Sports memorabilia trading offers unique opportunities to capitalize on the value of rare collectibles like autographed jerseys and vintage cards, driven by fan demand and historical significance. Watch investing focuses on acquiring luxury timepieces from brands such as Rolex and Patek Philippe, benefiting from limited production runs and enduring craftsmanship that often appreciates over time. Explore deeper insights into these distinct investment strategies to determine which approach aligns best with your portfolio goals.

Why it is important

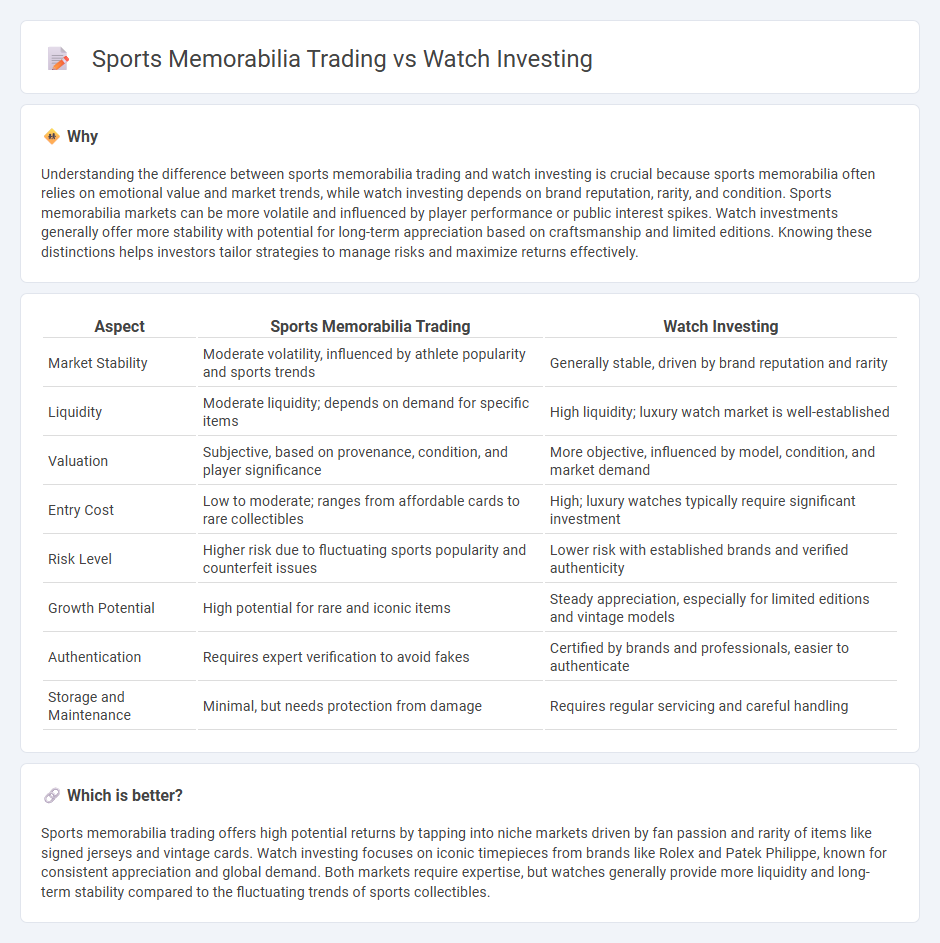

Understanding the difference between sports memorabilia trading and watch investing is crucial because sports memorabilia often relies on emotional value and market trends, while watch investing depends on brand reputation, rarity, and condition. Sports memorabilia markets can be more volatile and influenced by player performance or public interest spikes. Watch investments generally offer more stability with potential for long-term appreciation based on craftsmanship and limited editions. Knowing these distinctions helps investors tailor strategies to manage risks and maximize returns effectively.

Comparison Table

| Aspect | Sports Memorabilia Trading | Watch Investing |

|---|---|---|

| Market Stability | Moderate volatility, influenced by athlete popularity and sports trends | Generally stable, driven by brand reputation and rarity |

| Liquidity | Moderate liquidity; depends on demand for specific items | High liquidity; luxury watch market is well-established |

| Valuation | Subjective, based on provenance, condition, and player significance | More objective, influenced by model, condition, and market demand |

| Entry Cost | Low to moderate; ranges from affordable cards to rare collectibles | High; luxury watches typically require significant investment |

| Risk Level | Higher risk due to fluctuating sports popularity and counterfeit issues | Lower risk with established brands and verified authenticity |

| Growth Potential | High potential for rare and iconic items | Steady appreciation, especially for limited editions and vintage models |

| Authentication | Requires expert verification to avoid fakes | Certified by brands and professionals, easier to authenticate |

| Storage and Maintenance | Minimal, but needs protection from damage | Requires regular servicing and careful handling |

Which is better?

Sports memorabilia trading offers high potential returns by tapping into niche markets driven by fan passion and rarity of items like signed jerseys and vintage cards. Watch investing focuses on iconic timepieces from brands like Rolex and Patek Philippe, known for consistent appreciation and global demand. Both markets require expertise, but watches generally provide more liquidity and long-term stability compared to the fluctuating trends of sports collectibles.

Connection

Sports memorabilia trading and watch investing both capitalize on rarity and historical significance to drive market value. Collectors prioritize limited-edition items and vintage pieces, which appreciate due to unique provenance and cultural impact. This shared focus on exclusivity and authenticity underpins their attractiveness as alternative investment assets.

Key Terms

Authenticity

Watch investing depends heavily on verifying manufacturer authenticity, model rarity, and condition, with certifications from authorized dealers reinforcing value. Sports memorabilia trading revolves around proving provenance through authenticated signatures, game-used items, and certificates of authenticity from recognized organizations. Explore how authenticity standards impact investment security and market growth in both fields for deeper insights.

Provenance

Provenance plays a critical role in both watch investing and sports memorabilia trading, as authentic history significantly enhances the value and credibility of the asset. Watches with documented ownership and servicing records, especially those linked to notable figures or events, command higher prices in secondary markets. Explore how provenance influences investment strategies and market trends to maximize returns in these collectible markets.

Market liquidity

Watch investing benefits from higher market liquidity due to established global platforms like Chrono24 and WatchBox, facilitating quicker sales and more transparent pricing. Sports memorabilia trading, while growing, often experiences lower liquidity because sales typically occur through niche auctions and private collectors, resulting in longer holding periods and fluctuating prices. Explore the dynamics of both markets to optimize your investment strategy effectively.

Source and External Links

The Beginner's Guide to Watch Investing: How to Get Started - This guide covers investing in watch company stocks, watch investing funds, and physical watches, highlighting options such as Swatch Group stock, watch funds with notable returns, and the risks involved in the market.

Investing in Luxury Watches: Tax Benefits and More - Discusses how to craft a strategic watch investment plan focusing on goal setting, diversification, and selecting undervalued models to mitigate risks and optimize returns, noting luxury watches' resilience during economic downturns.

Are Watches a Good Investment? (Pros & Cons + An ... - Explains the benefits like portability, potential appreciation, and economic stability of watch investments, alongside disadvantages such as liquidity challenges and counterfeit risks, emphasizing the need for careful market research.

dowidth.com

dowidth.com