Sports memorabilia funds offer investors exposure to physical assets like signed jerseys and rare collectibles, capitalizing on market demand and historical appreciation trends. Private equity funds focus on acquiring equity stakes in private companies, aiming for growth and operational improvements to yield higher financial returns. Explore the comparative benefits and risks of both investment types to determine the best fit for your portfolio.

Why it is important

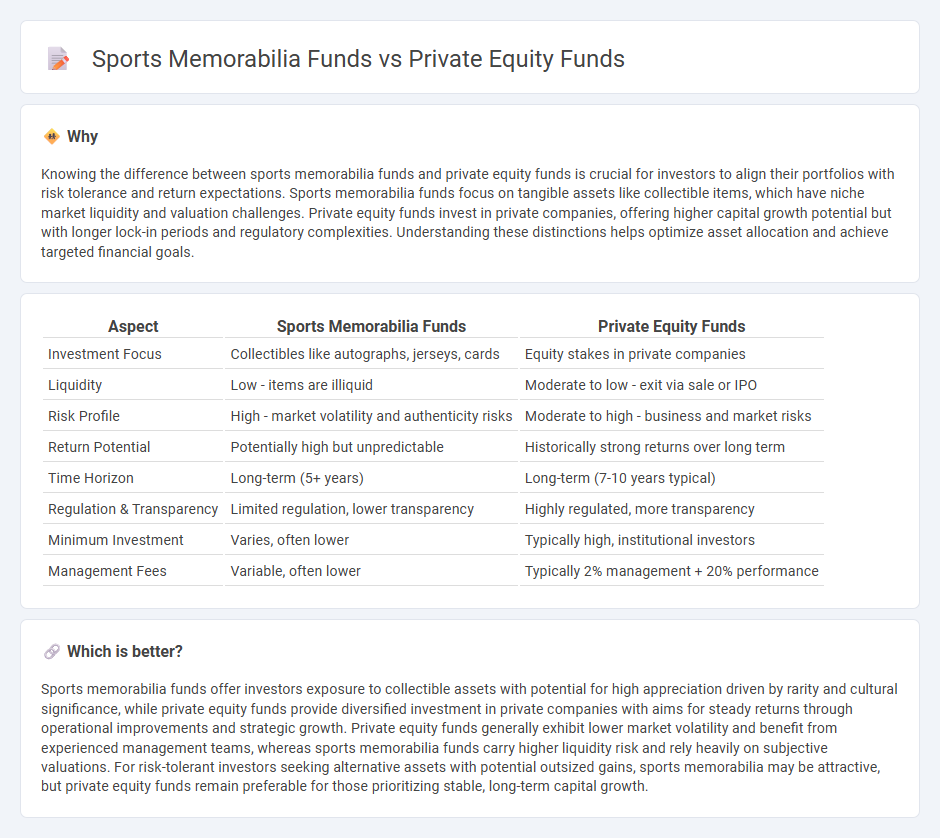

Knowing the difference between sports memorabilia funds and private equity funds is crucial for investors to align their portfolios with risk tolerance and return expectations. Sports memorabilia funds focus on tangible assets like collectible items, which have niche market liquidity and valuation challenges. Private equity funds invest in private companies, offering higher capital growth potential but with longer lock-in periods and regulatory complexities. Understanding these distinctions helps optimize asset allocation and achieve targeted financial goals.

Comparison Table

| Aspect | Sports Memorabilia Funds | Private Equity Funds |

|---|---|---|

| Investment Focus | Collectibles like autographs, jerseys, cards | Equity stakes in private companies |

| Liquidity | Low - items are illiquid | Moderate to low - exit via sale or IPO |

| Risk Profile | High - market volatility and authenticity risks | Moderate to high - business and market risks |

| Return Potential | Potentially high but unpredictable | Historically strong returns over long term |

| Time Horizon | Long-term (5+ years) | Long-term (7-10 years typical) |

| Regulation & Transparency | Limited regulation, lower transparency | Highly regulated, more transparency |

| Minimum Investment | Varies, often lower | Typically high, institutional investors |

| Management Fees | Variable, often lower | Typically 2% management + 20% performance |

Which is better?

Sports memorabilia funds offer investors exposure to collectible assets with potential for high appreciation driven by rarity and cultural significance, while private equity funds provide diversified investment in private companies with aims for steady returns through operational improvements and strategic growth. Private equity funds generally exhibit lower market volatility and benefit from experienced management teams, whereas sports memorabilia funds carry higher liquidity risk and rely heavily on subjective valuations. For risk-tolerant investors seeking alternative assets with potential outsized gains, sports memorabilia may be attractive, but private equity funds remain preferable for those prioritizing stable, long-term capital growth.

Connection

Sports memorabilia funds and private equity funds intersect through their shared investment strategies focused on asset appreciation and portfolio diversification. Both funds capitalize on niche markets by acquiring undervalued or high-potential assets, such as rare collectibles or private company equity, leveraging market expertise to generate significant returns. The convergence emerges as private equity entities increasingly allocate capital into alternative assets like sports memorabilia, recognizing its growing market demand and rarity-driven value uplift.

Key Terms

**Private Equity Funds:**

Private equity funds pool capital to invest in private companies, aiming for long-term capital appreciation through active management and operational improvements. These funds typically target established businesses with growth potential, offering diversified investment opportunities and professional oversight. Explore how private equity funds can enhance your portfolio with strategic, high-return assets.

Buyout

Buyout private equity funds specialize in acquiring controlling stakes in established companies, leveraging operational improvements and strategic growth to generate returns. Sports memorabilia funds focus on purchasing valuable collectible items like autographed jerseys or rare trading cards, aiming to profit from market appreciation and scarcity. Explore the unique investment dynamics and risk profiles of these contrasting fund types to make informed decisions.

Limited Partners (LPs)

Limited Partners (LPs) in private equity funds typically commit large capital sums to diversified portfolios aiming for consistent returns over long investment horizons, benefiting from established track records and regulatory frameworks. In contrast, LPs in sports memorabilia funds face higher volatility and unique market risks linked to asset authenticity, rarity, and fluctuating collector demand, often requiring specialized due diligence. Explore deeper insights into LP considerations for these contrasting fund types to optimize your investment strategy.

Source and External Links

Private equity fund - Wikipedia - A private equity fund is a collective investment vehicle, usually a limited partnership with a typical 10-year term, managed by investment professionals who raise capital from institutional investors to invest in equity and sometimes debt securities of companies, aiming for returns through longer-term holdings.

Private Equity Funds - Know the Different Types of PE Funds - Private equity funds pool capital mainly from institutional investors to invest in private companies, typically with a 4 to 7-year investment horizon, focusing on either venture capital or buyout strategies, aiming for profitable exits through IPOs or sales.

Private Equity Funds | Investor.gov - Private equity funds pool money from investors to take controlling or minority stakes in companies, actively managing these investments over a long horizon (usually 10+ years), but unlike mutual funds, they are not registered with the SEC and have limited public disclosure.

dowidth.com

dowidth.com