Tangible asset tokenization transforms physical assets like real estate and art into digital tokens, enabling fractional ownership and increased liquidity in investment markets. Venture capital involves direct equity investments in startups and early-stage companies, offering potential high returns but with higher risk and less liquidity. Discover how these innovative investment strategies can diversify your portfolio and optimize returns.

Why it is important

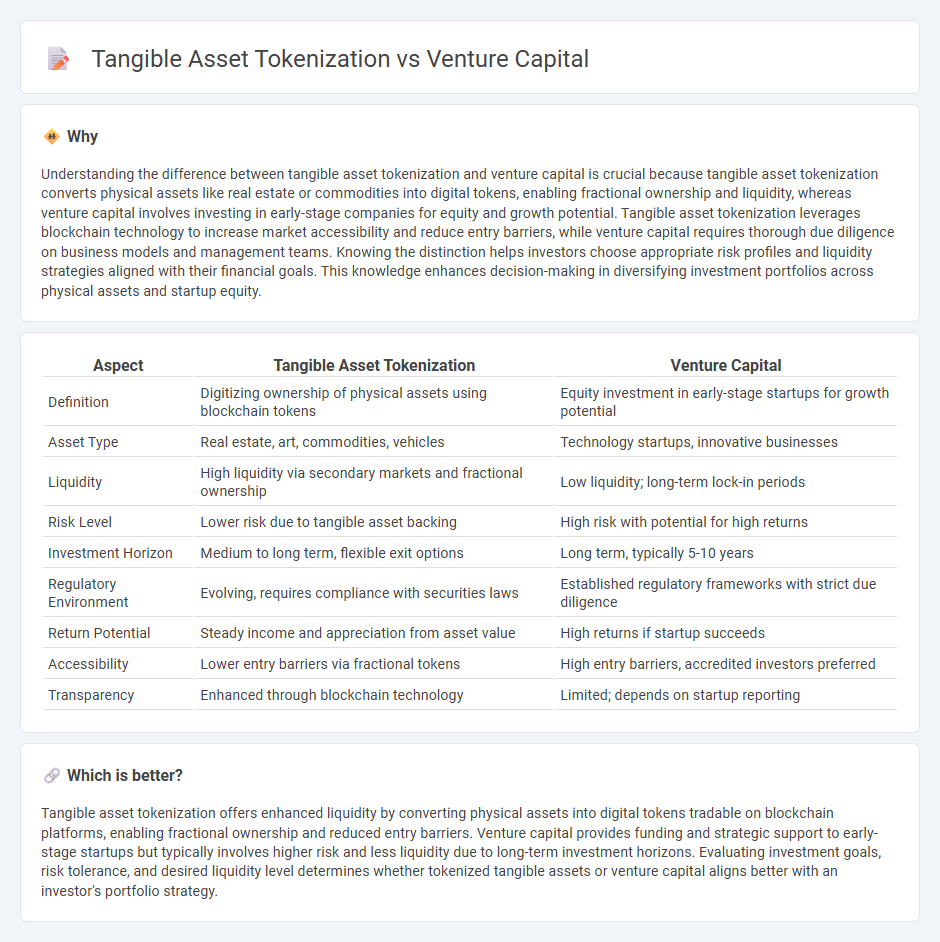

Understanding the difference between tangible asset tokenization and venture capital is crucial because tangible asset tokenization converts physical assets like real estate or commodities into digital tokens, enabling fractional ownership and liquidity, whereas venture capital involves investing in early-stage companies for equity and growth potential. Tangible asset tokenization leverages blockchain technology to increase market accessibility and reduce entry barriers, while venture capital requires thorough due diligence on business models and management teams. Knowing the distinction helps investors choose appropriate risk profiles and liquidity strategies aligned with their financial goals. This knowledge enhances decision-making in diversifying investment portfolios across physical assets and startup equity.

Comparison Table

| Aspect | Tangible Asset Tokenization | Venture Capital |

|---|---|---|

| Definition | Digitizing ownership of physical assets using blockchain tokens | Equity investment in early-stage startups for growth potential |

| Asset Type | Real estate, art, commodities, vehicles | Technology startups, innovative businesses |

| Liquidity | High liquidity via secondary markets and fractional ownership | Low liquidity; long-term lock-in periods |

| Risk Level | Lower risk due to tangible asset backing | High risk with potential for high returns |

| Investment Horizon | Medium to long term, flexible exit options | Long term, typically 5-10 years |

| Regulatory Environment | Evolving, requires compliance with securities laws | Established regulatory frameworks with strict due diligence |

| Return Potential | Steady income and appreciation from asset value | High returns if startup succeeds |

| Accessibility | Lower entry barriers via fractional tokens | High entry barriers, accredited investors preferred |

| Transparency | Enhanced through blockchain technology | Limited; depends on startup reporting |

Which is better?

Tangible asset tokenization offers enhanced liquidity by converting physical assets into digital tokens tradable on blockchain platforms, enabling fractional ownership and reduced entry barriers. Venture capital provides funding and strategic support to early-stage startups but typically involves higher risk and less liquidity due to long-term investment horizons. Evaluating investment goals, risk tolerance, and desired liquidity level determines whether tokenized tangible assets or venture capital aligns better with an investor's portfolio strategy.

Connection

Tangible asset tokenization enhances venture capital by transforming physical assets into digital tokens, enabling fractional ownership and increased liquidity. This innovation attracts a broader range of investors and improves capital raising efficiency for startups and projects. Venture capital firms leverage tokenized tangible assets to diversify portfolios and access new markets with reduced entry barriers.

Key Terms

**Venture Capital:**

Venture capital involves investing in early-stage startups with high growth potential, providing funding in exchange for equity ownership. This asset class is characterized by high risk and potentially substantial returns, driven by innovation and entrepreneurial ecosystems. Explore more about how venture capital shapes emerging markets and investment strategies.

Equity Stake

Venture capital involves investing in startup companies in exchange for equity stakes, providing investors ownership and potential high returns based on company growth. Tangible asset tokenization converts physical assets like real estate or machinery into digital tokens representing fractional ownership, facilitating liquidity and broader investor access. Explore how equity stakes differ in risk, liquidity, and regulatory aspects between venture capital and tokenized tangible assets.

Startup Valuation

Venture capital investment relies heavily on projected growth metrics, market potential, and intellectual property to determine startup valuation, often leading to high-risk, high-reward scenarios. Tangible asset tokenization anchors valuation in real-world assets such as real estate, machinery, or commodities, providing transparency and liquidity through blockchain technology. Explore deeper insights into how these valuation methodologies impact startup funding dynamics and investor confidence.

Source and External Links

What is Venture Capital? - Venture capital is a form of private equity that turns ideas and research into high-growth companies by providing risk capital to startups that traditional financing can't support, often partnering closely with entrepreneurs for long-term value growth.

Fund your business | U.S. Small Business Administration - Venture capital involves investors providing funding to high-growth companies in exchange for equity and active involvement, including board seats, with a focus on long-term growth and acceptance of higher risk.

What is Venture Capital? | J.P. Morgan - Venture capital funds startups working on innovative technologies with high growth potential by investing through equity or convertible debt, often over long periods, with investors expecting success mainly through large liquidity events like IPOs or acquisitions.

dowidth.com

dowidth.com