Fractional real estate investment offers partial ownership in high-value properties, allowing investors to diversify with lower capital requirements compared to turnkey rental properties, which provide fully renovated homes ready for immediate rental income. Turnkey rental properties appeal to investors seeking hassle-free management and stable cash flow without involvement in property upgrades or tenant placement. Explore the advantages and considerations of both options to determine the best fit for your investment goals.

Why it is important

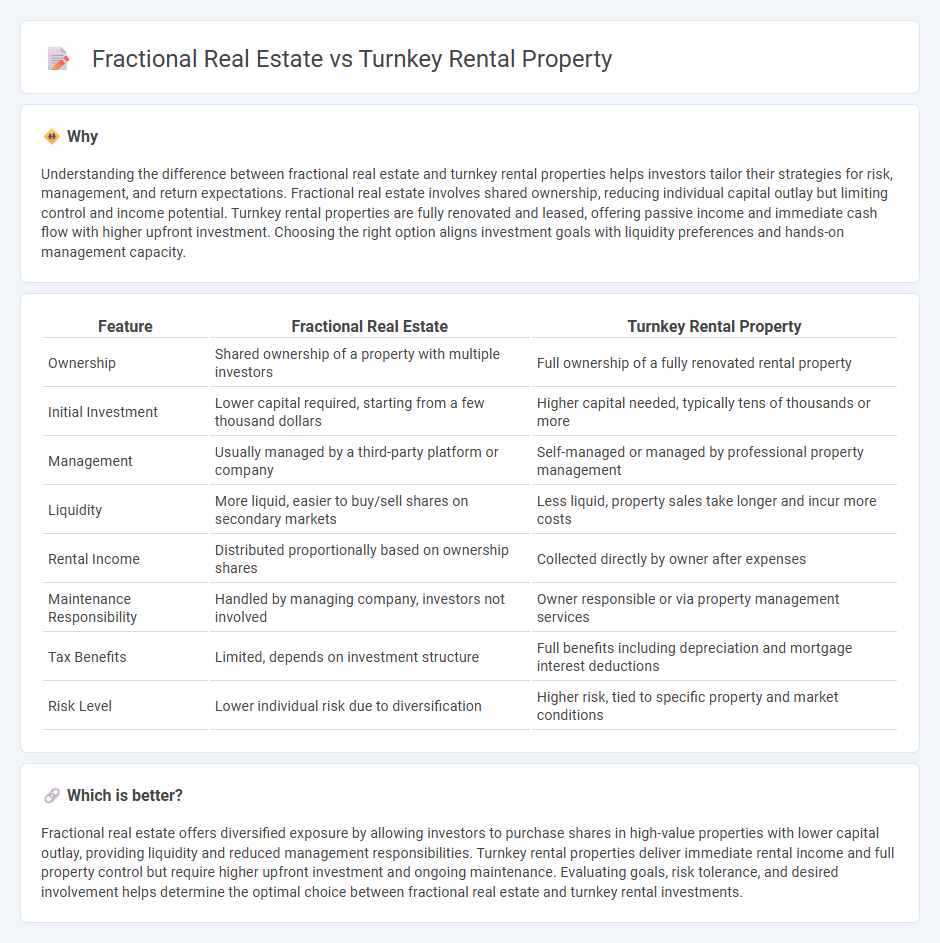

Understanding the difference between fractional real estate and turnkey rental properties helps investors tailor their strategies for risk, management, and return expectations. Fractional real estate involves shared ownership, reducing individual capital outlay but limiting control and income potential. Turnkey rental properties are fully renovated and leased, offering passive income and immediate cash flow with higher upfront investment. Choosing the right option aligns investment goals with liquidity preferences and hands-on management capacity.

Comparison Table

| Feature | Fractional Real Estate | Turnkey Rental Property |

|---|---|---|

| Ownership | Shared ownership of a property with multiple investors | Full ownership of a fully renovated rental property |

| Initial Investment | Lower capital required, starting from a few thousand dollars | Higher capital needed, typically tens of thousands or more |

| Management | Usually managed by a third-party platform or company | Self-managed or managed by professional property management |

| Liquidity | More liquid, easier to buy/sell shares on secondary markets | Less liquid, property sales take longer and incur more costs |

| Rental Income | Distributed proportionally based on ownership shares | Collected directly by owner after expenses |

| Maintenance Responsibility | Handled by managing company, investors not involved | Owner responsible or via property management services |

| Tax Benefits | Limited, depends on investment structure | Full benefits including depreciation and mortgage interest deductions |

| Risk Level | Lower individual risk due to diversification | Higher risk, tied to specific property and market conditions |

Which is better?

Fractional real estate offers diversified exposure by allowing investors to purchase shares in high-value properties with lower capital outlay, providing liquidity and reduced management responsibilities. Turnkey rental properties deliver immediate rental income and full property control but require higher upfront investment and ongoing maintenance. Evaluating goals, risk tolerance, and desired involvement helps determine the optimal choice between fractional real estate and turnkey rental investments.

Connection

Fractional real estate and turnkey rental properties both offer accessible pathways for investors to enter the real estate market with minimized risk and effort, enabling partial ownership or fully managed rental units. Fractional real estate allows multiple investors to co-own a property, often enhancing liquidity and diversification, while turnkey rental properties provide ready-to-rent homes requiring no renovation, generating immediate rental income. Combining these concepts, investors can leverage fractional investments in turnkey properties to achieve efficient portfolio growth with professional management and shared cost benefits.

Key Terms

Ownership Structure

Turnkey rental properties involve full ownership of a single rental unit, allowing investors complete control and direct income from tenants. Fractional real estate divides ownership of a property among multiple investors, enabling shared costs and risks with proportional distribution of returns. Discover the advantages of each ownership structure to determine the best fit for your investment goals.

Liquidity

Turnkey rental properties offer moderate liquidity through rental income and potential resale, but transferring ownership can be time-consuming due to full property sale processes. Fractional real estate allows investors to buy and sell shares in properties, providing enhanced liquidity by enabling partial asset transactions often facilitated via secondary markets or platforms. Discover more about how liquidity varies between these investment strategies and which suits your financial goals.

Property Management

Turnkey rental properties offer seamless property management services including tenant screening, maintenance, and rent collection, simplifying the landlord's role with minimal involvement. Fractional real estate ownership often requires coordinated management between multiple owners, complicating decision-making and day-to-day operations. Explore the distinct advantages of each model's property management to determine the best fit for your investment goals.

Source and External Links

What is Turnkey Real Estate - This article explains turnkey real estate, detailing how companies buy, rehab, and sell properties to investors, often with property management services included.

What is a Turnkey House - This guide outlines turnkey properties as fully functioning and ready to rent, allowing investors to generate passive income with minimal upfront effort.

MartelTurnkey - Offers turnkey rental properties with tenants and property management already in place, allowing for immediate cash flow and streamlined investment.

dowidth.com

dowidth.com