Tax lien certificates offer secured returns by investing in government-issued liens on delinquent properties, providing a unique blend of risk and reward through interest payments or property acquisition. Crowdfunding real estate allows investors to pool capital online for diversified property investments, often with lower entry costs and access to professional management. Explore the differences and benefits of each to determine the best strategy for your investment goals.

Why it is important

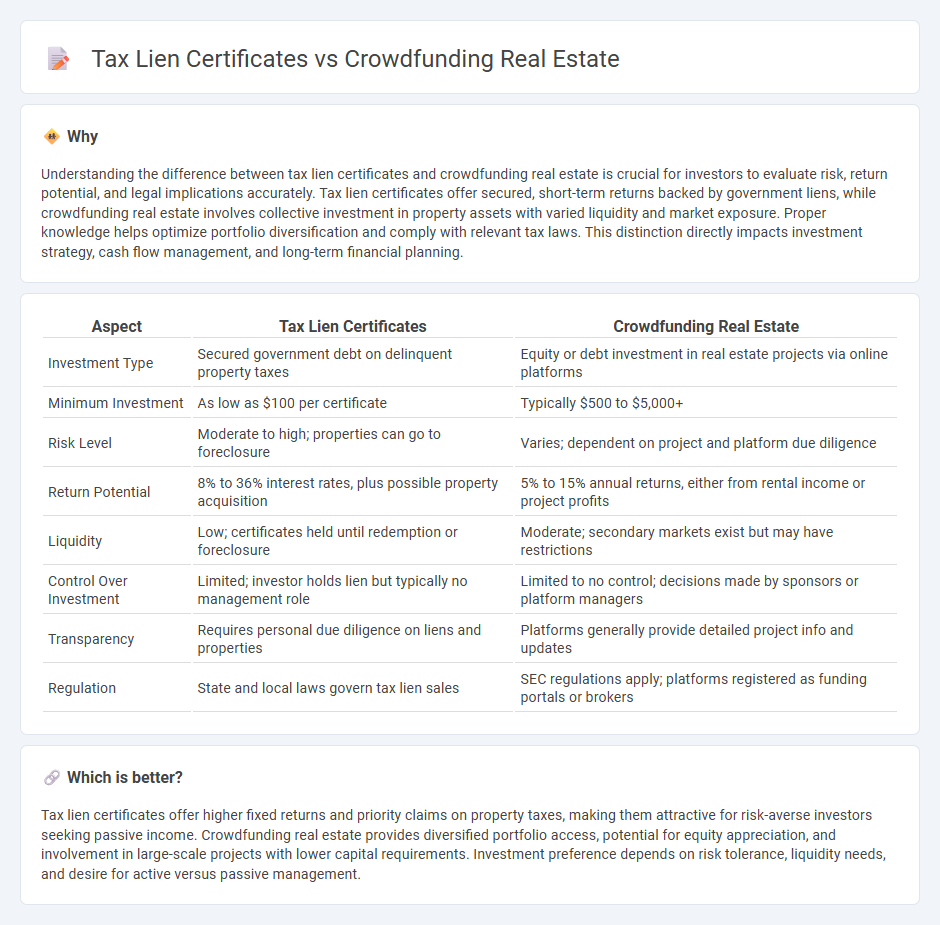

Understanding the difference between tax lien certificates and crowdfunding real estate is crucial for investors to evaluate risk, return potential, and legal implications accurately. Tax lien certificates offer secured, short-term returns backed by government liens, while crowdfunding real estate involves collective investment in property assets with varied liquidity and market exposure. Proper knowledge helps optimize portfolio diversification and comply with relevant tax laws. This distinction directly impacts investment strategy, cash flow management, and long-term financial planning.

Comparison Table

| Aspect | Tax Lien Certificates | Crowdfunding Real Estate |

|---|---|---|

| Investment Type | Secured government debt on delinquent property taxes | Equity or debt investment in real estate projects via online platforms |

| Minimum Investment | As low as $100 per certificate | Typically $500 to $5,000+ |

| Risk Level | Moderate to high; properties can go to foreclosure | Varies; dependent on project and platform due diligence |

| Return Potential | 8% to 36% interest rates, plus possible property acquisition | 5% to 15% annual returns, either from rental income or project profits |

| Liquidity | Low; certificates held until redemption or foreclosure | Moderate; secondary markets exist but may have restrictions |

| Control Over Investment | Limited; investor holds lien but typically no management role | Limited to no control; decisions made by sponsors or platform managers |

| Transparency | Requires personal due diligence on liens and properties | Platforms generally provide detailed project info and updates |

| Regulation | State and local laws govern tax lien sales | SEC regulations apply; platforms registered as funding portals or brokers |

Which is better?

Tax lien certificates offer higher fixed returns and priority claims on property taxes, making them attractive for risk-averse investors seeking passive income. Crowdfunding real estate provides diversified portfolio access, potential for equity appreciation, and involvement in large-scale projects with lower capital requirements. Investment preference depends on risk tolerance, liquidity needs, and desire for active versus passive management.

Connection

Tax lien certificates and crowdfunding real estate are connected through their shared potential for generating passive income and diversifying investment portfolios. Investors purchase tax lien certificates to secure claims on property tax debts, which can lead to earning interest or acquiring property through foreclosure. Crowdfunding real estate platforms enable multiple investors to pool resources, often including tax lien opportunities, to fund property acquisitions and developments, thereby broadening access to real estate markets with reduced individual capital requirements.

Key Terms

Equity Ownership

Crowdfunding real estate offers investors direct equity ownership in properties, providing potential for appreciation and rental income, whereas tax lien certificates represent a secured debt obligation with priority over other claims but typically do not grant ownership rights. Equity investors in real estate crowdfunding benefit from dividends and capital gains tied to property performance, while tax lien holders earn interest payments and the chance to acquire property if liens remain unpaid. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Default Risk

Crowdfunding real estate involves pooling funds from multiple investors to finance property projects, with default risk tied to market fluctuations, developer reliability, and property management. Tax lien certificates offer a secured investment backed by government liens on properties with unpaid taxes, where default risk hinges on property redemption or foreclosure outcomes. Explore more about how default risk impacts these investment strategies and their potential returns.

Liquidity

Crowdfunding real estate platforms offer moderate liquidity by enabling investors to buy and sell shares within specific offering windows or secondary markets, though transactions can take days to weeks to complete. Tax lien certificates provide less liquidity since investors must often hold certificates until the property owner redeems them or the certificate forecloses, a process that can take months or years. Explore detailed comparisons to understand which option aligns best with your investment liquidity needs.

Source and External Links

What Is Real Estate Crowdfunding & How Does It Work - BetterWorld - Real estate crowdfunding pools funds from multiple investors to finance projects, providing both equity (partial ownership with rental and appreciation returns) and debt (fixed interest payments) investment options, making real estate investing more accessible.

Crowdfunding real estate: What to know - Rocket Mortgage - Real estate crowdfunding allows investors to collectively purchase shares of residential or commercial properties through online platforms, enabling diversification with typically lower capital than traditional investments.

Best Real Estate Crowdfunding Platforms for 2025 - CRE Daily - Top platforms like CrowdStreet, Fundrise, and RealtyMogul enable investors to pool money to invest in various real estate projects and property types, often with low minimum investments and diverse portfolio options.

dowidth.com

dowidth.com