Farmland funds invest directly in agricultural land, offering stable cash flow through crop production and inflation hedging, while stock market funds provide exposure to company equities with higher liquidity but increased volatility. Farmland funds deliver diversification benefits and lower correlation to traditional markets compared to stock market funds, appealing to investors seeking long-term asset protection and income. Explore the benefits and risks of both investment types to determine the best fit for your portfolio goals.

Why it is important

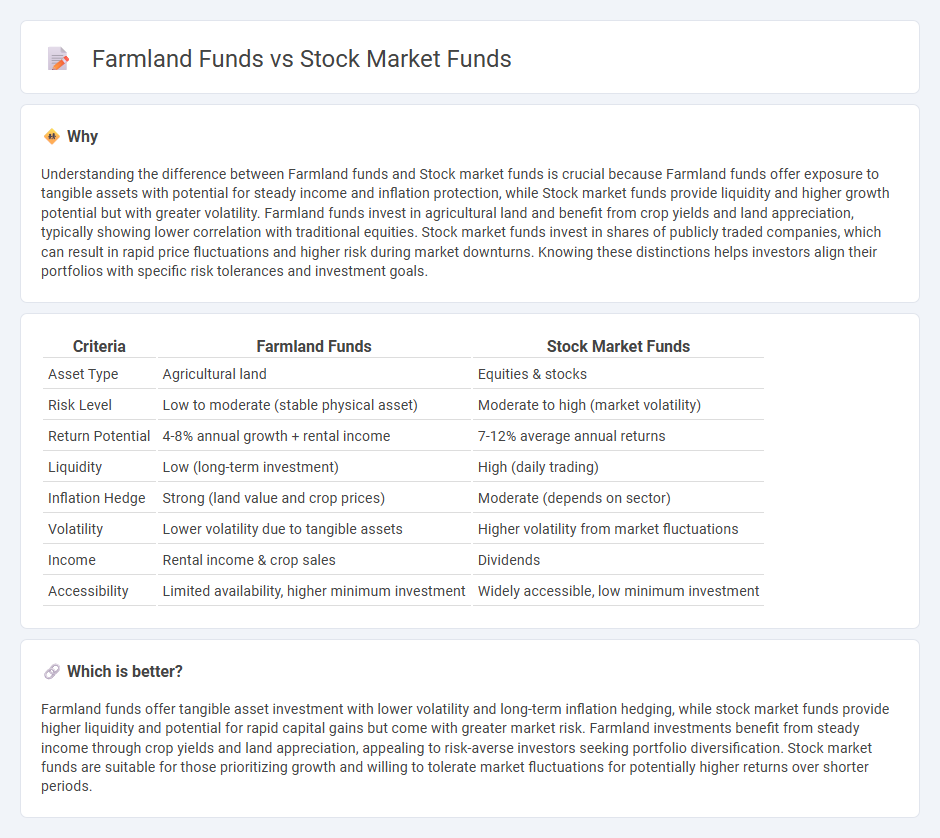

Understanding the difference between Farmland funds and Stock market funds is crucial because Farmland funds offer exposure to tangible assets with potential for steady income and inflation protection, while Stock market funds provide liquidity and higher growth potential but with greater volatility. Farmland funds invest in agricultural land and benefit from crop yields and land appreciation, typically showing lower correlation with traditional equities. Stock market funds invest in shares of publicly traded companies, which can result in rapid price fluctuations and higher risk during market downturns. Knowing these distinctions helps investors align their portfolios with specific risk tolerances and investment goals.

Comparison Table

| Criteria | Farmland Funds | Stock Market Funds |

|---|---|---|

| Asset Type | Agricultural land | Equities & stocks |

| Risk Level | Low to moderate (stable physical asset) | Moderate to high (market volatility) |

| Return Potential | 4-8% annual growth + rental income | 7-12% average annual returns |

| Liquidity | Low (long-term investment) | High (daily trading) |

| Inflation Hedge | Strong (land value and crop prices) | Moderate (depends on sector) |

| Volatility | Lower volatility due to tangible assets | Higher volatility from market fluctuations |

| Income | Rental income & crop sales | Dividends |

| Accessibility | Limited availability, higher minimum investment | Widely accessible, low minimum investment |

Which is better?

Farmland funds offer tangible asset investment with lower volatility and long-term inflation hedging, while stock market funds provide higher liquidity and potential for rapid capital gains but come with greater market risk. Farmland investments benefit from steady income through crop yields and land appreciation, appealing to risk-averse investors seeking portfolio diversification. Stock market funds are suitable for those prioritizing growth and willing to tolerate market fluctuations for potentially higher returns over shorter periods.

Connection

Farmland funds and stock market funds are connected through their roles in diversified investment portfolios, offering exposure to different asset classes that balance risk and return. Both types of funds provide investors with opportunities to generate income and capital appreciation, with farmland funds benefiting from agricultural land value growth and stock market funds from equity market performance. Correlations between farmland and stock market returns tend to be low, making farmland funds an effective tool for portfolio diversification and risk management.

Key Terms

Diversification

Stock market funds offer diversification across various sectors and industries, providing exposure to different economies and market cycles. Farmland funds diversify investment by allocating capital to agricultural land, which often has low correlation with traditional equities and fixed income assets, thus reducing portfolio volatility. Explore how combining both can enhance overall investment diversification and risk management.

Liquidity

Stock market funds offer high liquidity, allowing investors to buy or sell shares quickly during market hours, whereas farmland funds typically have lower liquidity due to the nature of agricultural land assets and longer holding periods. The liquidity of stock funds supports rapid portfolio adjustments and access to cash, contrasting with farmland investments where asset turnover is slower and secondary markets are less developed. Explore detailed comparisons of liquidity profiles between stock market and farmland funds to make informed investment decisions.

Asset Appreciation

Stock market funds typically offer higher liquidity and potential for rapid asset appreciation driven by company earnings and market trends. Farmland funds provide steady long-term asset appreciation through land value increases and agricultural productivity, often serving as a hedge against inflation. Explore deeper insights into performance metrics and risk profiles to make informed investment decisions.

Source and External Links

Index Funds | Investor.gov - Index funds are mutual funds or ETFs designed to track the performance of a specific market index, such as the S&P 500, by holding a representative sample of its securities.

Stock Fund | Investor.gov - Stock funds (or equity funds) invest primarily in stocks, offering either broad diversification across many companies or focused exposure to specific sectors, with their value fluctuating based on market conditions.

Mutual Funds | FINRA.org - Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities, allowing individuals to invest in a wide range of assets with a single transaction.

dowidth.com

dowidth.com