101: What to Look for When Investing in Antiques - The Antique Furniture Price Index has seen substantial long-term growth, suggesting that antique furniture can be a strong investment, though experts recommend limiting it to 10%-20% of your portfolio due to liquidity and price volatility.

dowidth.com

dowidth.com