Investment in music royalties offers a steady income stream derived from artists' earnings, providing lower volatility compared to private equity investing, which involves acquiring significant stakes in private companies seeking high returns through growth or restructuring. Music royalties investing benefits from long-term contracts and predictable cash flows, while private equity requires active management and entails higher risk but the potential for substantial capital appreciation. Explore the unique advantages and risks of each investment type to determine which aligns best with your financial goals.

Why it is important

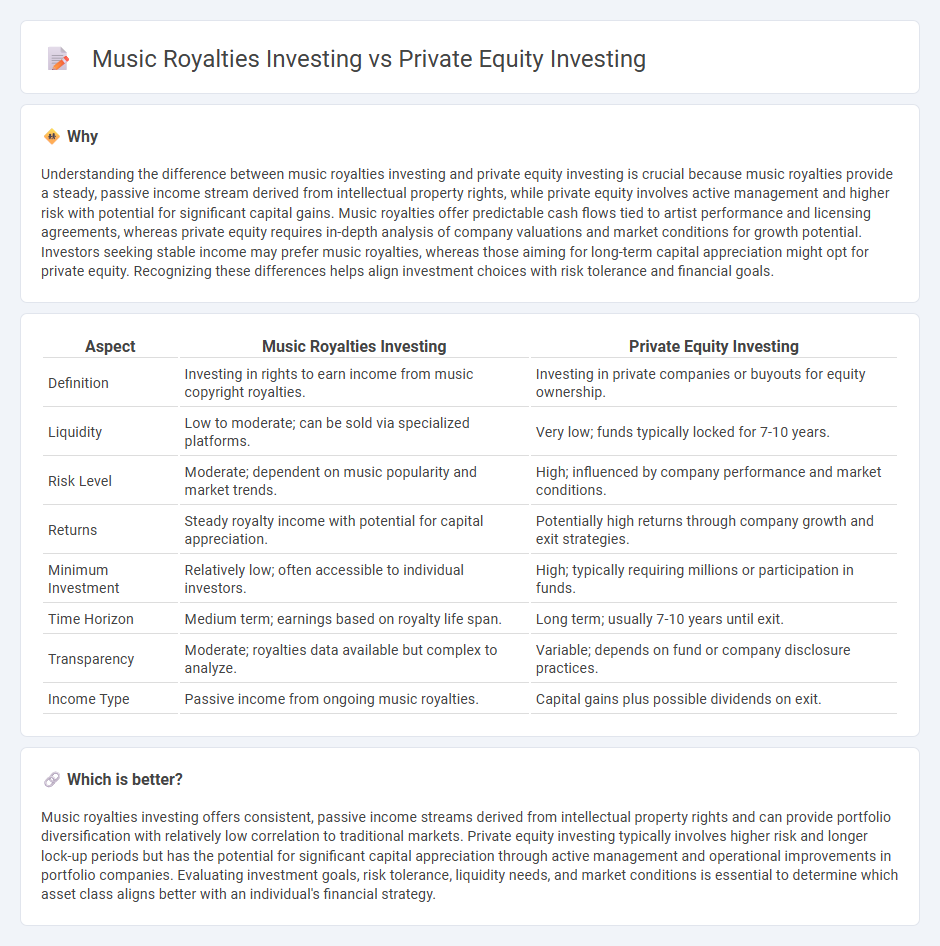

Understanding the difference between music royalties investing and private equity investing is crucial because music royalties provide a steady, passive income stream derived from intellectual property rights, while private equity involves active management and higher risk with potential for significant capital gains. Music royalties offer predictable cash flows tied to artist performance and licensing agreements, whereas private equity requires in-depth analysis of company valuations and market conditions for growth potential. Investors seeking stable income may prefer music royalties, whereas those aiming for long-term capital appreciation might opt for private equity. Recognizing these differences helps align investment choices with risk tolerance and financial goals.

Comparison Table

| Aspect | Music Royalties Investing | Private Equity Investing |

|---|---|---|

| Definition | Investing in rights to earn income from music copyright royalties. | Investing in private companies or buyouts for equity ownership. |

| Liquidity | Low to moderate; can be sold via specialized platforms. | Very low; funds typically locked for 7-10 years. |

| Risk Level | Moderate; dependent on music popularity and market trends. | High; influenced by company performance and market conditions. |

| Returns | Steady royalty income with potential for capital appreciation. | Potentially high returns through company growth and exit strategies. |

| Minimum Investment | Relatively low; often accessible to individual investors. | High; typically requiring millions or participation in funds. |

| Time Horizon | Medium term; earnings based on royalty life span. | Long term; usually 7-10 years until exit. |

| Transparency | Moderate; royalties data available but complex to analyze. | Variable; depends on fund or company disclosure practices. |

| Income Type | Passive income from ongoing music royalties. | Capital gains plus possible dividends on exit. |

Which is better?

Music royalties investing offers consistent, passive income streams derived from intellectual property rights and can provide portfolio diversification with relatively low correlation to traditional markets. Private equity investing typically involves higher risk and longer lock-up periods but has the potential for significant capital appreciation through active management and operational improvements in portfolio companies. Evaluating investment goals, risk tolerance, liquidity needs, and market conditions is essential to determine which asset class aligns better with an individual's financial strategy.

Connection

Music royalties investing and private equity investing both involve acquiring ownership stakes to generate passive income streams and capital appreciation. Investors in music royalties purchase rights to future royalty payments, similar to how private equity investors buy shares in private companies expecting dividends and value growth. Both investment types rely on thorough due diligence and leverage market analysis to assess revenue potential and risk mitigation.

Key Terms

Equity Ownership (Private Equity)

Private equity investing involves acquiring significant equity ownership in private companies, allowing investors to influence management and strategic decisions directly. Music royalties investing, in contrast, offers revenue share based on copyright ownership without control over the artist or production entity. Explore further to understand how ownership structures impact returns and risk profiles in these distinct investment types.

Royalty Streams (Music Royalties)

Royalty streams in music royalties investing provide consistent cash flow generated from ongoing earnings of copyrighted music assets, offering diversification compared to traditional private equity's equity-based returns tied to company performance. Unlike private equity investments requiring active management and longer exit timelines, music royalties yield passive income through licensed usage across radio, streaming platforms, and synchronization in media. Explore how royalty streams leverage intellectual property rights for stable income and portfolio resilience.

Liquidity

Private equity investing typically involves longer lock-up periods, limiting liquidity as investors often wait years to exit through a sale or IPO. Music royalties investing offers more immediate cash flow through regular royalty payments, providing a steady income stream with potential partial liquidity via royalty-backed lending or secondary market sales. Explore further to understand which investment suits your liquidity needs and portfolio goals.

Source and External Links

What Is Private Equity? How to Invest - Private equity involves investing in private companies through funds managed by firms that pool capital from investors, aiming to generate higher returns than public markets by actively managing and eventually selling these companies; investors typically act as limited partners with limited liability and receive returns from profits after the firm's share.

An Introduction to Private Equity Basics - Private equity strategies mainly include buyout, growth equity, and venture capital, and access is mostly available to institutional or qualified investors via funds, co-investments, or multi-manager strategies that provide diversification and potential fee benefits.

Private equity - Private equity firms raise funds from institutional investors to acquire ownership stakes in companies, using equity and debt financing to drive value creation through revenue growth, margin expansion, and operational improvements over a typical horizon of 4-7 years before exiting the investment.

dowidth.com

dowidth.com